Shopfit Co director Lachlan Waugh says company is ‘solvent’ despite $930k debts, failed creditor deal

An Insta-famous tradie says his company can handle its $930,000 ATO bill – despite a failed debt deal with creditors.

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

An Insta-famous tradie says his company can handle its massive ATO bill – despite a failed debt deal with creditors owed almost $1 million.

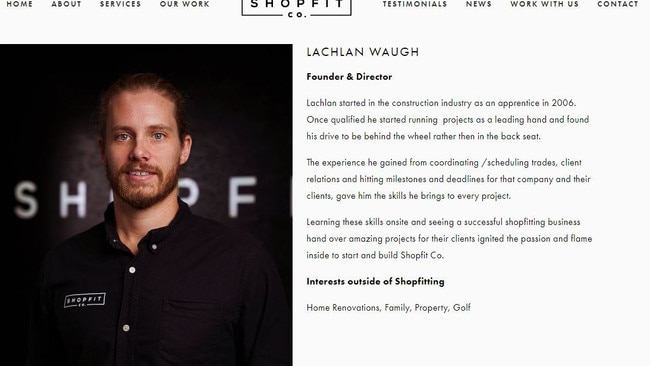

Shopfit Co is run by Lachlan Waugh, partner of Gold Coast reality TV star Skye Wheatley.

The company entered the Small Business Restructuring program in August, owing $927,000 to the ATO and thousands more to multiple small businesses and the Gold Coast Council.

While the rejection means Shopfit is no longer in external administration as part of the restructuring program, it is now unable to use such a plan to reduce its hefty debts.

The administrator hired to probe Shopfit’s finances, David Stimpson, found related parties including Mr Waugh had borrowed $357,472 from the company – funds which could be pursued in the event of a liquidation.

The report referenced a property at Tallai, where the couple has been documenting an extensive renovation of a dilapidated acreage mansion on social media.

Mr Stimpson’s report said he had not been provided with accurate records of the $10 million-a-year company’s finances and recommended creditors reject the deal.

He also raised concerns about a new company which appeared to have taken over operations – a statement Mr Waugh said was “completely false”.

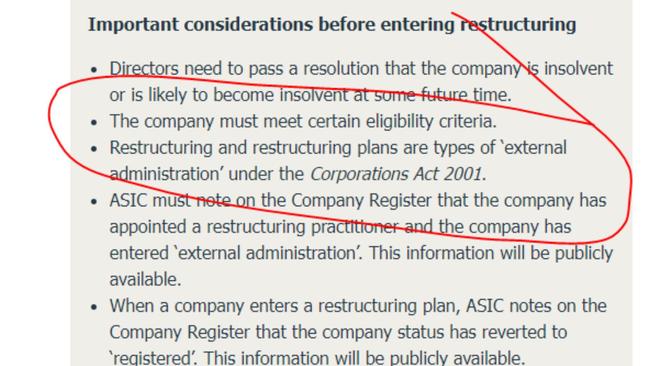

Mr Waugh and Shopfit’s operations manager Stephen Wilson have repeatedly claimed Shopfit was never in external administration, despite the Corporations Act formally classifying the restructuring process as such.

To be eligible to enter a Small Business Restructure, directors must declare the company is insolvent or likely to become insolvent.

Once the process commences, the company is classified on ASIC’s register as in external administration.

Mr Wilson declared media reporting of the issue as “fake news”, saying Shopfit was “not insolvent” and “not going into external administration”.

Mr Waugh also took to social media to criticise the Gold Coast Bulletin’s reporting of his company’s troubles.

“Nothing was ever in external administration, we’ve maintained control of the company the whole f***ing time, so where’s the good publicity? Where is it at?,” he said in an Instagram story.

In response to questions from the Bulletin this week, Mr Waugh said he looked “forward to seeing your story always a good read … I love the damage to small businesses during stressful times”.

Mr Waugh said Shopfit had “made significant profits up to the end of the September Quarter and appeared to be balance sheet solvent”.

He said loans made to him by his company were simply a way for him to “draw earnings” from it.

“Effectively the loan balance represents the wage you would have received from the company over the number of years it accumulated,” he said.

More Coverage

Originally published as Shopfit Co director Lachlan Waugh says company is ‘solvent’ despite $930k debts, failed creditor deal