He gives expert advice but Scott Pape knows what it’s like to be underinsured and botch a venture

When financial guru Scott Pape started handing out advice, his dad gave him a piece he’s never forgotten: “Don’t be a wanker. Look after the battlers.”

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

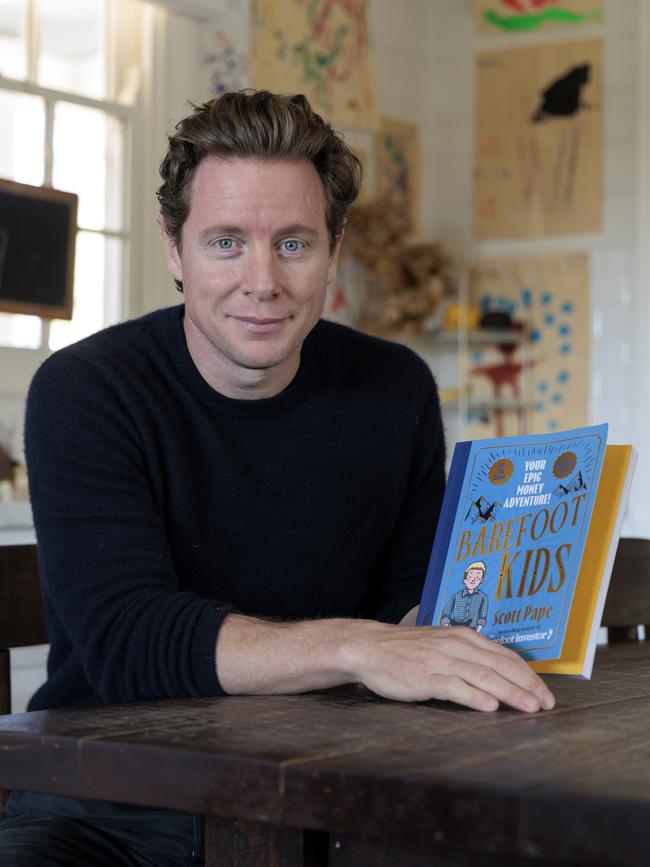

Scott Pape may be a financial guru to millions of Australians. But he’s also the bloke who can, with self-deprecating ease, describe his own errors. Such as being underinsured in a natural disaster. And botching one of his first financial ventures.

Pape learned about money early in life from his father Donald – who delivered fuel to nearby farms – and News Corp commentator Terry McCrann.

Father and son would watch Business Sunday on TV together.

Pape would also read McCrann’s newspaper columns out loud to his father; by then, in the 1980s, he had bought his first shares (in BHP), a precursor to his teen years when Pape was known to hit up teachers for a phone to trade shares at school.

Early on, the Papes lived in Ouyen, in northwest Victoria. There were small-town freedoms, such as riding bikes forever, and a newsagency honour box.

The childhood idyll not only defied the modern tendency to over-parent, but also inspired Pape to raise his own four children, three boys and a girl, aged from 18-months to nine, in much the same way.

Wife Liz is a country girl – they met when she was Pape’s producer on TV’s The Project. They married in 2012.

“Liz is the brains behind Barefoot and my best friend,” Pape says.

“I figure if I can last five-and-a-half months with four children in a six-metre motor home and come back saying, ‘I could’ve gone for a bit longer’ and that we’ll do it again I think that means that I’ve met the right person,” he says.

Pape is the Barefoot Investor, News Corp financial advice columnist and the author of a book with the same name which is the best-selling title in Australian history. His influence has been merrily described as “cultish”.

But he has other life roles, too – as a father, husband, and a chronic source of mirth for older relatives who wonder at his prominence.

Pape, the kid, was always chasing the next money-making scheme. When he alighted on a car washing business, he wanted to test his skills on his father’s prized Falcon. He overlooked a key detail – the zipper on an old jacket he used to polish the car.

Donald was “absolutely freaking ropeable” about the scratches on the duco. Even mum Joan, the unofficial family conciliator, a kind of “Switzerland”, was shocked into silence.

Over a lunch of pasta in a Southbank restaurant in Melbourne, Pape can laugh at all the missteps. He is candid, speaking at length about a dose of depression in 2014 and he is keen to share his latest long-term strategy.

