Michael Daley backtracks on proposed ‘luxury’ car tax

NSW Opposition leader Michael Daley has backtracked on his proposed luxury car tax, which would increase stamp duty on vehicles worth more than $100,000, when questioned over its fairness for farmers and workers.

Michael Daley has been forced into an embarrassing backdown on his centrepiece tax policy, admitting it may need to be revised just two weeks after he announced it.

The Labor leader spent Thursday in a muddle over the details of his luxury car tax hike and its impact on farmers and truck drivers.

The policy is to increase stamp duty on vehicles over $100,000 and boats over $200,000.

MORE NEWS

Knife-wielding man shot dead by police after killing ex

Three Irish men charged at airports over ‘roof scam’

Pete Evans supports well-known anti-vaxxer

But Mr Daley, who is within striking distance of claiming government, struggled to explain how the tax would be implemented and repeatedly stated he would need to seek further information.

He said the intent was for it to be a “luxury car tax”, but then could not say how this would impact farmers or tradies who pay over $100,000 for utes and trucks.

Asked if the tax would apply to prime movers, mowers or tractors, he said several times: “I’ll have to have a look at that.”

He then resorted to saying he would have his shadow treasurer Ryan Park “circulate detail”.

LISTEN TO THE AWKWARD INTERACTION

More than an hour later, he addressed the press again, saying the tax would apply to prime movers but not to tractors or mowers.

When pushed on the idea that he was slugging truck drivers, his response was that the government tolled them.

He claimed 23 of the 25 models of LandCruiser would not be affected by his tax.

Clearly struggling to answer questions in the press conference, Mr Daley said at least eight times he would either look at the details of the tax or ask his party to “circulate them”.

“What I’ll do is get the shadow treasurer to explain in detail today exactly what it does and doesn’t cover,” he said.

During the exchanges, he conceded he might consider an exemption for farmers if they were unfairly treated.

“I can tweak the policy and remove unfairness, that’s what governments do all the time,” he said.

“I’ve said what we will do if we are in government, and there are now unforeseen consequences, we are finding them out and we will find other sources.”

He later clarified: “It won’t apply to vehicles that are specifically farm vehicles.”

Labor is introducing the tax to pay for recruiting an extra 5500 nurses to the health system but it will not cover this entire cost.

“What I’ve done is say if we want to have these nurses, these 5500 new nurses at a cost of $413 million …. then we need revenue. And this tax, this increase in stamp duty, will pay for $248 million of it,” Mr Daley said.

Premier Gladys Berejiklian said the policy was “Michael Daley at his worse”.

“He doesn’t understand how to run a budget,” she said.

“He doesn’t understand that taxing people, including farmers, takes our communities backwards.”

THE BIRTHDAY CAKE CALAMITY

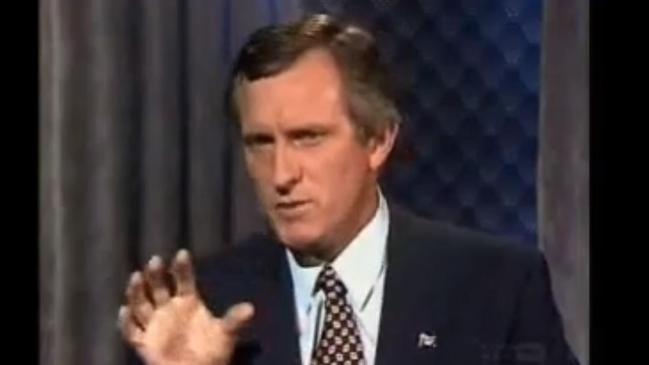

Michael Daley’s stumbling performance brought to mind the moment John Hewson lost the unlosable election in 1993.

In an interview with Mike Willesee, Mr Hewson unravelled as he failed to answer whether a birthday cake would cost more if a GST was introduced. He said it depended on how the cake was decorated and if the shop charged sales tax.

“If the answer to a birthday cake is so complex you do have a problem with your GST,” Willesee said.

DALEY’S FULL CAR CRASH Q&A

Q: The Premier met with farmers, trades people, trucking dealers saying that they were all going to get hurt by your luxury car tax, is this an ill-thought out tax?

A: It’s an increase on stamp duty at a certain threshold, and if you pay it now you pay a little bit more. If you don’t pay it now you won’t pay more.

But these aren’t Ferraris right? These are working vehicles.

Well I had a look at all the prices for example of land cruisers. There are 25 models of land cruiser — 23 of them come under the threshold. Two of them come over the threshold, and if you are purchasing those ones that come over the threshold you’ll pay a couple of hundred dollars more. And that’s the leather seats and big sound speakers and all that sorts of stuff.

What about a prime mover or something like that? There was a bloke we spoke to yesterday reckons it’ll cost him $7,000 more in stamp duty for a prime mover. He’s a business.

