Negative gearing: Bill Shorten says Labor policy will see more houses built and prices under control

Bill Shorten has declared his plan to reform negative gearing would not endanger the housing market and economy; sisters buy first home to negative gear; small business reacts to budget; and, Sydney to grow by 600k in next three years. BUDGET FALLOUT

- Katy Hall: First home buyers wait until parents die

- Big tax relief for earners under $40K in bold Labor plan

Bill Shorten has declared his plan to reform negative gearing would not endanger the housing market and economy, despite modelling showing it would send prices plunging by up to 16 per cent in some cities.

The Labor leader announced on Wednesday he will not reassess his plan to restrict negative gearing tax concessions only to purchasers of new properties and dismissed criticisms of the policy as “wrong”.

He also claimed the reforms would ensure more housing would be built to keep prices from spiralling out of control.

MORE NEWS

Natalie Joyce beats Barnaby blues by bodybuilding

Ausgrid worker electrocuted replacing power poles

New social media laws ‘rushed and poorly drafted’: Labor

His comments came as budget documents released on Tuesday revealed declining investment in the housing sector could detract from real GDP growth. The risks would be exacerbated if property prices were to fall much further than they already have, the budget said.

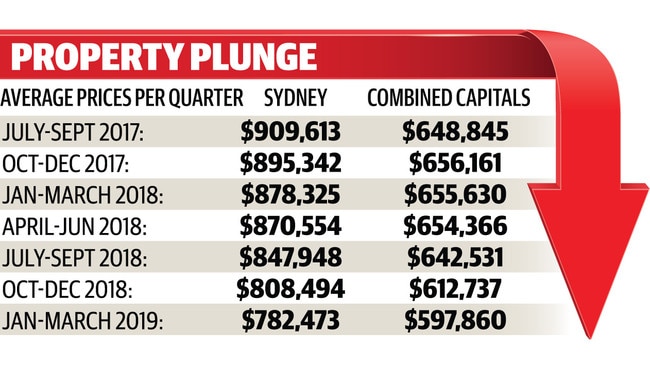

Prices have fallen by more than 10 per cent across Sydney and Melbourne in the year to March. All of the mainland capitals with the exception of Adelaide also recorded falls in prices over the period, according to CoreLogic.

Property analysts have since slammed the Labor leader’s comments, claiming his views showed a lack of understanding of the housing market.

“Bill is dreaming if he thinks this won’t hit the market badly,” SQM Research director Louis Christopher said.

He added that the reforms were counterintuitive and would backfire. The policy would stifle housing demand and push prices down by about 7 to 16 per cent in Sydney and Melbourne over the first two years it was implemented, SQM modelling showed.

It would also push prices down in Canberra by 10 per cent and Brisbane prices would fall by up to 7 per cent.

Price falls of this magnitude would discourage investors from buying new properties, even if they could still use negative gearing, because the risk of holding a mortgage worth more than the value of the home was too high, Mr Christopher said.

He said the majority of new properties remain units sold off the plan, where the buyers agree to pay a price at current market value but are only required to settle on the payment when the property is built, usually a few years later.

With fewer investors purchasing new properties, developers would have no choice but to pull their housing projects, Mr Christopher said.

— Aidan Devine

Sisters living the dream after first home buy

Sisters Brooke and Jade Miller are fresh from buying their first home in the Penrith area, and claim cuts to negative gearing would be “devastating”.

The pair plan to put their home up for rent next year to help take the sting off their repayments for a while, but the removal of the concession would make a significant dent in their finances.

Older sister Brooke, 25, said buying the home was a challenge. She was only able to afford the purchase by working two jobs, one in a high school office and the other at ANZ Stadium on the weekends.

The sisters also received help from their parents, who went guarantor on the loan for their $510,000 house at Cambridge Park.

“We work hard. We were hoping negative gearing would give us a leg up into the market,” Brooke said, adding they were planning to live in the property for the first six months to qualify for the NSW government first homebuyer concessions, which offer an exemption on stamp duty payments for properties prices under $650,000.

“You’ve got to do whatever it takes to make it work,” Brooke said. “Owning property was always a priority for us. We had to put a lot of effort into (it).”

Small business asset write-off reaction

A new fryer, ice machine and some badly needed chairs are among the purchases a Sydney restaurant owner is already eyeing off thanks to the increased $30,000 tax break for

small businesses.

Under the Coalition’s budget pitch, more than 3.4 million companies are now eligible to instantly claim on asset investments, including Lori Gardiner’s Coogee restaurant Milky Lane.

“My staff have been screaming out for a new fryer,” she said.

“It sounds silly but even things like we’re 10 chairs short at the moment and I’m having to say ‘let’s hold off (buying them) and see where we are next week’. It’s all those little things that add up that you just couldn’t justify investing in without being able to claim something back.”

BUDGET 2019: 3.4M BUSINESSES GET INSTANT ASSET WRITE-OFF

Ms Gardiner said the increased instant asset write-off would “greatly assist” small retailers around Coogee, who are struggling with high rent

costs and reduced customer numbers as ongoing construction obscures many shopfronts.

Master Builders chief executive Denita Wawn said the increased threshold for qualifying for a tax write-off — from an annual turnover of $10 million to $50 million — would help many small construction businesses.

“Thousands of small business builders around the country will benefit from the increase to $30,000, but more importantly, the significant expansion of the eligibility threshold to $50 million annual turnover,” she said.

— Clare Armstrong

Make room for a population boom with 600K more

NSW will be home to close to 600,000 more people in the next three years taking the state’s population to more than 8.6 million in 2022, the Budget papers reveal.

Rapid growth will result in Australia’s total population hitting almost 27 million in 2022 despite the Coalition’s pledge to cap annual migration at 160,000 people.

BUDGET 2019: COMPLETE LIST OF WINNERS AND LOSERS

The boom is partially attributed to a decline in the number of Aussies moving overseas as well as women having more babies.

The nation’s fertility rate was 1.78 babies per woman in last year’s census and was assumed to rise to 1.9 babies by 2021 and remain stable thereafter.

With congestion already bringing Sydney to a standstill, Treasurer Josh Frydenberg has conceded that governments on both sides at state and federal level have failed to plan for the boom.

Mr Frydenberg said population growth was putting real pressure on services, including health, education and public transport.

“The roads are more clogged than they ever were. What we are focusing on, working with the states, is to better share data, to better strategies together to get the infrastructure in place,” he said. The Coalition has promised to spend $100 billion on infrastructure over the next decade — up from $75 billion announced at the previous Budget.

Despite the population growth the national unemployment rate was expected to remain steady at about 5 per cent.

— Sheradyn Holderhead