Insurers are being forced to be more transparent on the increases you are being hit with each year

Insurers have been getting away with hiking costs for consumers without many of them noticing, but there’s one significant change that will put an end to this once and for all.

FINALLY some transparency on my latest insurance bill.

In fact, I almost feel like Christmas has come early.

Just the other day I received my annual landlord’s insurance bill in the snail mail and thought to myself, “here we go with some sort of hefty hike”.

I braced myself.

Aren’t we all used to seeing our annual bills climb well above inflation year on year?

Usually I have to dig out my old paperwork from the year before to calculate how much my insurer has jacked up my policy.

But not this time.

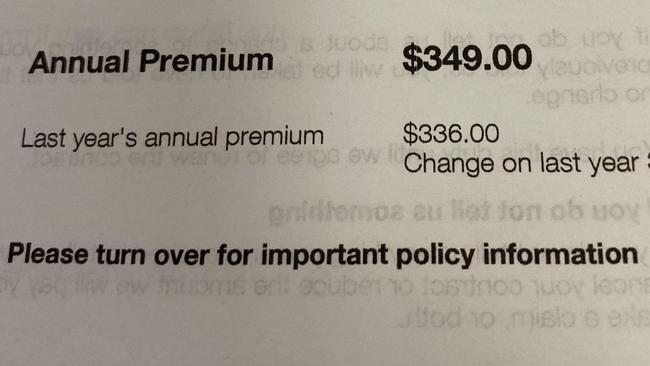

My landlord insurer Terri Scheer had put the annual premium renewal of $349 on the bill but then did something extra.

They spelled out how much I spent last year on the same policy – $336.

The insurer also explained the increase as “change on last year 3.9 per cent”.

Not only has this saved me time trying to fish out my files but it made me instantly think my insurer had nothing to hide.

They weren’t trying to sneakily jack up my premium cost with some exorbitant increase and hope it would go unnoticed.

They also explained why my premium changed and detailed my cover this time versus last time.

I had plumbing issues a few years back that I had to claim on, so I know full well how critical it is to have landlord insurance.

NSW has led the way on price comparison – under the NSW Emergency Services Levy Insurance Monitor it required from July this year that insurers provide premium comparisons in dollar terms from the previous year.

This is for property, home building and contents, personal property and motor vehicle policies.

However, some insurers have rolled this premium comparison out Australia-wide – and the move will be nationally enforced by the end of 2020.

This will allow consumers to take one glance at their bill and work out if they want to cop what is likely an increase to their costs on the chin, or consider taking their business elsewhere.

In my experience, car insurers are the worst at jacking up premiums and hoping that you don’t notice.

I’ve taken them to task on this several times and got them to reduce the cost, simply because double-digit increases didn’t seem acceptable to me.

The change to the rules of disclosing increases on bills will hopefully stop firms dead in their tracks if they think they can put up costs and get away with it.

Inertia has been a long-running problem among Australian consumers who simply can’t be bothered trying to get a better deal.

Being loyal to many companies – whether it be banks, insurers, telcos or power companies – usually doesn’t pay off.

Hopefully this significant change should prompt more consumers to take action if they think they’re not getting a good deal.

Originally published as Insurers are being forced to be more transparent on the increases you are being hit with each year