Shadow Treasurer Chris Bowen blasts negative gearing but might use it on his new holiday home

THE architect of Labor’s plan to cut back on negative gearing hasn’t ruled out using the tax incentive himself on his just-built lavish holiday house in Bawley Point on the NSW South Coast.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

- Chris Bowen: Why should the wealthy get tax cuts?

- Editorial: Labor’s property tax break plan just plain wrong

THE architect of Labor’s plan to cut back on negative gearing hasn’t ruled out using the tax incentive himself on his just-built, lavish holiday house in Bawley Point.

Shadow Treasurer Chris Bowen (pictured) yesterday launched an attack on the “growing group of negative gearers” who owned multiple properties, saying Labor was committed to putting “first home buyers on a more playing field with investors”.

But asked about his own property portfolio, Mr Bowen would not rule out taking advantage of the “grandfather” clause which would allow him to reap rewards from the same negative gearing policy his party wants him to reform.

“It is all on the interest disclosure, two properties … one I live in and a holiday home,” he said.

His media adviser later confirmed that Mr Bowen would not rule out negatively gearing his waterfront holiday home in the future.

Mr Bowen bought the block of land for $295,000 in May 2016 and spent the next two years building a holiday home which would be exempt from his negative gearing cuts.

Far from Mr Bowen’s Western Sydney seat of McMahon, Bawley Point is a tiny holiday town south of Ulladulla which is frequented by holidaying families, including Labor leader Bill Shorten.

Mr Bowen was not the only Labor politician to add to his property portfolio since announcing the reforms.

RELATED NEWS

Negative gearing: Is it good or bad, should it be scrapped?

Negative gearing reform to hurt NSW Labor voters

Labor MPs secured an extra 24 properties to their collective portfolio since the 2016 election, all of which would be protected from any of the party’s proposed negative gearing reforms.

The grandfathering clause will allow those who are already eligible to continue claiming the benefit should the reform become a reality with a Labor election win.

Speaking in Sydney yesterday, Mr Bowen unleashed a tirade on people with multiple investment properties, saying they were taking advantage of “the most generous tax concession in the world”.

“There are now 120,000 investors with three or more properties up from just a year ago,” he said.

“The Liberal Party thinks it’s more important to provide investors with five, six or seven houses with a more generous tax concession, the most generous tax concession in the world, than it is to invest in schools and hospitals. We actually have a different set of priorities … to put first home buyers on a more playing field with investors.”

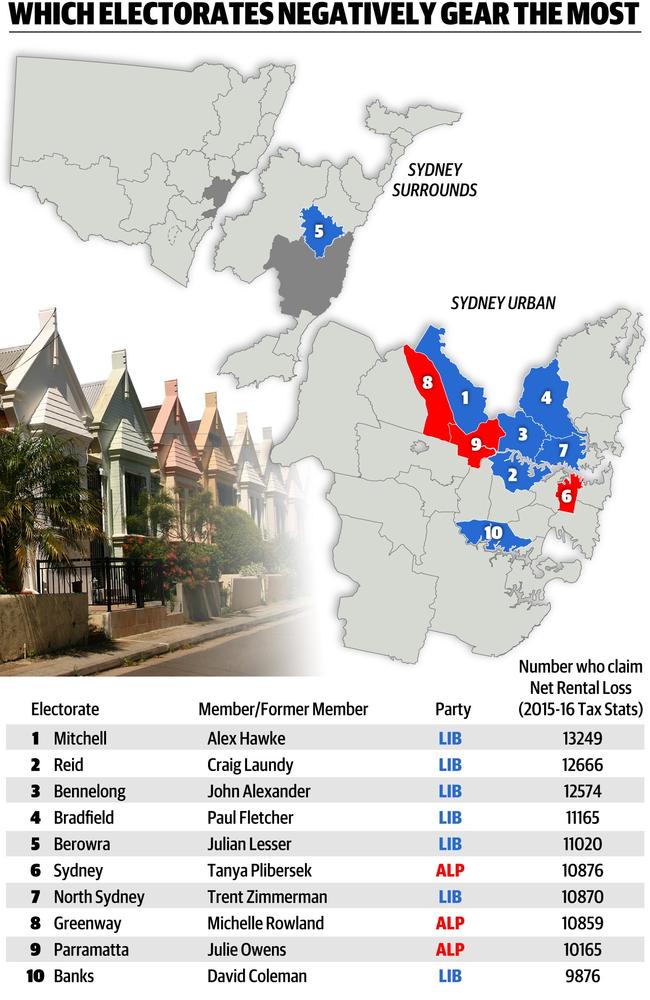

The comments came in response to revelations in The Daily Telegraph that 570,000 Australians in Labor-held seats claimed negative gearing benefits in the past financial year.

Across the country more than 1.3 million homeowners used the policy for tax benefits — the majority of them battlers who had a taxable income of less than $80,000.

Global Investment manager the Pendal Group said the softening of housing prices will escalate under Labor’s plan. Portfolio manager Tim Hart told The Australian a $720,000 two-bedroom unit could fall to $630,000.