Central Coast Public Inquiry: CEO David Farmer reveals how council crisis could have been avoided

Central Coast Council’s current CEO David Farmer has identified the exact time it needed to panic to avoid the financial crisis. Read what he told the inquiry into the $565m budget blowout.

Central Coast

Don't miss out on the headlines from Central Coast. Followed categories will be added to My News.

It was a tale of two chief executive officers at Central Coast Council’s Public Inquiry hearings.

One told of the exact moment the council needed to “panic” to avoid the financial crisis while the other outlined the host of issues that the council inherited and how $1.2b in overstated Gosford assets needed to be “written off” around the time of the merger.

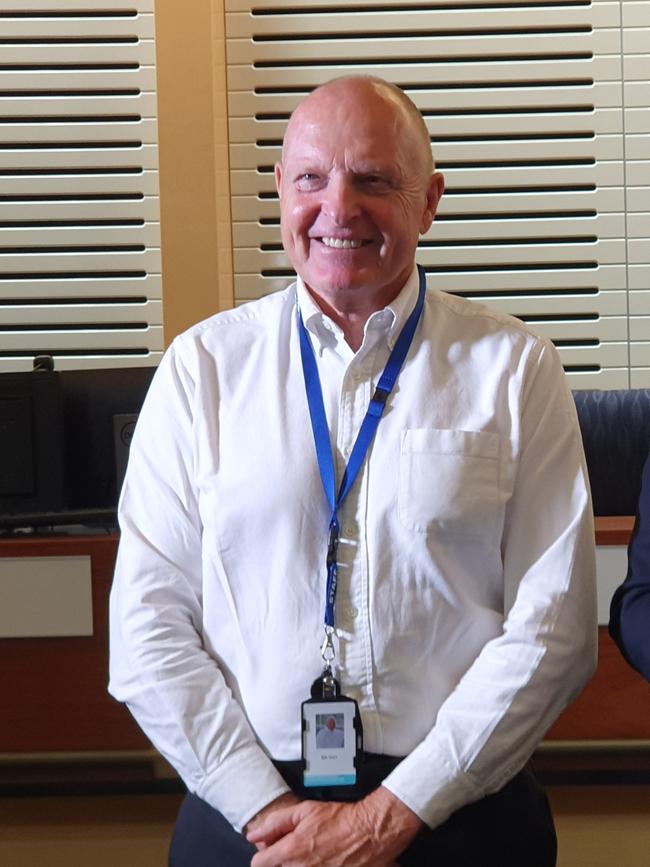

Current CEO David Farmer and one of the former CEOs Rob Noble gave evidence as the Inquiry continues to delve into how the council blew its budget to the tune of $565m.

Current CEO David Farmer

Mr Farmer, who has extensive experience in helping rebuild councils from “dark places”, said the council was on the right track and had a long term financial plan in place.

“We’ve really turned the place around,” he said “I’ve just seen September figures … we’ve gone from two $90m losses and we are running a surplus and better than budget for the last three quarters.

“We need to stay on track. Financial success and stability takes years to create and six months to destroy by lack of discipline.”

Mr Farmer said running a successful council was about having the settings right, receiving good information on a timely basis and having the will to succeed.

He said while he was focused on the future of the council, he had been looking into the past and where things went wrong.

“There was a range of information that was provided that people were making decisions on that was not sound,” he said. “That contributed to people making decisions that led us to where we went to.

Mr Farmer said the “salient point” in the financial crisis was the IPART determination on water and sewer rates in 2019 that saw a $39m loss in council’s revenue and council’s lack of appropriate action to deal with the loss.

“There wasn’t awareness of what the implication was,” he said. “They understated what the shortfall was … however they also understated the financial difficulties the organisation was in at that time.

He said between the 2017/18 and 2018/19 financial years, council went from a general fund surplus of $20m to a general fund deficit of $24m.

“There was a $44m negative turnaround in that year and I don’t think anyone picked that up. “That was lying under the surface when (the council) lost almost $40m in water and sewer. “That’s when you needed to panic and they didn't panic.

“They didn’t understand the underlying financial problem. The inability to take really serious action allowed caused the organisation to fall deeply in that 12 months and fall into the crisis. If serious action had have happened the crisis could have been averted.”

He said the other major downfall was in June 2019 when the council voted for an increased capital budget.

“Your balancing point is the capital budget … what you could have done is squeeze the capital budget down completely,” he said.

“It appears there was a lack of info and lack of will to address those issues. There was a whole heap of information coming forward that were red flags but you needed to be interested to look. I don’t think you had to be skilled … there were a range of things that were happening but if you had an inkling things were going wrong you could have looked and known what was going on.

“It’s extremely difficult for me to understand that anyone competent who was looking hard at that could not have identified those problems.”