Yet he doesn’t like talking about himself, he says, and doesn’t like having his photo taken although he recognises that sometimes it just has to happen.

He’s the ‘money guy’, but he isn’t materialistic. He doesn’t do much social media, arguing that algorithms “steal your time”. He’d rather read poetry, or a book about architecture.

“It can be incredibly boring to talk about finance constantly,” he admits. “I want to have different things in my life and meet interesting people.”

At home near Romsey, a tick over an hour from Melbourne, his kids sometimes wonder what their father – who wanders around the house – does for a living.

The family’s extended roadtrip across Australia last year bonded them so much that three of the kids have since continued sleeping in the same bedroom.

As a ‘dad taxi’, Pape takes the kids to scouts, jujitsu and ballet.

He clearly leans into the happy parent role, and he and Liz plan another family roadtrip – to Europe this time – next year.

Yet there have been tricky times. Their sheep property burned down in bushfires in 2014. Pape is uniquely attuned to the hardships faced by Victorian flood victims in coming months. On that dreadful day, he stood in the scorched paddocks, armed with a hose and futility.

About three months on, he slid into an emotional hole. The adrenal response to crisis had ebbed, the fences had been underinsured, and his need to return to the old normal had been replaced by the realisation that the old normal was lost.

He had also learned the price of public prominence. The media and their helicopters had turned up while the ruins still smoked. The journalists were doing their jobs. But for Pape they doubled as vultures sniffing for grief. He wanted them to go away, to leave him alone.

He was a public figure, he belatedly discovered, and he didn’t like it at all. The experience helps explain why he is fiercely protective of his kids’ privacy.

“Having people write about me and having the media chase me because it was a really hot story felt really invasive and really uncomfortable,” he says.

Yet this personal trauma also qualified Pape for a more recent incarnation as a financial counsellor. He saw a financial counsellor at an evacuation centre on the day his own life changed. Even for him, the giver of financial wisdom, the chat helped.

Pape doesn’t want to advise rich people on turning $5m into $10m. Instead, in 2020, he sat behind a card table in a town hall in Corryong, a Murray River town partly razed by bushfires, and listened to a line of people.

Many were bamboozled by the paperwork, and deeply troubled about the scope for personal recovery.

Australians are underinsured, as a rule, and country folk don’t much like asking for help. Pape was struck by the ‘cockies’ who said that others must have been worse off than they were. There weren’t many – some who lost their homes would confront Covid lockdowns in temporary accommodation for unknown periods of time.

“They’re devastated and freaked out of their minds, then the insurance company, say, hits them with all sorts of things that they don’t really understand,” he says. “That’s why I’m a huge advocate for the financial counsellor because they say ‘I’m going to sort this out for you, you just work out what’s going on with you and grieve’.”

Pape is almost 44, and less cynical than he once was. He knows that incompetence, as opposed to bastardry, usually explains the worst examples of customer treatment by insurers and banks.

Yet he rails at institutions that seek to put young people in debt through predatory approaches that leave many with a lifelong belief that they cannot handle finances.

His advice is not about making money, per se, as much as teaching financial literacy. He has embraced kindness and empathy as strengths.

He talks about one of his latest projects, the story of a storm victim who lost her husband, lives in temporary accommodation, and cries all the time. He’s off to ring her unhelpful insurer after lunch.

Going into bat these days for ripped-off readers, you suspect, is less about battle, and more about the result.

His new book in part seeks to defuse patterns of financial struggle before they can form. Barefoot Kids features 50 children who have got jobs, saved money, and learned to manage finances.

It’s written as an “epic adventure”, after a tough crowd of “editors” found faults with aspects of the drafting.

“My kids are the harshest critics,” he says. “They’re like: ‘That’s not funny at all, dad’. My nine-year-old said: ‘Oh I see what you are doing there – it’s a literary device for using humour. But it’s not really hitting the mark.’”

Shy-natured himself, Pape implores kids to apply SEA – to smile, make eye contact and ask questions.

He credits his father for instilling his everyday values. His dad’s advice when Pape first started giving paid speeches? “Don’t be a wanker. Look after the battlers.”

Pape shies from offering financial analysis beyond the average reader’s comprehension. When he started doing student radio, from whence his media writing evolved, the desire to explain how finances worked – to ordinary people – conflicted with highbrow media offerings elsewhere.

