ALP’s negative gearing reform plan will affect thousands in NSW Labor electorates

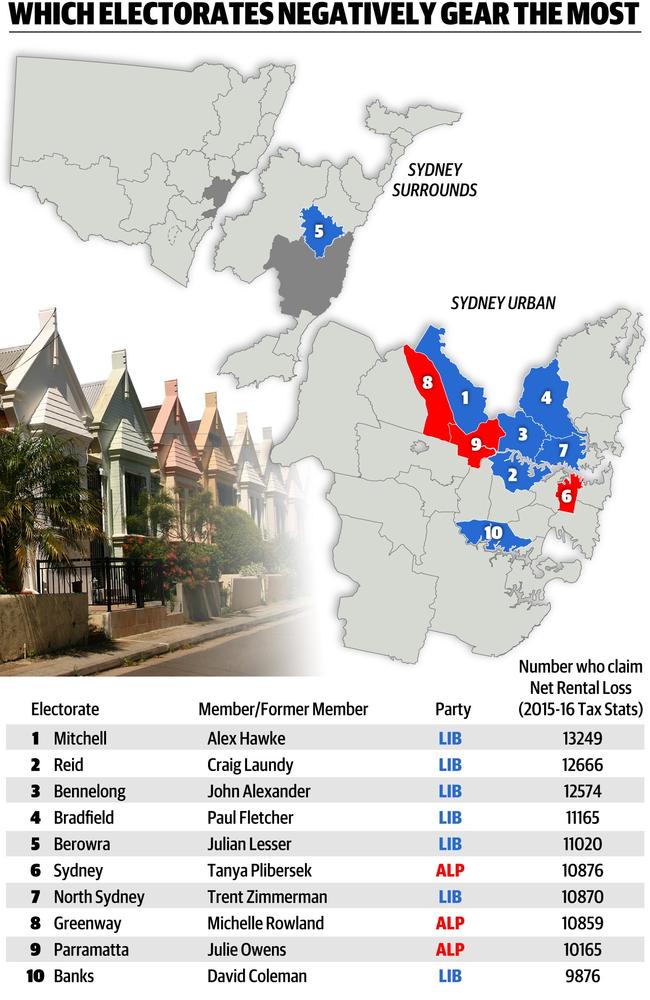

HALF of the 374,000 people in NSW benefiting from a tax savings live in Labor electorates — destroying Bill Shorten’s claim it’s a loophole that only benefits the rich. The Daily Telegraph can today exclusively reveal how many Sydneysiders in every electorate are able to claim the tax rebate. SEE THE LIST.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

HALF the people in NSW benefiting from negative gearing tax savings on investment property live in Labor electorates, despite Bill Shorten’s claim it’s a lark for the rich.

Labor’s plans to dramatically shrink the pool of new property investors able to claim the tax break would have its biggest impact in NSW, where 374,000 people are claiming the benefit, exclusive data from Treasury reveals.

Limiting negative gearing on property purchase to new houses and apartments will put a handbrake on already weakening investor demand, further pushing down prices and potentially leaving people stuck with assets they can’t find a buyer for, experts warn.

Investors would also be hit under Labor via a 50 per cent reduction in the capital gains tax discount on the sale of property and other investments. The discount will go from 50 per cent down to 25 per cent.

Treasurer Josh Frydenberg has slammed Labor’s plan as punishing the state’s property investors at the worst possible time.

“No real estate market will be harder hit by Labor’s ill-conceived property tax than the New South Wales market,” Frydenberg says.

MORE NEWS

Mark Latham returns to politics with One Nation

How hoaxers hindered search for child killer

Sydney cop ‘threatened to rape Senator Hanson-Young’s relative

“More than 350,000 people in New South Wales negative gear a property, which is more than any other state and represents over a quarter of properties that are negatively geared across the country, and half of these are in Labor seats.”

Labor leader Bill Shorten said the policy was “nothing to worry about” for existing investors as it was not retrospective.

“In terms of housing prices, they have been very high and I say to people I want to make sure that your kids when they are in their 20s and 30s don’t face unfair competition from property investors who are getting a tax subsidy from the government,” Mr Shorten said from the Birdcage at the Melbourne Cup.

Currently investors who make a net loss on their property after rental returns, interest payments and other costs can claim a discount on the amount of income tax they pay.

Treasury data reveals around 10,000 people in each of the Labor electorates of Parramatta, Greenway, Barton, Sydney and Kingsford Smith claimed the tax discount.

Of these seats, Labor’s margin in Parramatta is the tightest, 1.3 per cent, followed by Kingsford Smith at 2.7 per cent, while the other three are held by a margin of less than 4.6 per cent.

More people in deputy opposition leader Anthony Albanese’s Grayndler electorate are using the concession _ 8566 people _ compared with 8195 people in former prime minister Malcolm Turnbull’s old electorate of Wentworth, according the data.

“We are not talking about rich property barons here, we are talking about ordinary people who are saving for their retirement and are building a nest egg outside of their super,” said chief executive of the Property Council of Australia Ken Morrison.

Mr Frydenberg said the impact of Labor’s plan would not be limited to new investors, but will push down prices for everyone.

“Labor’s property tax will not only punish the 350,000 people in New South Wales and the 1.3 million Australians who negative gear, but every Australian with equity in their home.”

Already investors were leaving the market, as banks made it harder for investors to get loans, Mr Morrison said.

New investors may find it harder to find a buyer for their property or see the value of that asset depleted due to a shrinking pool of potential buyers, he said.

“There’s a whole bunch of question we don’t know the answers to. We are playing with a very big slice of the market and the opposition is proposing to make very big changes at a time when the market is already changing quite fast.”

Shadow treasurer Chris Bowen defended the policy as necessary to make it easier for first home buyers to enter the market.

“Labor wants to reform negative gearing so we’re levelling the playing field so first home buyers can better compete with property investors, while retaining negative gearing for new houses and apartments — that stimulates construction, jobs and supply in the housing market,” Mr Bowen said.

“The Grattan Institute has found that the top 50 per cent of benefits of negative gearing flow to the top 10 per cent of income earners,” he said.

He rejected suggestions now was a bad time in the property cycle to introduce the changes.

“All the evidence being put forward by economists and independent commentators — as opposed to vested interests like property or real estate organisations — is that now is actually a better time to introduce these reforms, because a lot of investor demand has come out of the housing market.”

WHAT DOES THIS MEAN?

Negative gearing allows property investors to deduct net rental losses against their taxable income. Labor wants negative gearing for property investors tio apply only to new purchases.