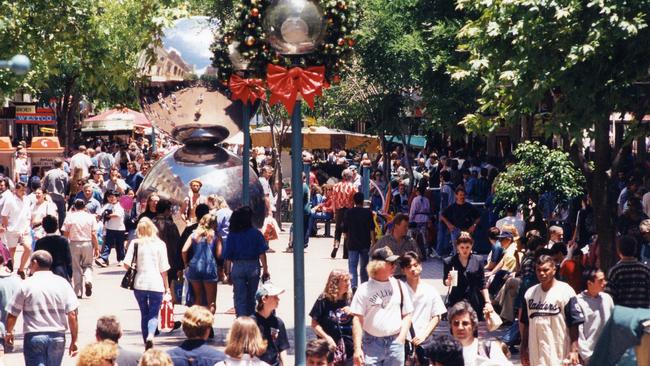

Christmas shoppers warned to prepare for the busiest shopping days ahead

THESE are the busiest shopping days yet to come so shoppers need to get organised or face the crowds and potentially spending more.

Saver HQ

Don't miss out on the headlines from Saver HQ. Followed categories will be added to My News.

THE countdown to Christmas is well and truly on with shopping madness still ahead for many consumers who are yet to fill their festive stockings.

For some, this will mean shopping right up until store doors close on Christmas Eve, but for most, the retail stampede is expected to see the busiest shopping days on Saturday, December 9 and the weekend of December 16 and 17.

And shoppers are getting smarter with their festive splurges — this year 43 per cent are more likely to sort out a budget before they hit the shops — an increase from 40 per cent last Christmas.

LENDERS: Enticing Christmas deals rolled out in time for the festive shopping spree

New research from the Commonwealth Bank has also found women are tipped to finish their shopping one week before Christmas arrives but as for their male counterparts, they’ll take an eleventh-hour approach.

One in five are expected to finish their Christmas shopping on December 23.

CBA’s executive general manager of retail products, Clive van Horen, said many shoppers will be not only flocking to bricks and mortar stores, but will also be ordering presents from the comfort of their living room couch.

Mr van Horen urges consumers to make e a game plan before whipping out their plastic or punching in their credit card details online to secure a purchase.

“Three simple steps that people should take is to make a list of the people they should be buying a gift for and assign a budget to it,’’ Mr van Horen said.

“Also make sure you budget for food and drink because you often go out a lot and it can be a double whammy if you are not budgeting for both.”

Many shoppers will however be forced to rely on credit this Christmas which is not good for the nation’s ballooning credit card debt.

RETIREMENT: Are you superannuation savings on track for a comfortable retirement?

Latest Reserve Bank of Australia figures show Australians owe a massive $51.4 billion on credit cards and more than $31.4 billion is accruing interest.

Crown Wealth Management’s founder Scott Parry urges shoppers to try and avoid ending up with mounting festive debt by opting to pay for festive purchases by cash.

“Don’t take your credit cards out shopping with you, leave your credit card at home because your mindset shifts,’’ he said.

“You don’t want to end up with a credit card hangover in the new year, so cash is king.”

Mr Parry also suggests going back to last year’s bank and credit card statements to see what you spent and use it as a guide to work out if spending needs to be cut this year.

He also suggests setting limits for spending on various categories, including gifts, food and drink and travel expenses.

Originally published as Christmas shoppers warned to prepare for the busiest shopping days ahead