Finance experts reveal their top money secrets

It’s a tough time of year to be juggling bills and new expenses but it doesn’t have to be.

Lifestyle

Don't miss out on the headlines from Lifestyle. Followed categories will be added to My News.

In addition to the usual festive hangover, there’s another aftermath many of us grapple with at this time of year: the financial repercussions of Christmas spending.

Recovering from the holiday splurge doesn’t have to be daunting with these tips to manage debt and set a course for a financially resilient 2024.

Understanding post-holiday financial strain

Money coach and author Max Phelps says while holiday overspending is normal, it’s the lack of planning that makes the impact harder for many of us to handle.

“It’s common to spend an average $2400 extra at Christmas, but most people don’t set aside the $200 a month needed to be ready for it,” says Phelps.

Building a solid financial foundation

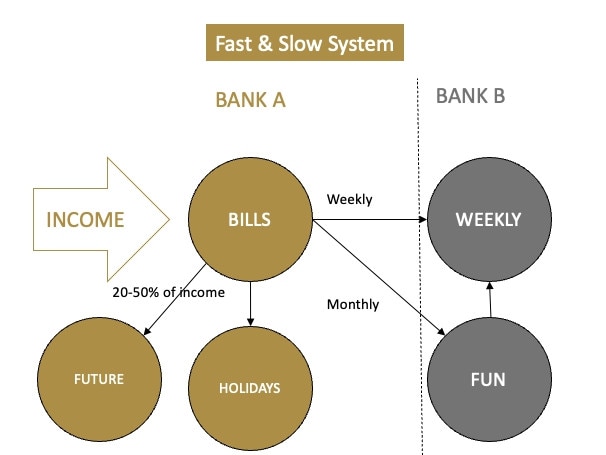

Phelps – author of Spending, Fast and Slow: Why Your Money Disappears so Fast and How to Slow Down the Flow – suggests adopting the Fast & Slow System for better financial management.

He recommends dividing your funds between two different banks, dedicating one for bills and savings, while the other is used for variable spending.

“The idea is to have your pay land in Bank A, used only to pay bills and then transfer into your spending bank, Bank B,” he says.

“Ignore the pay cycle and do the transfers to Bank B weekly for groceries and small routine spending items, plus a monthly transfer for gifts, clothes, electronics and fun stuff.

“Then open up separate savings accounts labelled ‘Future’, ‘Holidays’, and another for ‘Xmas’ with your Bank A, or any other high-interest bank accounts not with Bank B, and put money in those every pay to be ready for next year.”

He also suggests curbing small routine purchases under $30 and cutting back on groceries to save more for fun activities and long-term goals.

Tackling debt and smart budgeting

Phelps recommends the snowball method for tackling debt: start by paying off the smallest debt and work your way up.

He says this approach provides a sense of accomplishment with each debt cleared, motivating continued progress.

He advises controlling impulsive spending by limiting access to funds outside of your weekly and monthly budgets.

“That means no card access to the accounts from Bank A,” he says.

“Any cards for those accounts should be cut up, put on ice, or kept in the car, this forces you to pause and think before dipping into the bills, or any of the savings accounts.”

When it comes to bills, Phelps advises planning these expenses for the year by estimating the total and dividing it by 12, 26, or 52 based on pay cycles for better management.

Creating emergency funds

“Buffers are essential to peace of mind,” says Phelps, recommending starting with a $500 buffer which is hard to access, gradually increasing it to cover three months of living expenses.

“Emergencies shouldn’t be predictable things like holidays and car repairs, these should be planned in as normal expenses, based on an estimate,” he says.

Finding what works for you

Licensed financial content creator Queenie Tan and partner Pablo Bizzini employ monthly budget reviews.

Tan says wealth is rarely built overnight, so it’s important to find something that works for you and is sustainable over the long term.

“The budgeting strategy we personally use is the ‘pay yourself first’ budget, which means no matter what, every month we contribute $1000 to our investments before we start allocating our expenses,” says Tan, who regularly shares financial tips using social media handle @investwithqueenie.

“Other budgeting strategies work for different people, like the 50/30/20 budget – which is 50 per cent of your income to needs, 30 per cent to wants, and 20 per cent to savings and investments.

“Setting up different bank accounts for each expense is another popular budgeting strategy which works for some people, it’s all about finding one that works for you.”

Shifting mindsets for financial health

“Pablo and I went through our budget and realised we were spending heaps more on food than we usually do – our expenses went up by an extra $500 per month,” says Tan.

“Once we knew this, we were able to be more mindful of our spending and now we spend around $500 less on food each month and the quality of our meals or our food hasn’t decreased. We’ve just been more mindful.”

Looking ahead

Tan says she finds breaking her financial goals down to 90 days helps.

“I don’t believe in New Year’s resolutions because one year is a really long time, and sometimes the goals I set at the beginning of the year aren’t something that’s aligned with my life by the end of the year, So I prefer to set 90-day goals,” she says.

“I find it’s a good amount of time to achieve pretty big goals, and it’s not too long before you completely forget about your goals.

“If you set goals every 90 days, you can achieve four times as many goals in a year than if you just set goals at the beginning of the year. Break down your goal into smaller pieces. If you want to save $10,000 in one year, that’s $27.40 per day, which is a lot more manageable.”

Originally published as Finance experts reveal their top money secrets