Not being a “classically trained” writer is a plus, he says. And he has stayed faithful to his father’s admonition.

“I think I’ve always tried to write in a way that my parents and friends would understand,” he says.

“The thing that I kind of found is that a diesel mechanic is incredibly intelligent but may not know the language of finance. And the worst thing that you can do is make somebody feel stupid.”

Pape radiates an energy that resembles British chef Jamie Oliver for passion and innovation.

Two of his mentors, McCrann and ex-finance editor, Malcolm Schmidtke, are notable for their almost youthful chirpiness.

Pape wants a National Debt hotline to be as recognised as Beyond Blue. A lack of money, after all, traps women in bad relationships, causes the most intra-family arguments and drives people to bleak choices.

It’s one of maybe half a dozen initiatives he offers over a couple of hours of lunch. For Pape, at home or work, there will always be a next thing.

Not long ago he planted 1000 chestnut trees on his farm. Call it a long-term investment. The fire retardant trees should eventually grow to 20m high. Nuts will start forming after about five years but it may be a couple of decades before the yield will thrive as a commercial proposition.

He likes how the nuts fall to the ground and he is working on convincing his wife to allow pigs to graze underneath. The biggest plus?

The four kids will have a reason to come home, he predicts.

And they can capitalise on a strategy many years in the growing.

“They say you plant a vegie garden for yourself, fruit trees for your kids and nut trees for your grandkids,” he says.

“The romantic notion is that after I waddle off, the kids will come back around Easter for the harvest, which will pay for the upkeep of the farm and pull all our kids and their partners back to the farm.”

For now, he wants to capitalise on the time when his children “still like me”.

“My kids are still in primary school and I’m still that kind of cool hero right now while I can still hang out with them,” he says.

“That’s what I want to be doing. What do they say? That parenting is the art of

letting go?”

MONEY ADVICE FOR KIDS

STEP 1:Earn some money

Money comes from working! If you want cool stuff – and you don’t want to wait around for Christmas or your birthday – you’re going to have to work for it. Plus, doing jobs and earning money is lots of fun! We’re going to start small and earn some quick money.

How? By getting your parents to pay you to do three simple jobs around your house.

STEP 2: Stash your cash

When you get paid, you’re going to divide your money into three money buckets.

● Splurge: Everyday spending – little things

● Save: Savings goals – big things worth working for

● Give: Make people smile – acts of kindness

● Rule: Each bucket gets some money every payday.

When you get a bit older you’ll graduate from using jam jars or envelopes to having your own bank account.

STEP 3:Be a ‘barefoot’ boss

This step is the one that everyone gets excited about. You’re going to do something really cool: start your very own business! First up, you need an awesome business idea and in my book I’m going to help you find one that you can make your very own. My first business idea was a disaster. Just ask my dad. Yet I didn’t quit. I just shook it off and tried something else … can you imagine if I’d chucked a tanty and given up? There are two reasons why you should not be scared of failure. First, dreaming up the idea and planning it all is what everyone agrees is the most exciting part. Second, you have a head start on other kids.

STEP 4: Get what you want

First, you’re going to dream up one big goal … something you really want: A bike? A boat? A puppy? Whatever you decide on (and I’ve got loads of ideas to help you decide), I will show you how you can turbocharge your savings and reach your goal quicker than you ever thought possible.

STEP 5: Make someone smile

The fastest way to feel good is to help other people.

The stuff you buy doesn’t make you happy. Helping people makes you happy.

Once you open your hand and start giving, you’ll find it hard to stop.

You do one small act for someone and then they do something for another person and everyone feels good. You feel good when you do good things for other people. Now you’re going to use the money in your GIVE bucket to start your own ripple of kindness.

Kindness is a super power.

STEP 6: Grow your money

Our final step is a very special one: I’m going to show you how to grow your money. Some adults think this step is about ”magic” … but it’s really just about being smart with your money. I’ll let you into a secret: Growing your money is like any other skill you can learn.

You grow your money by setting up an investing app on your parents’ phone. The investing app invests in shares of huge businesses, and they pay you money when they make money.

Your money actually works for you while you’re sleeping! This is how your money grows over the years. And that’s how you get what you want!

Originally published as He gives expert advice but Scott Pape knows what it’s like to be underinsured and botch a venture