Property giant Bensons Property Group saved from liquidation in rescue deal

Melbourne-based property giant Bensons Property Group has been saved from liquidation after creditors agreed to take a hefty haircut on the more than $811m they are owed.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Melbourne-based property developer Bensons Property Group has avoided being plunged into liquidation after creditors signed off on a rescue deal, settling for half of what they are owed.

Bensons, which collapsed in December with more than 1000 homes under construction worth about $1.5b, owed creditors more than $811m.

Among those owned money are builders, other tradies, investors and a number of state government revenue offices.

Creditors on Friday accepted a rescue deal put forward by the company in which the family founders of the group will tip in close to $480m over the next three years to strengthen the group’s financial standing.

Administrator KordaMentha had recommended creditors take the rescue deal, saying creditors would secure $414m under it as opposed to just $625,772 paid to employees if the company was liquidated.

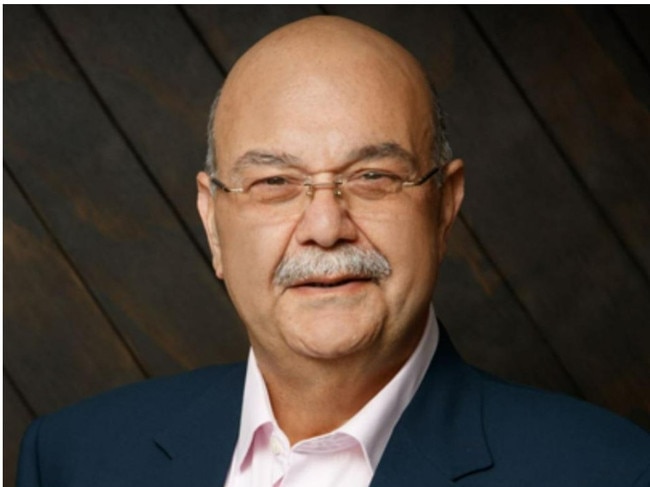

Bensons was founded in 1994 by multi-millionaire winery owner Elias Jreissati.

It’s understood the company is working on 1300 projects nationally, including the construction of 740 apartments across Melbourne’s suburbs, with an estimated collective value of $452m.

In a statement published on Friday, Bensons said the decision was “near unanimous” with 98 per cent of creditors voting in favour of the deal.

They said they intend to put the arrangement into force in the coming week, with control returned to the company on or before next Friday.

A Bensons spokesperson said the company remains committed to their $1.5b project development pipeline.

“We understand the responsibility that comes with this, and we will work tirelessly to fulfill it,” they said.

“We are deeply humbled by the immense trust and support of our employees, trade creditors, project partners and investors throughout this challenging time.

“We recognise the opportunity we have been given, and we are determined to deliver for those who have placed their trust in us.”

Approval of the rescue deal comes after administrator Craig Shepard of accounting firm KordaMentha indicated that the company may have been insolvent since as early as July 2023.

“Our preliminary investigations suggest the company (Bensons) exhibited indicators of insolvency, and may have been insolvent, as early as 1 July 2023 and as late as 30 June 2024,” he said in a recent report lodged with the corporate regulator.

But Mr Shepard said Bensons directors sought “safe harbour” protection in 2023, potentially giving them protection from future investigations if the company was to enter liquidation.

Safe harbour is a form of protection under the Corporations Act that shields directors from personal liability during insolvency, as long as they are actively taking steps to improve the company’s financial situation.

There is no suggestion of wrongdoing on the part of Bensons’ directors.

The KordaMentha report revealed the company’s revenue plummeted from $243m in 2019 to $45m in 2021, $11m in 2023 and just $4m by December 2024.

The company – which entered administration with $163,672 in the bank – said tough conditions in the industry, including higher interest rates and increasing construction costs, contributed to the administration.

One of Bensons’ key projects in Melbourne, luxury apartment block Society Armadale, is described as “beautifully crafted boutique residences with large terraces and courtyard-style gardens” on their website.

Other projects in Melbourne include 24-level Footscray apartment building Liberty One and high end block of residences St James Park in Hawthorn.

Originally published as Property giant Bensons Property Group saved from liquidation in rescue deal