Housing finance figures disappoint the market

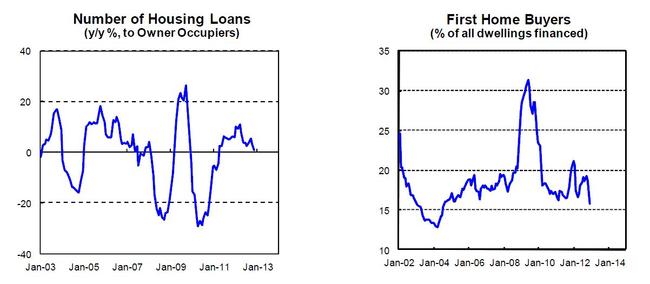

THE number of new housing loans for owner-occupiers fell 0.5% in November last year, data from the Australian Bureau of Statistics revealed on Monday.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

THE number of new housing loans for owner-occupiers fell 0.5% in November last year, data from the Australian Bureau of Statistics revealed on Monday.

Driving the fall in new housing finance commitments was a 2.9% drop in lending to first home buyers in November, after a 2.9% fall in October last year.

The total value of finance commitments fell 0.8% in the month and new lending, excluding refinancing, fell 1.3% in November.

This result highlights the tenuous nature of the forecast housing recovery in 2013, said the Housing Industry Association.

"It has been encouraging to see steady improvements in lending for construction and the purchase of new homes throughout 2012, particularly in the latter half of the year. " said HIA Economist, Geordan Murray.

The 4.8 per cent monthly decline in new home lending was driven by a fall of 1.8 per cent in loans for construction and a 10.3 per cent fall in loans for the purchase of new dwellings.

The number of loans for existing property, net of refinancing, declined by 1.3 per cent.

In November 2012 the total number of seasonally adjusted loans for the construction and purchase of new homes declined in all states.

The ACT was the only exception increasing by 18.0 per cent.

See the data for yourself:

5609.0 - Housing Finance, Australia, Nov 2012

The number of loans declined

- 0.1 per cent in New South Wales,

- 11.0 per cent in Victoria,

- 1.4 per cent in Queensland,

- 1.7 per cent in South Australia,

- 4.1 per cent in Western Australia,

- 27.0 per cent in Tasmania and

- 5.1 per cent in the Northern Territory.

Originally published as Housing finance figures disappoint the market