Why women are at a disadvantage when it comes to money matters

Over the past year Sarah Megginson found the time to be a surrogate for her best friend and has now embarked on a new mission to change the lives of women around the world.

Sydney Weekend

Don't miss out on the headlines from Sydney Weekend. Followed categories will be added to My News.

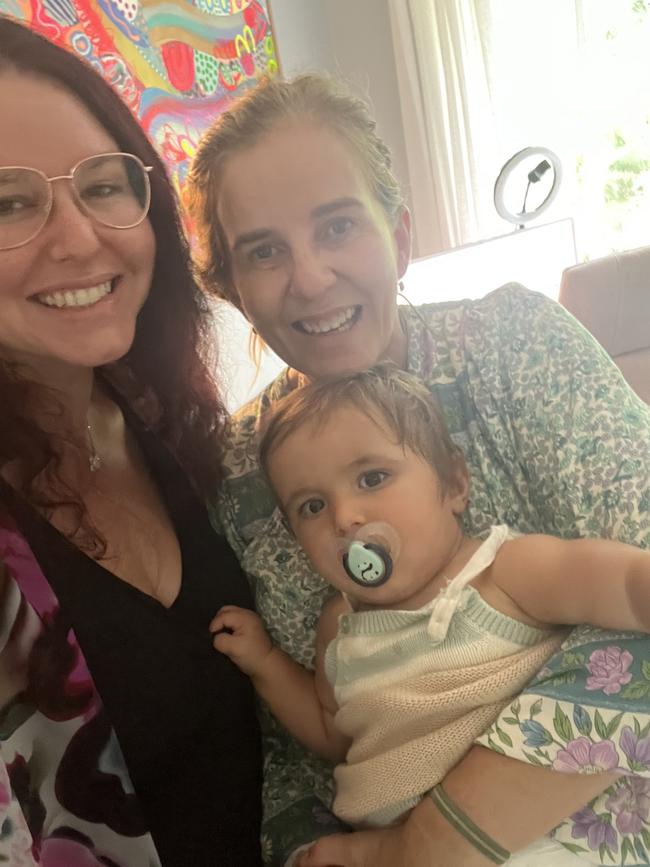

Less than a year ago, Sarah Megginson was pregnant, carrying her best friend Lisa Messenger’s beautiful baby Hugo. Entrepreneur and author Messenger had experienced a long and painful fertility struggle and, after three kids of her own, Megginson stepped in to help.

The financial expert has had quite the year, and not only as a surrogate.

She and Messenger have just submitted the final draft of their new book detailing their experience.

And she’s recently back from New York where she was selected by the UN to share her voice with the Commission on the Status of Women on a topic she’s passionate about – financial literacy for women – and the conference was something she describes as a completely “life-changing experience”.

“We never slow down,” the 42-year-old says of her life with husband and Gold Coast radio personality David “Christo” Christopher and kids Lila, Noa and Jesse.

“And Hugo is absolutely divine. He’s now nine months old, so he’s been out and about in the world for as long as he was baking, and Lisa only lives about an hour away in Byron, so we see each other regularly.

“They came over for lunch the other day and I don’t think Lisa sat down for more than 60 seconds at a time, because he’s crawling and go-go-go.

“The kids adore him and he is a total bundle of adorable energy.

“Lisa is a natural and has taken to parenting like a duck to water.”

Messenger says she wished for baby Hugo for eight years, and describes him as the “greatest gift on the entire planet’’.

“In all that time I was so focused on having a baby, I don’t think I ever really stopped and let myself realize just how delightful actually having a baby if my life would be,’’ she says.

The pair’s book about their surrogacy journey, and the magic that can happen when you come together for a greater purpose, is titled The Power of Two.

“It’s due for release later this year and we’re very excited,” Megginson says.

FINANCIAL CRISIS

In her work as a personal finance expert at comparison website Finder, Megginson knows the gender inequality faced by women every day – whether that be around super, parental payments, and even cost-of-living pressures that have led to lost homes and couch surfing, making a near impossible situation even worse.