The other “inflection point” was a Grant Thornton report councillors received in 2020 which revealed the council was going broke. He said councillors were not prepared to make a decision on the report or act quickly.

Mr Farmer said staff morale at the council was still “highly challenged” as they continue to deal with the “shame” of the crisis, an angry community and dramatic restructure which saw them lose many of their colleagues.

“There’s a lot of headwinds for the staff at the moment but I am confident if we go forward we can be successful,” he said.

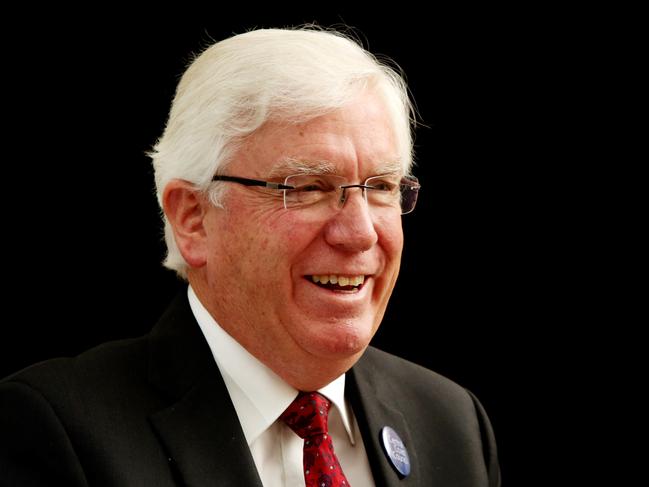

Former CEO Rob Noble

Mr Noble was the interim CEO of Central Coast Council when it was formed in May 2016 and remained in the position until September 2017. Prior to that he was acting CEO of the former Wyong council.

Commissioner Roslyn McCulloch was keen to hear from Mr Noble on whether he was aware of the accounting change that occurred at the council in the early days of the merger which saw $88m in restricted water and sewer funds reclassified as unrestricted funds.

“As a former financial professional from 40 years ago … I was embarrassed to confess to (Administrator Rik Hart) that I didn’t remember anything about the change in accounting practice,” he said.

However he said when the draft Wyong accounts were being reported to council around November 2016, PrincewaterhouseCoopers (PwC) made a “recommendation to us that we change the treatment of the restricted vs the unrestricted funds”.

“I did not and still don’t remember that taking place and as I said I am a little embarrassed I didn’t remember it.”

Mr Noble said he would have discussed the PwC recommendations with his CFO and Administrator Ian Reynolds.

“Because it came from PwC which has a wonderful track record … we must have just trusted them with their advice.

He said in hindsight, the decision could have been made to make the unrestricted cash ratio come more within the guidelines.

“Looking back on it … I am pretty certain that that would have led uninformed readers to believe the unrestricted cash position was way better than it actually was.”

Mr Noble described issues with the forensic accounting, difference in pay scales and said there was no confidence in internal control systems. He believed at the time the merger would take around 10 years.

He said when he started at the former Wyong council he was informed that “Gosford had been cooking the books” and after the merger he discovered “massive irregularities” in the finances.

“We did have to write off just under $1.4b of Gosford assets which had been overstated in their accounts,” he said. “The roads assets were overstated by $700m and they had around $600m in manhole covers that had been double counted,” he said. “That was fairly frightening to discover that.”

He highlighted issues at Wyong such as the council voting not to consider the affects of climate change in its processes.

Mr Noble said he had also looked into the idea of selling the multi-billion dollar Central Coast Water Authority to deal with the infrastructure backlog and said it may be an idea for the current council to consider in the future.

Interim Administrator Dick Persson AM

Mr Persson was appointed to delve into the crisis in October 2020.

He told the Inquiry the 16 months Administration period at the time of the merger was not enough as council was “years behind”. He recommended Commissioner Roslyn McCulloch not reinstate councillors until at least September 2022 to allow staff to get the business back on track.

“I think keeping the councillors out of business while the hard management task is undertaken is very important,” he said.

“The whole calamity and political drama surrounding (the crisis) has probably put them (council) backwards in terms of their ability to go forwards.”

In terms of the budgets over the years, Mr Persson said simply that councillors weren’t up to the job and the council fell short in terms of its chief executive officer and chief financial officer.

However said councillors would not have known about the use of restricted funds.

“That was a very technical matter, I don’t think as Administrator I would have noticed that if the CEO and CFO had not brought it to my attention,” he said.

Mr Persson reiterated his previous reports into the crisis that it was an “inability and failure to manage the budget”.

He said the council did not act sufficiently and make the hard decisions necessary when it realised it was set to lose $39m in income from the IPART decision on water rates.

“There was no sense of urgency and action,” he said.

“The CEO and the councillors have a responsibility to deal with what is in front of them.”

Mr Persson said when the crisis hit, the council’s 100 Day Plan was “too little too late” and not enough to get them out of a hole.

