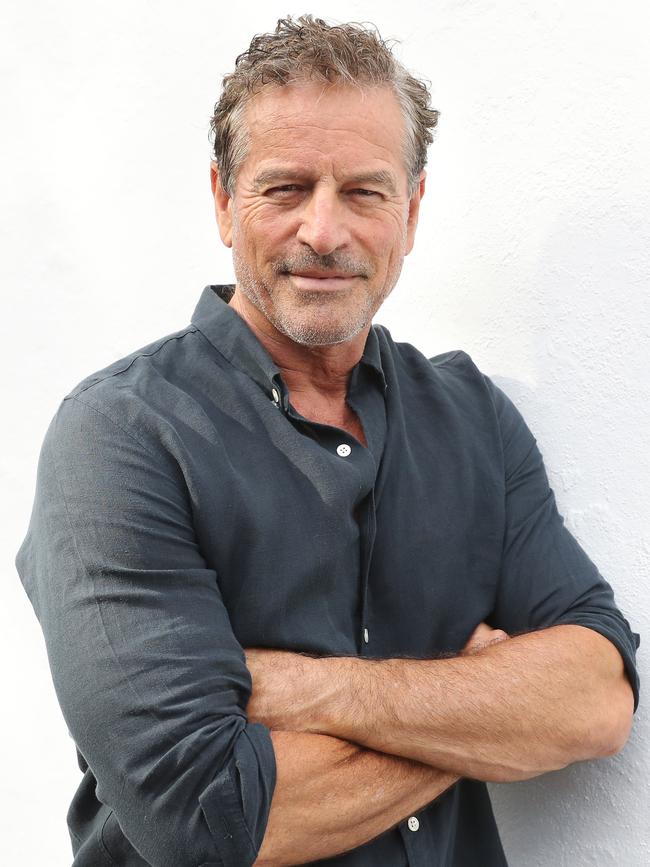

Mark Bouris: ‘We will all pay if mortgage brokers go broke’

The first victim of the banking royal commission appears to be the country’s mortgage-broking industry. To make borrowers pay for a mortgage broker’s service will not only kill the industry, but also allow banks to regain their stranglehold on the mortgage market and consumers, Mark Bouris writes.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The Hayne Royal Commission has illuminated the darkest and dirtiest corners of Australia’s financial sector and a tidal wave of long-overdue change will soon be colliding with our biggest banks and lenders.

But there is always a risk of others being washed away in the resulting floodwaters, accidentally leaving us in a worse position than we are in today.

The first victim appears to be the country’s mortgage-broking industry, with the Hayne report recommending a monumental shift in the way the business operates, changing from a commission-based to a user-pays system.

On paper, what that means is that, rather than the banks and lending groups paying mortgage brokers for their services, that responsibility would instead fall on the people actually applying for a loan.

In the real world, though, it means something else entirely. Because you and I know that is never going to happen. Buying a home in Australia is difficult enough, what with our sky-high prices, monstrous stamp-duty obligations and ever-tighter lending criteria.

MORE FROM MARK BOURIS:

‘IT’S TIME FOR BUSINESS OWNERS TO TRAIN LIKE ATHLETES’

SCOMO’S FINANCE FUND A BIG WIN FOR SMALL BUSINESS

And with all those demands on our limited funds, who among us has an extra $10,000, or more to pay a mortgage broker for their help in compiling a loan application and finding us the best deal? Exactly.

There are about 17,000 mortgage brokers in Australia, and these people aren’t millionaires.

In fact, their average wage is about $80,000, before tax and superannuation is paid.

That means most of them are lucky to take home between $50k and 60k. And each and every one of them will have to find new jobs in new industries if these changes go ahead.

If that happens, the 60 per cent of Australians getting their loans through brokers are going to suddenly find it very tough.

It’s the most complicated and complex time I can remember to get credit. It’s not easy, and it’s getting harder every single day, and without the option of being able to easily shop around, fewer people will secure finance.

Which means fewer buyers and it doesn’t take an economist to calculate the impact that will have on already fragile property prices.

A buyer’s only option will be to visit the banks, which will regain their stranglehold on the mortgage market. And if we’ve learned nothing else from the royal commission, it’s the impact that a monopoly (or quadropoly) has on competition in this country.

Full disclosure — as executive chairman of Yellow Brick Road, which provides mortgage services, I do have a horse in this race. But I’m also not blind to the flaws of our broking industry.

Rorting does occur, most notably with brokers fudging figures to secure finance for people that really shouldn’t get it, and thus may not have the means to comfortably pay it back.

The Australian Securities and Investments Commission should — and does — come down on those rogue operators with the full weight of its powers. And as an industry, our focus should be on education and compliance above all else.

But to make borrowers pay for a mortgage broker’s service will kill the industry overnight.

And if you think the banks, which are the ones that actually pay those broker commissions, will pass those savings onto their customers, you haven’t been paying close enough attention to commissioner Hayne’s findings.

* Mark Bouris is chairman of the SME Association of Australia

* Mark Bouris, chairman of Yellow Brick Road (ybr.com.au), is one of Australia’s most successful entrepreneurs. He writes a column for The Sunday Telegraph, sharing his extensive business skills and answer your questions about doing good business.

* Ask Mark at mentored.com.au