It was that passion to advocate for female financial literacy that saw her head to New York in March, to understand what can be done right here in Australia. And there’s a lot to do.

Megginson says the fastest-growing household category in Australia right now is single women over 50.

“This age group is really vulnerable to homelessness, because they’ve had half a lifetime of lower wages, lower superannuation and they’ve taken time out of work to raise families,” she explains.

“Add in domestic and family violence and relationship break ups, and the fact that many women are less educated about managing a budget and investing than men, and it’s easy to see why this demographic is so disadvantaged.

“We’re in a situation where we see many older women couch surfing or even living in their cars, because they can’t afford to rent. Last year, Anglicare Australia’s Rental Affordability Snapshot showed that a single woman on the age pension could afford less than 1 per cent of rental listings across Australia.

“That included (when accessing) the highest rate of rent assistance.

“At the same time, younger women are facing some of their own uphill battles when it comes to earning a good wage, being able to buy a home and the general pain of the cost of living crisis.”

Research at Finder shows that women are 40 per cent more likely than men to be facing cost-of-living induced financial stress, and recent data from the Workplace Gender Equality Agency found that Australian women experience a 21.7 per cent gender pay gap. For every dollar a man earns, a woman receives 78c.

“This means women make $26,393 less than men on average – this is a huge disparity,” Megginson says.

“At a practical level, how we see this manifest is that many women stay in really bad relationships and in dangerous situations because they can’t afford to leave.

“It’s heartbreaking to think of how many families in Australia right now are stuck in a cycle of poverty and abuse.

“It’s a crisis in Australia, and we’re not talking about it enough.”

I AM MORE INSPIRED THAN EVER

The Commission on the Status of Women is an annual gathering of more than 6000 women and gender allies, coming together from across the globe to help solve some of the world’s biggest problems around poverty, violence, the gender pay gap and more.

Run by the UN, it is the biggest international gathering of leaders dedicated to addressing gender equality and women’s rights.

The 68th session, from March 11-22, had the priority theme, “Accelerating the achievement of gender equality and the empowerment of all women and girls by addressing poverty and strengthening institutions and financing with a gender perspective”.

Megginson says the challenge is as much about holding on to rights women already have, as it is about making progress. It’s a growing concern – this year’s International Women’s Day theme was “Count Her In: Invest in Women. Accelerate progress” – with a financial bent.

“That is my passion,” she says.

“I was there as an observer rather than a delegate who is actually shaping the document – the process is literally paragraph by paragraph, with different parties from different countries in the room together to make progress and shape the wording and policy.”

Megginson was one of the Australian delegates, who included Natasha Stott Despoja and Sex Discrimination Commissioner Dr Anna Cody. She says meeting the delegation’s leader, Katy Gallagher, federal Minister for Women and Minister for Finance, was a highlight.

“She commented that having more women in integral decision-making positions in government is so key, and having the data to inform these decisions is crucial,” she says.

“She referenced the recent changes to tax cuts, which were applied with a gender viewpoint (and) show just how much women stand to benefit from the revised … tax cuts.

“First of all, I was absolutely blown away at the scale of the event. It was insanely inspiring to be in rooms with people from so many

diverse backgrounds and solving such a wide range of problems.

“I am so passionate about making money easy to master and helping women understand the ins and outs of managing their budgets, because I believe there is so much power and freedom in it. After this trip, I am more inspired than ever.”

OPEN AND HONEST

For Megginson, there is no greater investmentthan that of the next generation – which is why the journey to financial literacy starts at home. And as young as possible.

“I started having money conversations with my kids really early, so they can learn and understand the value of money,” she says.

Many parents aim to protect their kids from money stress by not talking about it, but not discussing money has an impact too, she continues.

“I am a really big believer in having open and honest conversations with your kids, in an age appropriate way,” she says.

“When you don’t talk about money, it can take on an air of being mysterious, taboo and challenging.

“Having an open and healthy dialogue around money will also help them develop good financial habits around budgeting, saving and investing’’.