‘We’re dying for hope’: Is the Federal Budget going to help families?

Tax cuts, superannuation on paid parental leave and energy rebates were all announced in tonight’s budget, but so was a “luxury” tax on large family cars… who are the winners and losers this time around?

Family Life

Don't miss out on the headlines from Family Life. Followed categories will be added to My News.

The Federal Budget was delivered tonight, and while there was some relief in sight for Australian households, a new “luxury” tax on a typical family car has left people scratching their heads.

Treasurer Jim Chalmers spoke live from Parliament House in Canberra on Tuesday at 7:30pm, calling the 2024-25 budget “a budget for the here and now and a budget for decades to come”.

But what does that mean for ordinary families struggling with cost-of-living pressures?

Should we, as Scott Pape, AKA the Barefoot Investor skip budget night?

“All the rosy economic forecasts they make in the Budget can’t hide the fact that many people feel like they’re living in a recession right now,” he wrote in The Herald Sun on Sunday.

The workings of politicians in Canberra feel light years away when you're standing in the grocery store facing the reality of dairy products that have gone up 20 percent, it’s tempting to ignore the Budget altogether. But there are some benefits for families.

Let’s look at the winners and losers.

Want to join the family? Sign up to our Kidspot newsletter for more stories like this.

Energy relief for households

Energy relief payments are nothing new, and this year the Labor government are offering more help to more families.

From July 1, every Australian household will receive $300 towards their energy bills. Small businesses will get “a little bit more” than $300.

“Electricity prices would have risen 15 per cent in the last year, if not for our efforts. Instead, they rose an average of 2 per cent,” he said.

“And tonight, I assure Australians that more help is on the way. This budget delivers $3.5 billion in new energy bill relief for everyone. Just as every Australian taxpayer will get a tax cut, every Australian household will get energy price relief.”

Last year, eligible families got up to a $500 rebate on their energy bills, while small businesses received $650.

The $500 rebate wasn’t for everyone though; only concession card holders, pensioners and veterans were eligible.

RELATED: Mum despairs over cost of living

RELATED: Woolies promises cost-of-living relief on everyday items

RELATED: Mum’s epic rant about the cost of living and its impact on the next generation

Superannuation on paid parental leave

The government has announced 12 percent superannuation payment on paid parental leave from July 2025. The scheme is part of an effort to close the superannuation gap between men and women.

The $106 super payment every week will help, but it won’t address underlying reasons for the gap between women and men’s super balances: gender pay gap, career breaks and lower workforce participation.

Tax cuts in 2024-25 Federal Budget

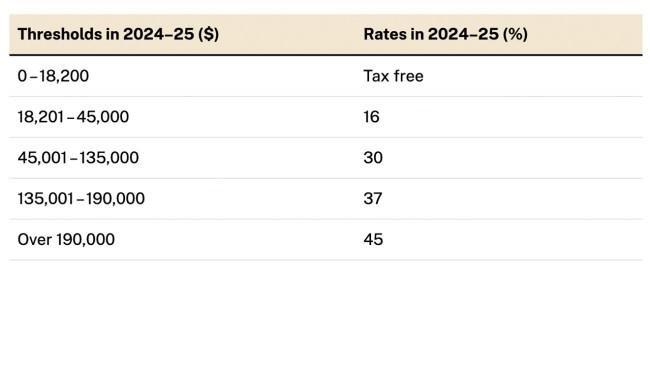

Tax cuts are also coming on July 1, reducing the amount of tax paid by those in lower income brackets.

The 19 percent tax rate will go down to 16 percent, 32.5 percent will go down to 30 percent.

Family hybrid cars will attract “luxury” tax

The controversial New Vehicle Efficiency Standard will come into effect on January 1, 2025, driving up the cost of some of Australia’s most popular cars.

It’s all part of the government’s plan to reduce vehicle carbon emissions.

What does that mean for families? If you’re buying a new car in 2025, it could cost significantly more than it did the previous year.

Popular family cars like the Toyota Kluger, Mazda CX-60 and CX-90 will all be hit with a 33 percent Luxury Car Tax.

The new tax is applied to cars that have a maximum fuel consumption of 3.5 litres per 100 kilometres. The tax is applied at 33 percent on every dollar over $76,950. If the car is defined as “fuel-efficient” the tax kicks in at $89,332.

Barefoot Investor Federal Budget advice

If those little kernels of hope aren’t enough, let’s go back to Scott Pape.

“Don’t look to Canberra for help. They’ve got enough problems of their own,” he wrote.

“Instead, focus on what you can directly control, and I guarantee you’ll move mountains.”

That could mean finding a super fund with better returns or lower rates, paying off your debts from smallest to largest, getting a cheaper deal on insurance or redoing your budget to account for all the interest rate rises and rental increases.

More Coverage

Originally published as ‘We’re dying for hope’: Is the Federal Budget going to help families?