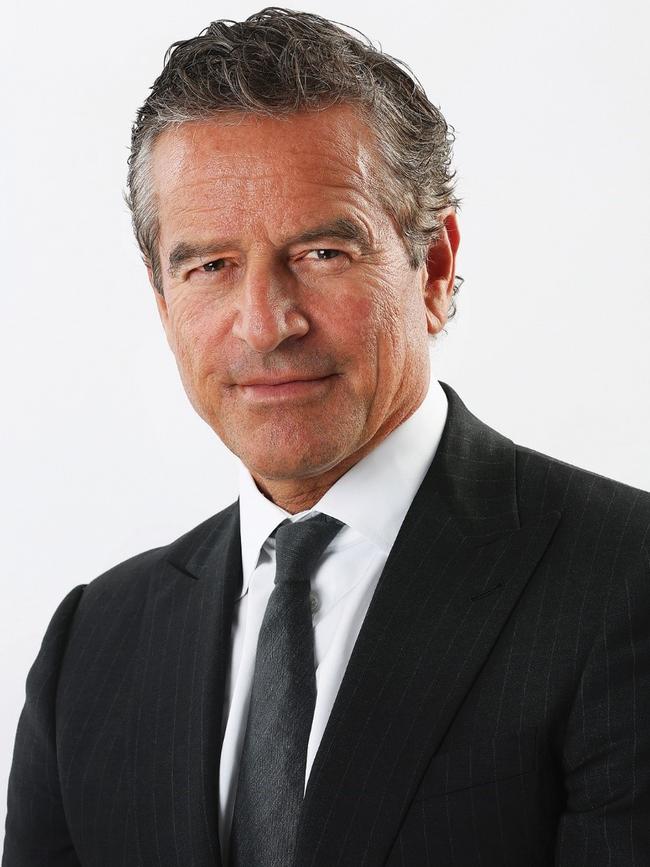

Mark Bouris: ‘Wrong time for Labor to hit property market with new tax policies’

Scrapping negative gearing and increasing the capital gains tax will hurt too many Australians in the hip pocket, according to businessman Mark Bouris. He believes it is the wrong time for the Labor Party to hit the property market with new tax policies. Here’s why.

It’s something every single parent in the country already knows (even if some of our politicians clearly don’t); when your children are over-stimulated, you need to temporarily take their toys away.

But you don’t just throw them in the bin, do you? When everyone has calmed down again, you give the kids their toys back.

It sounds bloody simple, but policies that are introduced to stimulate the economy are no different. They need to be managed when the market becomes over-stimulated. But that doesn’t mean scrapping them altogether.

Because when the toy is something as valuable to the economy as negative gearing, you can’t just throw it away.

The ALP has made no secret of its plan to make some major tax policy changes should it win office. But for me, there are two key changes that will have a huge impact on the economy. They are the elimination of negative gearing concessions and changes to the way capital gains tax is calculated on the sale of assets.

MORE FROM MARK BOURIS:

WINNING IS A STATE OF MIND FOR BUSINESS OWNERS

‘WE WILL ALL PAY IF MORTGAGE BROKERS GO BROKE’

The reason people invest in property is because they can claim the loss they make on rent and interest payments against their own taxable income. And when they sell it, they get further capital gains tax benefits, too.

But the Labor Party has vowed to change those concessions, increasing the amount of tax investors will pay.

But on this issue, the Labor Party is acting like children, throwing the toys out of the pram at a time when we simply need to be better than that. We need to be the grown-ups when it comes to a policy change of this magnitude.

To understand why this is such a big and potentially dangerous deal, you need to also understand what happened the last time a government tried to abolish negative gearing.

It was 1985 and the Hawke government said that losses made on properties could no longer be used to offset personal income tax — a change that was supposed to raise some $55m that would be used to fund a broader income tax reduction.

But 12 months later, the changes had reaped just $11m and there were some other serious consequences, too. For one, investors left the market, and those that remained immediately attempted to recoup their losses by increasing rents, especially in Sydney.

Just two years later the Labor Party scrapped the changes, reinstating negative gearing and thus re-sparking the property market.

And now, some 35 years we’re back where we began.

So what’s the big deal? Why is everyone banging on about it? Because most people don’t understand the significance of Labor’s proposal.

I’m not suggesting for one minute that the negative gearing tax policy will be a good policy forever. But when it was re-introduced there was a reason for it. It was brought back to encourage people to invest in property. And it worked.

And in my view, it is still working.

Negative gearing is a valuable toy that we know works to encourage property ownership in Australians who would ordinarily not be able to go into that market. It’s part of an incredibly important basket of fiscal policy stimuli that helps everyday Australians access property and drives GDP and employment growth.

More important, it takes the pressure off the RBA’s only tool to spark economic growth. We don’t have anywhere near the headroom we used to have when it comes to interest-rate cuts. With the official rate already at a staggeringly low 1.5 per cent, the ability of the RBA to stimulate the economy using the rate is now very limited.

Plus, every time they are forced to reduce the interest rate, our retirees get a lower return on the money they’ve put away for retirement.

Yes, there will be periods of time, particularly when the market is booming, when a policy will distort and measures need to be deployed to stop those distortions. The toys need to be taken away, if you will.

But if you look at the state of the property market across the country, haven’t those measures already begun working?

Since 2016, foreign investment in our property market has fallen by two-thirds and property prices in almost every major city have been falling right along with it.

First homeowners are returning to the market and rents in most cities are dropping, with renters now flush with both choice and power.

And all of that has been happening right alongside negative gearing. So is now, just as our fragile property market at last shows signs of stabilising, the right time to pull a lever designed to deter investment? Is the time right to take another toy away? In my opinion, it is not.

Right now, scrapping negative gearing and increasing the capital gains tax will hurt too many Australians in the hip pocket.

Don’t get me wrong, nobody wants to see house prices rise so fast it makes buying unaffordable.

But we’ve already stopped foreign buyers from over-stimulating the economy and that’s a good policy that should stay.

So I don’t see why we should be making Australians stop buying real estate, too. We need investment in the property market to continue if we want to keep the economy stable.

And one thing is for sure, we are going backwards at the moment.

Property developers and builders are simply not building. The only thing that carried this economy through GFCs and other potential recession drivers has been the construction industry and it’s flagging at the moment.

All Australians need to have access to buying property and negative gearing is one device that encourages that to happen.

It’s all about timing. The property market is suffering a major downturn and while some people might think that’s a great way to get into the market, those same people need to understand that it’s a falsehood, because if the broader economy falls into risk territory and employers stop employing people, then nothing is affordable because you’ll not have an income.

You need to look at these major policy changes in the view of the total economy and long-term sustainability.

If asked my opinion right now, I would have say to the Labor Party that, respectfully, this is the wrong time to hit the property market with new tax policies.

Will there be a time in the future when negative gearing will need to be reviewed? Almost certainly. But right now is not the time to take such a valuable toy away.

* Mark Bouris is chairman of the SME Association of Australia

* Mark Bouris, chairman of Yellow Brick Road, is one of Australia’s most successful entrepreneurs. He writes a column for The Sunday Telegraph, sharing his extensive business skills.