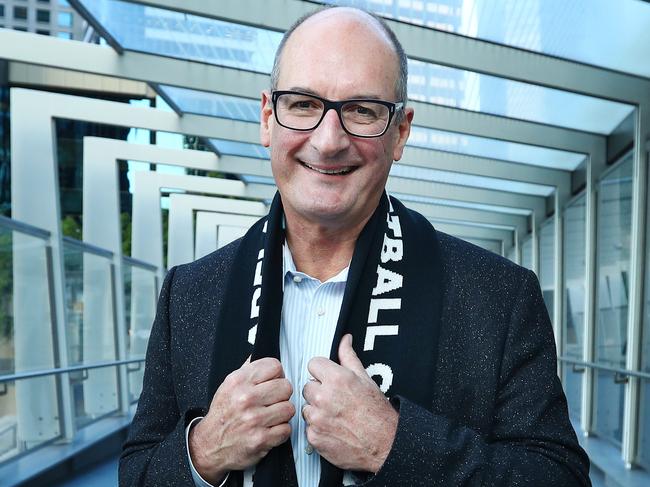

Kochie provides tips for selling real estate as property prices fall

PROPERTY prices are on the way down, but this doesn’t mean you have to settle for a dud sales result on your home, Kochie explains.

Saver HQ

Don't miss out on the headlines from Saver HQ. Followed categories will be added to My News.

LAST December we wrote a column on how to sell your home in a slow property market. We received a lot of critical feedback saying the market was booming and not to be so pessimistic.

Now, seven months later, reality is setting in particularly in Sydney and, to a lesser extent, in Melbourne.

Hindsight shows the Australian housing market peaked in September last year.

Since then the average number of days a Sydney house has taken to sell has risen from 45 days to 63 days. For home units the days on market has risen from 54 to 64 days.

In Melbourne, days on market for homes is stable at 48 days but with home units the days have actually dropped from 100 to 75.

Sydney auction clearance rates have dropped from around 80 per cent to the mid 50s and Melbourne is the same.

Another key statistic is the discount to the advertised price that properties were sold for. In Sydney that discount has risen from 5 to 6.4 per cent and in Melbourne from 4.6 to 5.7 per cent.

BEST WAY TO INVEST YOUR TAX RETURN

HOW TO THINK LIKE A RICH INVESTOR

The data is now irrefutable that the biggest property markets in Australia are softening. Going against the trend is Hobart with continuing strong growth but Sydney and Perth have significant slides and other capital cities are stagnant.

As we advised in December, a falling property market needs sellers to;

. be realistic in their pricing.

. hire a good real estate agent

. present the property well

. never buy a new property before you sell

The pendulum has turned in favour of buyers. If you’re a buyer;

. organise pre-approval on your finance

. make offer well below asking price

. don’t get emotionally attached to a property

The big question now is how far the market will turn down. There are lots of pessimists who claim parts of the residential property market are 40 per cent over valued. That’s because we didn’t go through the worldwide property downturn following the Global Financial Crisis.

We’re not nearly as gloomy as that. But there are 6 warning signs to monitor when it comes to the future of property values.

Rising interest rates

Borrowing money has never been cheaper. Record low interest rates have meant property buyers have been borrowing more for less. It has been a golden period for anyone wanting to get into the property market.

But this period of easy money can lead to a financially deadly “debt trap” for those who over do it. A rise in interest rates can have a devastating impact on an over geared borrower … and it can sneak up on you.

For example, a 2 per cent rise in interest rates on a 4 per cent home loan doesn’t sound much until you realise it would mean a 50 per cent jump in repayments.

The Reserve Bank is indicating that official interest rates won’t be rising anytime soon but expect the major banks to put up home loan rates slightly to offset their increased costs of funding.

Rising unemployment

After 25 consecutive years of positive economic growth, the job market has been pretty solid for quite some time and unemployment has been relatively low. That has been good news for the property market because stable employment gives buyers the confidence to borrow and get into the market or trade up.

If the economy slows, the job market deteriorates, unemployment rises, incomes become uncertain, confidence falls and property prices suffer.

Falling auction clearance rates

Auction clearance rates are a regular, consistent barometer of property market health. It’s an indicator on the balance between buyers and sellers, which is the fundamental supply and demand foundation of all property markets.

The higher the clearance rate the healthier the market as it indicates there are plenty of buyers competing for stock on the market. When clearance rates fall it indicates fewer buyers and more sellers which is likely to see property values fall or stabilise.

Those auction clearance rates have already started to fall. Beware.

Rising vacancy rates

An important driver of property values is the investment market. Investors buying property for both capital growth and income from rents.

The key to making an investment property stack up financially is they must have tenants paying rent. Rising property vacancy rates (the number of empty properties) means there aren’t enough tenants to go around so investors will either have to slash their rents to attract tenants or sell the property because the returns don’t justify the investment.

This combination will push values down because more stock will come onto the market and lower rents mean the property isn’t as attractive as an investment as before.

Falling rental yields

Linked to increasing rental vacancy rates. A property is valued based on the rental income it can produce and its capital growth prospects from rising values.

If vacancy rates rise, then landlords will have to lower their rents to attract tenants otherwise the property will be vacant and earn no income. No, or lower, rental income means the property isn’t as valuable and other potential investor buyers won’t pay as much.

Above average construction numbers

Property is fundamentally about demand and supply. Building just enough properties to satisfy demand so there is competition between buyers to underpin valuations.

If construction outstrips demand then values will fall as sellers compete to attract buyers by lowering prices to make their property more attractive.

That’s the current concern about the Melbourne, Sydney and Brisbane inner city home unit market. A huge amount of construction is still in the pipeline and there are fears that when these developments are finished, and come onto the market, there will be an oversupply and values will fall.