“What was needed was to get down to the table, roll their sleeves up and work out what needs to be done,” he said. “The capital works program needed to be reduced immediately. It was a cluster-mess, it really was. People were trying to say ‘we weren’t told this’, ‘we didn’t know that’ … that’s just rubbish.”

Mr Persson said former Mayor Jane Smith was “determined to affect changes”, was tough on staff while former CEO Gary Murphy did not provide a balance.

“That was the beginning when it went off the rails. There was an attitude that we are going to expand and the CEO went along with it,” he said.

He also pointed to the council’s failure of putting on an extra 250 staff after amalgamation.

He spoke about his controversial statement that the CEO and CFO “clearly” knew about the use of restricted funds, going through the emails he publicly released where the subject of restricted funds was raised in notes and emails.

“It’s just inconceivable to me … a very strong indicator that they were discussing the issue quote a long time beforehand,” he said.

However he said he was never able to speak with Cr Murphy or former CFO Craig Norman due to their leave requirements.

During his evidence, Mr Persson was questioned by Mr Murphy’s legal representative

Vanja Bulut about his statements that Mr Murphy knew about the use of restricted funds.

Ms Bulut said it was a “very serious allegation and finding to make”.

She took Mr Persson through the emails to prove his findings were “unreasonable” and were only highlighted as they contained the word “restricted”, however Mr Persson continuously replied that while it may not be proved in a court of law they were “smoking guns”.

“I believe it was clear that there was an awareness of this issue,” he said.

“It’s inconceivable that a CEO would not have known.”

Commissioner McCulloch asked Mr Persson about the role of councillors and the notion that all walks of life can apply for the role.

“You've just opened up the biggest can of worms for the local government system,” Mr Persson responded. “They don’t have experience for the function that they take on under the act.”

Former CFO Craig Norman

Mr Norman, who was CFO from May 2019 to April 2020, has not spoken about the financial crisis since leaving the council.

He told the Inquiry the week before he started was when he was advised about the IPART decision with council looking at a $39m loss in revenue from water rates.

He said in dealing with the IPART decision they looked at savings targets for various directorates and said time was a significant factor.

“Obviously with the benefit of hindsight we would have taken a different approach to affect that change,” he said.

He spoke about the budget meeting with councillors in February 2020 with the rushed process and “no attempt to achieve a balanced budget or surplus budget”.

“My preference was that we should try to move to a scenario where we had a long term future with small surpluses and deficits. One councillor indicated we were here to run deficits.”

Mr Norman said this was his first role in local government and he was “learning as I got my feet under the desk”.

He said the only issues around restricted funds that he was aware of was the $13m the council paid back from the use of funds by the former Gosford council.

Mr Norman said he wasn’t aware that the line item of “unrestricted funds” had been removed from investment reports in October 2019.

“No wasn't aware of it. I accept it was signed off under my signature,” he said.

He said he was not aware at the time that the balance of unrestricted funds had become negative. He said a staff member would have known and “I should have done too” however he couldn’t explain why the issue wasn’t escalated.

Mr Norman said the idea around use of restricted funds to compensate for a lack of income when Covid hit was discussed across all NSW councils and in CEO forums.

“Everybody was concerned where the money was going to come from,” he said.

However he maintained his position that he was unaware of any unlawful use at the council.

“In hindsight the organisation as a whole was battered from pillar to post in terms of bushfires and the flood incident and Covid,” he said.

“I can understand why people would see finance not reacting quickly enough. Finance can have a view across the organisation that doesn’t necessarily get the whole view all of the time so there is accountability for all people and budget holders around that.”

He also said he noticed that there was a “disconnect” between the finance and the business section of the organisation.

“Some senior managers worked quite well and diligently with finance to make sure they delivered budgets. That wasn’t consistent across the organisation”.

He said he left as the job “wasn’t a good fit for me” and there were plans to restructure his position that he disagreed with.

Mr Norman said he had highlighted at the council that there needed to be “stronger strategic alignment between outcomes from operational plans and the finance”.

“What happened in reality is that they both went their separate ways,” he said. “I don’t think the clear cut connection between strategic alignment and budgets was as good as it could have been.”

Current Administrator Rik Hart

Mr Hart, who was brought in to fix the crisis becoming interim CEO in November 2020, said the former Gosford and Wyong councils were not “Fit for the Future” as they were deemed at the time of merger.

He said the former Gosford council hadn’t increased rates for years, had zero working capital, an infrastructure backlog and “suspect” liquidity ratios while Wyong council had just under $6m in cashflow.

Mr Hart also highlighted the issue of keeping the Wyong CEO and creating a theme of “automatic bias” between the two councils.

In terms of the crisis, he said he found it extraordinary that CFO and CEO were unaware of their working capital position.