Well, I’ll have to have a look at that.

Would you think about carving out vehicles that are used on farms?

It’s for luxury cars.

He’s saying the way it’s written out is that he’s got a truck dealership, so all his trucks, they’re all vehicles over a hundred grand, he’s now gotta pay this extra tax on and he’s got a business where he uses those trucks for whatever so he’s got to pay an extra seven grand, so were businesses exempt or not?

It falls on the purchaser of the vehicle who have to pay the stamp duty. And if they pay it now they pay a bit more and if you’re not paying now.

So is that unfair though, why should a business which is buying the trucks over a hundred grand and needs them for a business, why are they paying this, tax this luxury car tax?

I’ll have a look at the details of that.

Is there a reason why we don’t know, because there were a few of us who were asking about this yesterday, is there a reason why we don’t have an answer today?

I’ll have a look today and get back to you about those details.

Does it seem to be appearing to you at the moment that this isn’t really taxing the rich to pay for the nurses and midwives, it’s just taxing the everyday man and woman trying to run a small business?

I’m just being honest. All of our policies are (inaudible) and I’ve found savings measures and I’ve found revenue measures. What I’ve done is say if we want to have these nurses, these 5,500 new nurses at a cost of $413m over (inaudible), then we need revenue. And this tax, this increase in stamp duty, will pay for $248m of it. I have outlined savings measures and been honest with the stamp duty thresholds and pay rise tax thresholds and we’re not going to go ahead with, what the government is doing is promising the world, and they’ve identified no savings measures, they’ve offered tax cuts, they need to explain how they’re going to pay for it. I’ve been completely upfront.

But taxing farmers in a drought is that something you would want to reconsider From any point you look at it you can see that that’s an issue?

Well as I said, if you’re buying the luxury two models of land cruiser, the land cruiser I’m told is one of the most common vehicles used in rural NSW, 23 out of the 25 don’t hit the threshold.

What happens if you’ve got a John Deer, a slasher or something?

We’ll look at the details.

So you’re looking at carving it out?

Well if I have to do that for farmers, we will. But I don’t think it applies to them on the off-chance.

So that could then apply to tractors for example, especially in this region a lot of farmers are spent over roads, so a lot of people have to register their tractors to also travel on the road in-between properties

It’s a luxury car tax, not a tractor.

So what about boats? There are a lot of people up here who own expensive boats, it’s their business it’s their industry. And boats are being taxed so would those businesses be exempt.

If they’re over the thresholds then they’ll pay yes.

But it’s a business not a luxury.

There’s no free way of paying for nurses and paramedics and hospital upgrades. You can’t conjure money out of thin air. What we’re doing is asking people who can most afford it to pay a little bit more. So if you can afford a $200,000 boat, you can afford to pay a little bit more to help us put nurses in our hospitals. I can’t make any apology for this. There’s no free money, and if the Premier says to you “you can have it all”, inverted commas or brackets, for free, there’s no such thing as that. I’ve been really honest. Now the nurses have said to us we want nurse to patient ratios. And they said quite clearly when the Premier said we’re going to give you 5000 new nurses they just said we don’t believe it. She hasn’t told us how she can pay for it, hasn’t told us how she’s going to implement it, we don’t believe it. But we’ll believe you if you make a commitment to legislate mandated nurse-to-patient ratios. Now I went to Westmead Hospital, and this is what really moved me. I went to Westmead Hospital to announce an upgraded Westmead Hospital. A young nurse came up to me and said — with a tear in her eye — she said Mr Daley all I’ve ever wanted to do since I was a little girl was to be a nurse. And I’m a nurse now, a mental health nurse. And the other night I had to look after 10 or 11 patients, mental health patients, by myself, and with inadequate security. I can’t stay in the job. If you don’t give us nurse-to-patient ratios, I’m sorry, I’ll have to leave. And I’m not going to say to that nurse I’m going to let you down. And if I have to increase the stamp duty to the people who are millionaires, then so be it and I’ll make no apology whatsoever for that.

A lot of farmers and small business owners are not millionaires though. No one’s denying that we need more nurses and midwives, but is it really fair to target …

I’ll get Ryan Park to circulate precise details for that, there’s a lot of misinformation floating around about it.

Can you understand why it doesn’t taste right to them, that you’re saying that this is a luxury? That a b double or a farm vehicle is a luxury?

I’ll get Ryan Park to circulate the exact details today of which vehicles it does cover.

With respect to that Mr Daley this is a new tax you’re putting on and you don’t know the details.

An increase. It doesn’t apply to farm vehicles, it’s a luxury car tax and a luxury boat tax.

Does it apply to farm vehicles?

I don’t believe it does no.

