Find out the best home loan interest rate deals in 2019

Home loan customers are in the box seat to demand a better deal in 2019. Here are the top tips from the industry experts on how to get ahead.

Saver HQ

Don't miss out on the headlines from Saver HQ. Followed categories will be added to My News.

Home loan customers are in the box seat to demand a better deal in 2019 as the big banks fight for redemption after a horror Royal Commission.

Cases of charging fees for no services, gouging thousands of customers dead or alive and simply misleading them has tarnished the reputations of the big four banks.

There’s no doubt they will be fighting harder than ever to attract new customers this year as it gets harder to dish out credit and attract new business.

The home loan markets in many states have continued to soften and lenders have been forced to run the microscope over their lending practices while buyer demand has dropped off.

The Reserve Bank of Australia has failed to move the cash rate since 2016 and many economists think this will remain the case in 2019.

But this does not mean customers should relax.

Instead they should be ensuring they are not paying too much and if they are they should be hunting for a better deal.

This involves giving your home loan an annual health check.

Here’s some helpful ways to get your mortgage in tip top shape for the year ahead.

CHECK YOUR RATE

Owner occupier borrowers should not be paying a rate over four per cent.

If that’s you then you’re simply throwing money down the drain.

There’s dozens of lenders out there offering customers interest rates with a “3” in front — some deals are as low as 3.44 per cent.

But the gap between the cheapest and most expensive rates has widened so it’s easy to be getting ripped off.

If you’re not sure of your interest rate, log into your online banking to find out or phone up your lender and ask.

Tom Moloney, 35, his wife Shanelle, 33, and two children George, 4, and Max, 2, refinanced their three bedroom home last month in order to reduce their monthly interest payments.

The couple have an $890,000 loan and their repayments were about $2200 a fortnight.

Mr Moloney said after shopping around they jumped from a big four bank to a mid-tier lender.

“We had a mobile banker who came out and interviewed us and talked through the loan and savings we could make,’’ he said.

“We’d been with ANZ about 10 years and we did a renovation six months ago and refinanced through them, but we hadn’t changed banks.

“It will help us save a lot of money now and because you have your loan for 30 years you want to save some money over that time.”

By switching lenders the couple’s interest rate fell from 3.9 per cent to 3.69 per cent.

This has reduced the couple’s repayments from about $4198 per month to $4091 — this is equivalent to an interest saving of $40,000 over the loan term.

ME’s head of home loans Andrew Bartolo encouraged borrowers to “regularly check the interest rate on their home loan.”

“For an owner occupier your rate should probably start with a three,” he said.

“It’s a bit more complex for investors because they usually have a preference for interest-only lending.

“Investor rates are more generally starting with a four.”

“It’s a very competitive market and rates are moving around all the time.”

LOAN FEATURES

Many home loans come with plenty of bells and whistles attached.

This includes offset accounts, redraw facilities and linked credit cards, all popular features in a home loan package deal.

But just because they are on offer doesn’t mean customers should sign up to them.

It’s important to work out what is helping bring your costs down and if you have features you don’t need then it’s time to reassess the type of home loan product you have.

OFFSET ACCOUNTS

Mr Bartolo said offset accounts — a daily transaction account linked to your home loan — was one of the easiest ways to cut monthly interest charges.

“They are a great feature,” he said.

“We offer multiple offset accounts attached to the one loan.”

But often loans that come with an offset account charge higher fees, so customers should do the maths or ask their bank if it’s worthwhile having this type of account.

Offset accounts allow customers to reduce the interest charged based on the balance in the account.

For instance, if a customer has a $300,000 home loan and $10,000 sitting in an offset account interest will only be charged on $290,000.

REDRAW FACILITIES

Other popular features of home loans includes redraw facilities.

This allows the extra repayments that have paid above the minimum repayments to sit in a redraw facility and be available “at-call” to customers.

Redraws can be handy when unexpected expenses arise or even planned costs such as home renovation or buying a new car hit.

But be wary of pulling money out of a redraw account.

It ultimately means you are going backwards on your loan and your loan balance will be pushed upwards.

Usually banks want it to be easy for you to dip into your redraw account so you can pull cash out, increase your loan balance and take longer to pay off the loan.

This will deliver them more money in interest charges.

SPLIT LOANS

This allows a customer to split their loan with a portion on a variable rate and the other portion on a fixed rate.

But be wary of opting for a fixed rate loans if you are considering selling your property because you will be hit by break costs if you break the term early.

Split loans are popular for customers who want to take a bet each way on whether or not rates will move.

Fixed rate loans also have restrictions including how much in extra repayments you can make each calendar year.