“The only explanation I have … Mr Norman alluded to it. He came from private sector …

people in the private sector tend to see depreciation as a non cash item. In local government it is not.”

Mr Hart said he had sympathy for councillors who he believed didn’t have any idea and said the chamber was all about “political pointscoring”.

When asked if the council was now in a position to control use of its restricted funds, he said “absolutely, it’s a different organisation now”.

“(New CEO David Farmer) is an extraordinarily good operator,” Mr Hart said. “He is financially trained and comes with a strong reputation.”

He said between Mr Farmer and CFO Natalia Cowley, “nothing is getting past them”.

He explained how the council had downsized and now published monthly finance reports publicly. He also explained new guidelines for executives and performance reviews for the CEO.

However he said the council should remain under administration with an election to be held in September 2022.

Former Administrator (at time of merger) Ian Reynolds

Mr Reynolds took the reigns at Central Coast Council when it was first formed, saying that while he identified significant issues he also set strong foundations for the new councillors.

Mr Reynolds gave evidence at the Public Inquiry hearings into the financial crisis on Monday.

Ian Reynolds held the position of Administrator for 16 months before councillors were elected in 2017.

He told the Inquiry that the time the State Government allocated to his role was “not adequate to bed down the new Central Coast Council given the complexity of issues involved in the merged entity”.

He said there were issues specific to the coast such as size of the budget, complexity of the two separate operations, geographical issues such as coastal and inland waterways as well as erosion issues that occurred during his time.

“Dealing with all those issues was going to be a significant challenge,” he said.

“I found when we arrived … both councils operated in very different ways. Melding two quite differently run organisation was a significant issue.”

He said he developed a project management office to work through more than 40 workstreams involved in the amalgamation.

“That gives you an idea of scope of issues we were facing,” he said. “In terms of the administration size of things 16 months was a very big challenge.”

Mr Reynolds said he aware that both councils prior to merger needed to upgrade their IT systems, a cost not necessarily related to the merger.

He said his role was to “set the foundation for the new incoming elected council to have best chance for success” and a united IT system was essential.

He said more money from the State Government to help newly amalgamated councils would have been helpful.

The Inquiry heard the three year staff freeze implemented at the time of merger put council “in a bind”.

“It didn’t enable the amalgamated council in its early stages to achieve efficiency that might have been achieved. Staff were protected in that respect,” Mr Reynolds said.

When asked about the financial status of the former Gosford and Wyong councils he said Gosford was “problematic” with double counting of assets and issues with land variations along with security and tracking issues in financial systems.

“Gosford accounts were particularly troublesome for us. We had to engage one of the bigger firms to reconstruct the accounts of Gosford so they could be audited.”

He said they eventually had to disclaim the audits and chose not to dedicate staff time to further investigation as it would have involved “significant resources” for financial staff.

“Apart from the issue itself which was troubling, that would have compromised their ability to

move forward with the restructure and basis of the new council. That was a concern to me.”

Many councillors have criticised the initial lack of handover during their evidence.

Mr Reynolds said as soon as the councillors arrived, he had to leave. However he held seminars for potential candidates in the lead up to the election.

“I wasn’t statutorily able to do anything,” he said.

“Prior to the election we felt we were doing as much as we could to equip people who might want to stand.”

Mr Reynolds said he believes he and his team made a lot of headway during Administration.

“Clearly there were still issues running outstanding, particularly now in hindsight,” he said.

“There seemed to be a growing support for the amalgamated body. We made some minor savings along the way. I think in my own mind we laid the strongest foundation we could for success down the line on the basis of what we knew at the time.”

Current CFO Natalia Cowley

The council’s director of corporate affairs and chief financial officer Natalia Cowley gave evidence at the Inquiry.

She said did a lot of research in the lead up to joining the council embattled in October 2020 when news of the crisis was unfolding.

Ms Cowley said her expectations of budgetary mismanagement and “less appetising” financial decisions were quickly realised.

She confirmed that restricted funds were inappropriately spent.

“In October when the issue was shone, we had essentially used up all our internal restrictions and gone into external restrictions,” she said.

Ms Cowley said she doesn’t believe the problems were a case of someone intentionally making the decision to dip into funds.

She highlighted deficit budgets, increased capital expenditure program along with “a perfect storm” of Covid, floods, bushfires and erosion which saw money being taken from the unrestricted cash. When there was none left, restricted money was used.

She said there was a lack of “agile accounting” where someone needed to identify that there was no money left.

“This becomes that tension point where a strong finance person will have to bring this up with the executive leadership team (ELT) and CEO and have this discussion and say ‘we have a serious financial situation’. That didn't happen, the money kept being spent.”

Ms Cowley said there was most likely “insufficient understanding” and knowledge where to escalate the issue.

She also confirmed that from a councillor point of view, the information was not available.