Desirable and cheap: Sydney’s best suburbs for first homebuyers to get value for money

It’s possible for first-time buyers to secure homes near work and good amenities with a minimal deposit and affordable mortgage in some often overlooked suburbs, a special report shows.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

They’re the Sydney suburbs where first homebuyers should look if they want value for money, lower prices, good amenities and a property that will grow in value.

Research provided exclusively to the Saturday Telegraph revealed the best suburbs for first homebuyers based on a range of metrics, with suburbs in the west and south coming up tops.

The measures included the typical time it took to save a deposit, the selection of shops, schools, transport and other infrastructure, along with the potential for price rises in the future.

Many of the suburbs flagged as good first homebuyer options in the Canstar and Hotspotting research were gentrifying enclaves of Western Sydney.

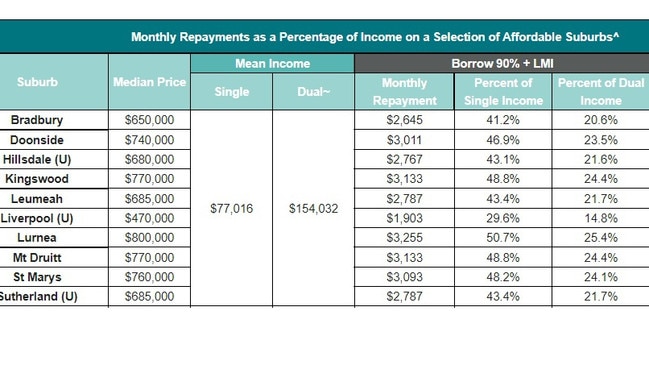

They included Doonside, St Marys, Kingswood, Bradbury, Lurnea, Liverpool and Mt Druitt.

Some of these areas were receiving multiple waves of government sponsored improvements, but lower prices meant buyers could pull together a home deposit much quicker than in the rest of Sydney.

Servicing the repayments on a home loan were also well within the budget of buyers on an average household income and allowed room in the budget to account for imminent rises in interest rates.

Repayments on a 90 per cent loan would require less than 20 per cent of a couple’s monthly income in some cases – roughly half of what most new Sydney buyers need to allocate towards their mortgage.

Outside of Sydney’s west, units in Sutherland and Hillsdale in Sydney’s south were also pinpointed as top first homebuyer markets.

Canstar money expert Effie Zahos said the suburbs identified in the research offered the best prospects for first homebuyers because they balanced lifestyle, accessibility and affordability.

Home values in these areas were also likely to grow, which meant it was a much safer for first homebuyers to use smaller deposits, Ms Zahos said.

“It’s not only about where is cheaper,” she said. “These are well-established suburbs that are changing and they’re affordable and have a lot of amenities.”

The Canstar and Hotspotting Bright Starters report also examined 14 capital city and regional markets across the country, confirming Sydney was by far the least affordable market.

Harbour City home prices grew by an average of nearly 25 per cent over 2021, with the median price of all dwellings jumping from $871,000 to $1.1m.

A first homebuyer on an average Sydney income who wanted to buy a property priced at the bottom end of the city market would need nearly 11 years to save a 10 per cent deposit and stamp duty.

This assumed the buyer saved about a fifth of their after tax pay each month.

The time it would take the same buyer to save a 20 per cent deposit without the help of a partner would blow out to 20 years, the report said.

Saving a 10 per cent deposit and stamp duty in Perth – deemed the best capital city market for first homebuyers – would take just over three years, while a 20 per cent deposit would require seven years of saving.

Ms Zahos said that first homebuyers’ best chance of getting into the Sydney market in a reasonable time frame was by getting a “stepping stone” property they could live in for a few years before upgrading.

“It may be a unit and it may be in a different suburb than originally planned,” she said.

Hotspotting director Terry Ryder said the biggest mistake Sydney first homebuyers could make was thinking their prospects of getting into the market were “hopeless”.

“It’s not easy, but it is achievable with the right mindset,” he said. “It may mean giving up on saving a 20 per cent deposit, which can get you stuck, and it may mean settling for a unit if you’re in a more expensive market.

“The reality is that unless you have rich parents you’ll probably also have to accept that your first home is not going to be your dream home. You may need to make some sacrifices and compromise.”

Mr Ryder said gentrifying suburbs in Sydney’s west offered “value”, not just lower prices.

Areas such as Mt Druitt, St Marys, Kingswood and Bradbury would benefit from infrastructure upgrades, including new train links and the coming airport at Badgerys Creek. They were also near emerging employment hubs, Mr Ryder said.

“There may be some (suburbs) that surprise people or they once had a bad reputation and people ask, ‘but who would want to live there?’ The answer is that a lot of people do.

“These suburbs are near where many people work and new infrastructure is being built there for a reason.”

Ray White-St Marys principal Peter Diamanditis said the Mt Druitt-St Marys area was brimming with first homebuyers.

Many had not been to the region in years and recently discovered how much it had changed, he said.

“They’ve cleaned up the social housing and a lot of the old blocks are being turned to townhouses,” Mr Diamanditis said. “It’s the same sort of changes we saw in areas like Balmain. Back in the 1970s, few people wanted to live there. Look at it now.”

HOW WE MADE THE DREAM COME TRUE

First homebuyers Josh and Belinda Harbach said buying in the Campbelltown region and being persistent helped them achieve the Aussie dream.

The pair purchased a house late last year using the First Home Deposit scheme (FHLDS) and finding a home priced with the eligible threshold for the incentive.

“About three brokers told us it wasn’t worth it,” Mr Harbach said. “They kept telling us that there was no possible way for us to get the scheme,” Ms Harbach said.

The couple didn’t give up and said they leaned on their broker Evelyn Burton at Aussie Liverpool to help them get it.

“If we didn’t get the grant we would still be living at our parents’ house,” Mr Harbach said.

“It would have taken another four or five years of saving to build our deposit.”

Ms Burton said the recent expansion of the First Home Guarantee Scheme to 35,000 places was giving first homebuyers fresh hope.

“I’ve received a lot more inquiry,” she said. She added that state government grants and stamp duty concessions were also proving helpful in Sydney’s southwest. “We’ve got a number of young people, especially singles, purchasing apartments,” she said.