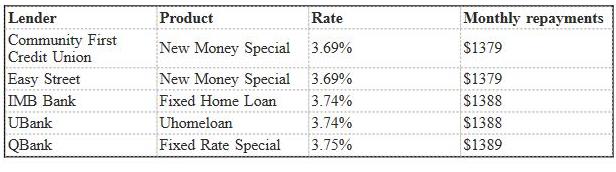

Financial comparison website Mozo’s spokeswoman Kirsty Lamont said borrowers can get very cheap fixed rate deals.

“Borrowers can lock in fixed rate deals just 25 basis points more than the lowest variable rate on the market,” she said.

“A good strategy is to fix a portion of your loan and leave some of it variable part so you can pay down that part while taking advantage of a fixed component.”

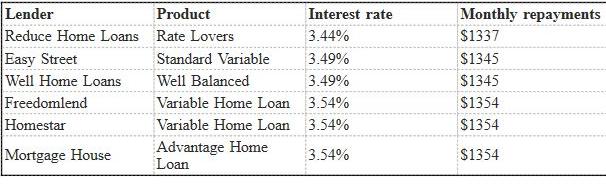

Mozo’s database found for a $300,000 30-year loan the lowest variable rate is 3.44 per cent by Reduce Home Loans compared to the lowest three-year fixed rate by Community First Credit Union and Easy Street at 3.69 per cent.

Fixed rate loans are also unlikely to come with a offset account which many customers like to have to bring down their interest charges.

DEMAND A BETTER DEAL

Refinancing a home loan has become tougher as banks crackdown on lending and are much more picky on who they hand over money to.

But Kirsty Lamont said borrowers could sometimes score themselves a better deal without having to jump lenders or do a scrap of paperwork.

Instead they should just phone up their existing lender and ask for a better deal.

“Haggle with your existing lender and ask them to drop your existing rate,” Ms Lamont said.

“Before you ring them up, go online and find some of the lowest rates on the market from non-bank lenders so you can see what rates are on offer.

“Once you have this get on the phone and demand a better rate from your lender, it’s as simple as that.”

When contacting your bank make sure you ask for their home loan retention team.

These employees are paid to try and keep you as a customer so they will often jump through hoops to ensure you stay.

Sometimes they can be hard to get a hold of and it may take one of their staff a few days to get back to you just to discuss your loan.

So be persistent but patient because it often pays off.

UBank’s chief executive officer Lee Hatton said there’s never been a better time to score yourself a cheaper deal and borrowers need to keep a close watch on what charges they are paying.

“Many Australians sign up for a home loan and then don’t stay on top of their rate,” she said.

“There are great offers in the market all the time, so if you’re not looking for the best one, it could be costing you thousands.”

EXTRA REPAYMENTS

While rates are at historically low levels borrowers should be proactively trying to pay down their debt as quickly as possible.

Tipping it additional funds over the minimum amount can make a massive difference.

Realestate.com.au’s head of home loans Andrew Russell said the sooner you can make extra repayments the better.

“Switching to fortnightly repayments creates an additional payment each month and over the course of your loan you are paying it off sooner by paying less interest,” he said.

“Make sure your home loan balance is always as low as it can possibly because you are paying less interest and are going to be paying your loan off sooner.”

Calculations by Mozo found on a $300,000 30-year home loan with a rate of four per cent, if the customer paid an extra $100 month they would more than $28,700 in interest charges and cut three years and six months off their loan term.

But if they tipped in an extra $200 per month they would save more than $50,400 in interest charges and cut the loan term by six years and two months.

Paying fortnightly instead of monthly is also an easy way to bring down your home loan interest charges which are calculated by the lender daily.

RATE PREDICTIONS IN 2019

Despite economists forecasting the RBA to kept the cash rate on hold for the entire year already banks are pushing up rates.

Mid-tier lender Bank of Queensland this month revealed it was increasing home loan rates between 11 and 18 basis points for both new and existing customers.

The bank’s group executive of retail banking Lyn McGrath blamed “continuing funding cost pressures” for the rise.

“While decisions like these are never easy, offsetting the impact of these costs ensures we balance the needs of our borrowers, depositors and shareholders,” she said.

The hikes kicked in on January 11 and its expected other lenders will follow suit and jack up their charges throughout the year.

Ms Lamont said there will be more lenders following this trend of “hiking rates unobtrusively.”

“It may be that you think your home loan is more competitive than it actually is,” she said.

“It is quite likely that your rate has gone up by 25 even 50 basis points if you have had your home loan for a few years.

“You could find out you are paying much more than you think compared to the lowest rates on the market.”

BEST VARIABLE RATES

BEST THREE-YEAR FIXED RATES

Originally published as Find out the best home loan interest rate deals in 2019