According to what it comes under though it’s only farm vehicles that aren’t registered don’t fall under this scheme but farm vehicles that are registered you have to drive on public roads between properties are included.

I’ll get all the details today.

Same with fisherman, have they got to pay?

Well someone’s got to pay.

Why the fishing industry?

If we have to do something to exempt farmers from that, for working vehicles, we will.

Why the fishing industry? So you picked boats, sure there’s some expensive speed boats but if you’re saying all boats, what about a guy who is a local fishing trawler, why is he paying for it and not other small businesses?

The money’s got to come from somewhere. We want nurses in our hospital, the money’s got to come from somewhere.

If you’ve got a small business tax why doesn’t it apply to all businesses?

Bridget, the money’s got to come from somewhere, we have finite resources, and there are limited opportunities for state government to raise revenue. If we want 5500 more nurses in our hospitals so they don’t walk off the job, these are the things, the tough decisions we’ve got to make.

Y ou’ve said you were going to look at farmers being exempt from this. Would you look at whether small businesses earning under a certain amount per annum were also being exempt from this?

I’ll have a look at those details.

Are you concerned that you’re going to isolate the whole of the north coast fishing industry by doing this, by saying you’ve all got a boat over a hundred grand, you’re paying a tax?

What I’m doing is responding to the concerns of the people across NSW who want more nurses. The nurses themselves are saying they can’t go on. The mandated nurse to patient ratios came from Qld and Victoria, I want them in NSW. but the money has to come from somewhere.

Sorry, that didn’t answer my question. The fishing industry now by having a luxury boat tax that the whole industry is paying for, you’re saying you’re not concerned that that might isolate the fishing industry? You’re not worried they might be thinking, well, why are we paying for this?

As I’ve done throughout my whole time in public life, when people have concerns I’ll sit down and talk to them. The money has to come from somewhere.

There are clearly consequences to this though. Is it good enough that you haven’t thought through?

There are consequences of not doing it either. There are consequences of not having new nurses in hospitals. We have to make hard choices in government and that’s what I’ve outlined I’ll do. I’ve been honest here. What should happen is that the Premier and the Treasurer should explain where their money is coming from because they’ve promised the world to everyone, they’ve promised 5000 new nurses and don’t know where the money’s coming from and so they need to answer where they are going to get their money from. I’ve told you what our revenue sources will be.

Is the stamp duty on a $500,000 dollar fishing boat will be $40,000 to $50,000, so that’s what they’ll be paying, adding to the nurses, but some other industry doesn’t have to pay?

These are the tough choices we need to make.

Isn’t it a problem though you’re putting up a policy that you clearly haven’t thought through?

There are very limited opportunities for increasing revenue in state governments. We don’t have the capabilities that federal government does. We have very, very limited opportunities and limited revenue sources. So if you want nurses, you want more paramedics, you want more cleaners, you want more allied health workers in your hospital, the money has to come from somewhere.

You mentioned stadiums before, couldn’t you use some of the money you’ll save on your stadiums policy to go towards nurses and midwives?

That’s capital.

You’ll say you’re potentially exempting farmers, if you do that, won’t it throw your costings out?

What I said I’ll do is get the shadow treasurer to explain in detail today exactly what it does and doesn’t cover. There is some inherent unfairness in it that we’re of course always willing to sit down with people and remove that unfairness.

Surely this would have been something you should’ve come up in the planning phases of this policy? Someone should’ve said “hang on, who is this going to target?”

Well, what we’ve tried to do is be honest and identify a revenue source. But you do in opposition as you would government. When there are unforeseen consequences and tweaks that have to be made with policy, you sit down, you listen to people and you do it. And I’ve said that’s what we’ll do. But I will not compromise on the sources of revenue or the need for that revenue to be derived because without it you can’t do it. And this is the point I want to make, without this revenue, we can’t do these things that we’ve committed to. So we’ve been honest.

Therefore you won’t be able to compromise then?

I can tweak the policy and remove unfairness, that’s what governments do all the time.

But that will remove revenue, won’t it, by its very nature?

I’ve said what we will do if we are in government, and there are now unforeseen consequences, we are finding them out and we will find other sources.

You’ve tried to put yourself up as a leader who can run the economy well and if you can’t manage a policy like this, doesn’t that say …

I’ve used the example of Land Cruisers. People are saying that farmers are working 4WD on farms and will be caught. Well the luxury ones will, but the working ones won’t. That’s what I’ve explained to you.

With Land Cruisers though a lot of people buy add-ons. That’s not necessarily the sale price with it.

You can buy the add-ons after you purchase it won’t make any difference. After you purchase, if you want, you can add anything you like.

Won’t that hurt dealers though who sell in package deals with add-ons?

We’re talking about $200 here.

$200 can mean a lot to someone though, running a farm or a business.

$200 can mean a lot to a nurse as well.