Why modern machines are good managers of your money

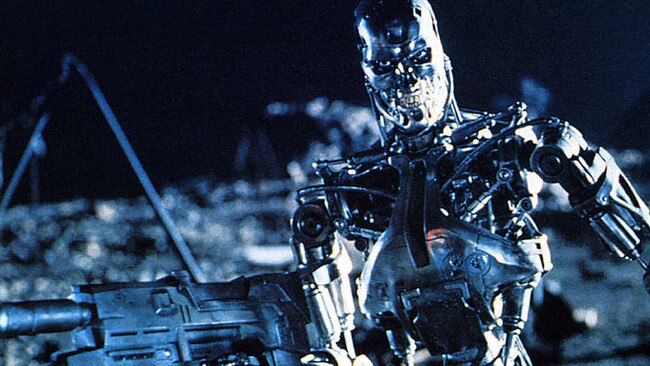

Robots in the movies may often be scary, but when it comes to helping Australians save and invest, machines are playing a new role.

Saver HQ

Don't miss out on the headlines from Saver HQ. Followed categories will be added to My News.

Artificial intelligence is evolving quite nicely.

Firstly, it hasn’t sent robots from the future to terminate us, or our parents.

Secondly, machines haven’t yet taken over all of our jobs, with unemployment rates in many countries very low.

And thirdly, AI doesn’t appear to be nasty. Earlier this decade computer scientists created an artificial brain with one billion connections and let it loose on YouTube. The first thing it learned to recognise was human faces. After that, it kept looking at cat videos, again and again.

• Hits from the past can save you cash

• End family fights about electricity

Perhaps more important than feline entertainment is modern machines’ ability to manage our money and investments better than we can.

The key reason for this is emotion.

More accurately, it’s AI’s lack of emotion.

They don’t freak out and rush to hit the sell button when financial markets are falling. And they don’t suffer fear of missing out and pile in just when markets are at record highs — which is usually the worst time to invest.

While humans have a herd mentality when it comes to investing, machines will only do what they’re programmed to do. Often they will invest right through the investment cycle — smoothing out returns — or could be set to invest more heavily when prices are cheap and most humans are running the other way.

Banks and financial services companies around the world are already using AI behind the scenes to do much of the work than humans used to do.

Robo-advisers invest and reinvest clients’ money according to predetermined wisdom and planning, while other technology tells us when we make certain transactions or is used to detect fraud.

It’s hard to see machines replacing all types of financial advice, especially where specialists need to be creative about people’s planning and goals, but it can make the nuts and bolts of investing much easier.

AI also works very well for younger generations who have already shown that many prefer screens to human contact.

Other ways that machines might help manage our finances in the not-too-distant future include:

• Analysing our spending to see if there are ways to save money.

• Talking to connected home appliances such as fridges and airconditioners to monitor usage and cut the cost of bills.

• Having intelligent human-like conversations about financial planning and investment goals.

A great example of automation in investing has been exchange traded funds (ETFs), which have exploded in popularity in the past decade and now hold more than $42 billion of our money.

ETFs traditionally tracked a particular index — such as the ASX 200 — by investing people’s money in every stock in the index in proportion to their size. More actively managed ETFs are now popping up but the principles remain the same — diversify money over many different assets.

There are specific ETFs that invest in Aussie shares, global shares, emerging markets, currencies, commodities, bonds and even — fittingly — robotics.

So forget about Terminators, fem-bots with machineguns and those crazed cowboys from Westworld. Modern money machines are here to help.

Originally published as Why modern machines are good managers of your money