Treasurer Josh Frydenberg calls for calm in US-China trade war

As global markets claw back some of the ground lost during the last 48-hours’ $98 billion wipe-out, Australian Tresurer Josh Frydenberg has called for “cool heads to prevail” in the escalating US-China trade war.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

Treasurer Josh Frydenberg has called for cool heads as the United States and China lock horns over currency and tariffs in an ongoing trade war.

The US Treasury Department has accused China of currency manipulation after the yuan was devalued to its lowest level in more than a decade. The move rattled financial markets in Australia and abroad, however, local shares are expected to open higher on Wednesday after Wall Street clawed back some losses overnight.

US President Donald Trump announced last week he would slap a 10 per cent tariff on a further $US300 billion in Chinese imports from September 1. Mr Frydenberg said it was important to be realistic about uncertainty in the global economic outlook.

“We shouldn’t overreact to these developments, but we should recognise that China’s currency moves and the increase in the US tariffs are an unwanted escalation,” he told ABC radio’s AM program on Wednesday.

“These are concerning developments and our message is to continue to encourage cool heads to prevail and for differences between China and the US to be negotiated between the parties.” He said the federal government would continue to act domestically to stimulate economic growth, pointing to personal income tax cuts which passed parliament last month.

“Right now the Australian government would like to see cool heads prevail,” he said.

Mr Frydenberg downplayed risks to Australians’ retirement savings after former treasurer Peter Costello warned superannuation and the budget’s bottom line could be hit by uncertainty in the global economy.

“People who have had super and money in managed funds have done much better than if they had money in the bank,” he said.

“We’ll still deliver a surplus next year and we’re absolutely determined to do that.”

The Aussie dollar plunged to a 10-year low on Tuesday and $86 billion was wiped off the value of Australia’s biggest companies in 48 hours of carnage triggered by the escalating US-China trade war.

Adding to the tensions is a potential Indo-Pacific arms race as China warned on Tuesday it was ready to match the US in deploying new intermediate missiles following the collapse of a Cold War treaty.

Analysts said it was too early to tell whether the stock market turmoil meant shares were heading for a crash or that the world economy was marching toward recession.

“Will this be a small pull back or has the market topped? No one knows the answer,” said Geoff Wilson of Wilson Asset Management.

“What we do know is that in the US it’s been the longest bull market ever.”

The flight to safe haven investments pushed the price of gold up to a six-year high and bond yields to record lows. Even crypto currency found some investor love, with Bitcoin strongly up yesterday to $US12,000.

MORE NEWS

‘I love you forever’: Family mourns teen killed by bus

$4bn demand for new dams as towns risk running dry

Nassif companies’ new legal case over building defects

The Aussie dollar was last night trading around its lowest levels in a decade, 67.8c, compared with 82c in March last year.

President Trump accused Beijing of “currency manipulation” after China’s central bank’s decision to let the yuan fall to the lowest level since the GFC, spooking investors across the globe.

“This is a big, big signal that the gloves are off,” said Investsmart chief market strategist Evan Lucas said. “This is a big escalation.”

It follows President Trump’s announcement of a new round of harsh tariffs on Chinese goods sold in the US from the start of next month.

Beijing’s central bank lowered the value of its currency in a move widely interpreted as an attempt to temper the cost of the new tariffs.

Mr Trump tweeted: “China dropped the price of their currency to almost a historic low. It’s called “currency manipulation.” Are you listening Federal Reserve? This is a major violation which will greatly weaken China over time!”

But amid the turmoil are some potential positives for the Australian economy according to analysts.

“Australia might actually be a winner out of this trade dispute,” said CMC Market’s chief strategist Michael McCarthy.

Beijing is imposing restrictions on agricultural imports from the US, potentially creating a bigger market for our farmers to export to China.

“Australian exporters might have the opportunity to jump in and fill the gaps. It could be a good news story for Australia in the long run,” Mr McCarthy said.

A lower dollar also means demand for Australian exports could increase.

“That makes Australian goods look cheaper compared with other economies,” Mr McCarthy said.

In the long term cheaper stocks on the Australian share market also had an upside, after the market hit a record high just one week ago.

“The key question is whether this is the beginning of a crash or a correction,” Mr McCarthy said.

Also shaking investor sentiment were moves by Iran to detain oil ships it claims are smuggling fuel in the Persian Gulf.

“That’s a major concern. We can’t afford interference with the freedom of shipping,” said Mr McCarthy.

The US has also withdrawn from global nuclear deal on Iran and imposed tough new sanctions to prevent it from exporting oil.

Escalating the instability is the expiration of the United States and Russia’s Cold War treaty in the Asia Pacific.

Russia and the US are both now considering deploying intermediate-range missiles in the Indo-Pacific region while Beijing now says it “will not stand idly by” if the US makes good its ambition to deploy weapons within months.

China’s chief arms control official Fu Cong warned other countries not to allow the US to deploy intermediate-range missiles on their territory.

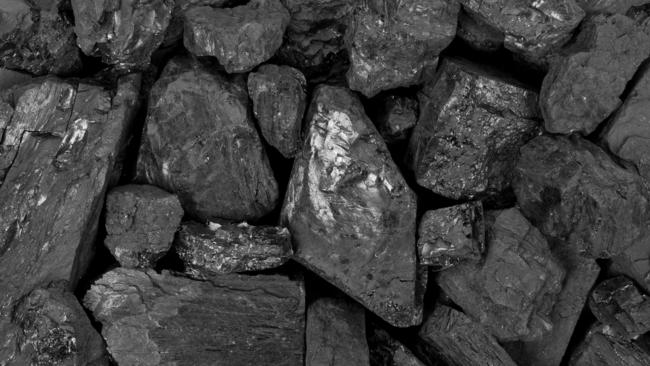

Meanwhile, Australia has its own trade battle with China, with Australian coal imports held up at Chinese ports earlier this year.

Overshadowed by the geopolitical tensions and volatile world markets was the Reserve Bank’s decision on Tuesday at its board meeting to keep interest rates on hold at one per cent after they were cut by 0.25 per cent in June and July.

The board warned trade disputes meant downside risks to the global economy but did not elaborate on the escalating US and China trade war.

Royal Bank of Canada analyst Su-Lin Ong said she suspected that the discussion at Tuesday’s board meeting would have been robust.