How Salim Mehajer’s gamble to make a quick buck backfired

SALIM Mehajer boasted to friends about how he could earn tens of millions of dollars from his high-rise development. In the end it was his greed that finally brought him down.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

THEY are the four floors of an apartment block that plunged Salim Mehajer into financial disaster.

To his private circles, the flamboyant property developer boasted he could earn tens of millions of dollars from his high-rise development known as Skypoint, which towers over John St in Auburn.

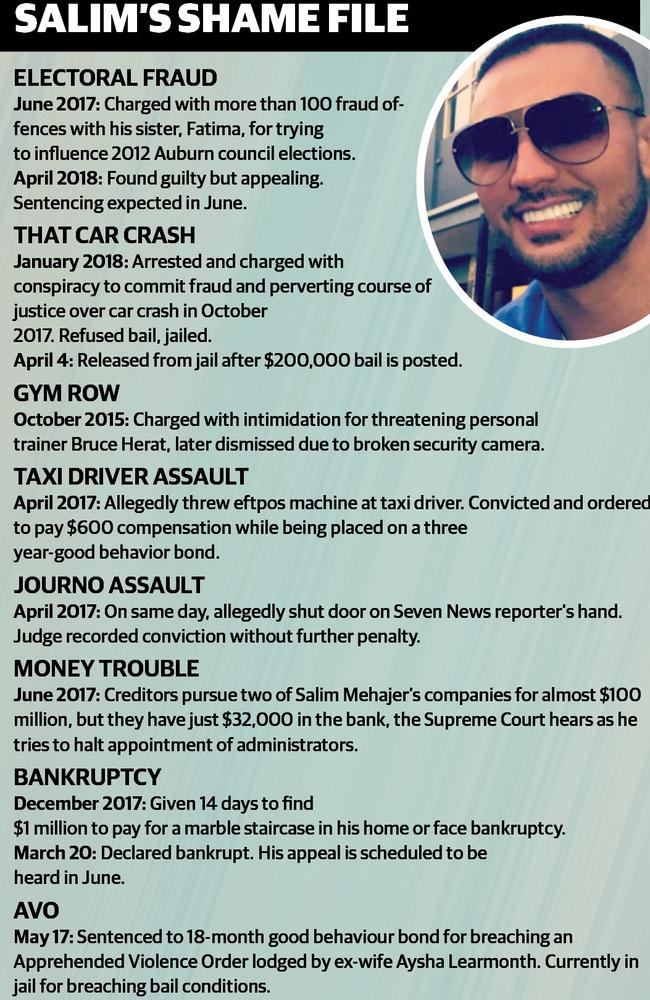

With Mehajer seemingly buried in scandals ranging from criminal convictions for assaulting a journalist to electoral fraud — which he says he will appeal — the development was his great financial hope.

But Mehajer made one fatal misstep, revealed in ASIC documents obtained by The Sunday Telegraph.

Instead of selling the apartments and clearing the $73.5 million loan he took out to fund the project, Mehajer made a disastrous overreach. He delayed the unit sales to submit another development application to Cumberland Council in the hope of adding four more storeys, the ASIC documents said.

The council rejected the application and Mehajer fought the decision in the NSW Land and Environment Court, but lost again.

The documents said in that period Mehajer’s companies defaulted on the loan from Hong Kong-based hedge fund SC Lowy Financial.

Interest and other penalty payments had seen the debt creep up to $82 million by mid-2017.

This triggered a clause that allowed SC Lowy to order Mehajer’s companies to immediately repay all of the debt with enormous penalty interest payments attached.

The development saw the debt balloon to about $100 million once the interest was attached and other creditors emerged to claim they were also owed money.

The development and the two Mehajer-related companies used to build it were put in the hands of receivers HoganSprowles, which began selling the units to clear the debts.

It is now likely that Mehajer will not receive a cent from the development once all the units are sold and creditors paid off.

He is now languishing in jail with his bail refused.

His new love interest Melissa Tysoe made headlines on Friday when she used social media to hit out at trolls who said she looked like a “sheman” and should kill herself.

“What happened to humanity?” Ms Tysoe wrote on Instagram.

An insider from Mehajer’s camp said the Skypoint disaster was a massive blow.

“It was always (assumed that) as soon as John St is sold, he’ll be sweet,” the insider said. “It was a stupid, stupid move (to default on the debt).”

According to an administrator’s report by HoganSprowles, the Skypoint project was completed ahead of schedule in February 2017.

SALIM MEHAJER DECLARED BANKRUPT

MEHAJER FACES COURT OVER ESTRANGED WIFE’S AVO

But instead of pushing ahead with the unit sales, the report said “we understand Mr Mehajer had directed the companies to proceed with lodging a development application”, the document said.

SC Lowy issued a demand for $83 million on June 16, 2017, while third parties claimed they were owed $14 million. In its October report to creditors, HoganSprowles estimated the debts could be as high as $116 million.

It came at a terrible time for Mehajer. In February 2016, Auburn Council’s administrator effectively cost Mehajer millions by reversing a council decision to sell Mehajer a council carpark at 13 John St where he planned to build a block of 96 units. In November 2015, the disgraced former deputy mayor had been banned by ASIC from being a company director.

Despite this, the administrators said Mehajer “has acted as a shadow director” on the companies behind the development and had control over their bank accounts.

Mehajer could yet face more charges as the administrator also said in its report it believed the property developer had breached his “director’s duties” and should be further investigated. An ASIC spokesman said the corporate watchdog was aware of the criticism but declined to comment further.

Had Mehajer begun selling the units rather than pursue the development application, the administrators estimated he could have reduced the then $82 million debt to SC Lowy by about $58 million. If he sold the rest of the units and cleared the rest of the debts, he could have walked away with about $4 million in profits.

But the financial documents point to Mehajer drowning in debt, a possible explanation as to why he tried to build the extra four floors.

The matter has landed in the NSW Supreme Court after Mehajer lodged caveats on a number of the units. A company linked to SC Lowy has taken action to have the caveats removed.