Gold prices reach new high as experts explain how Australians can invest

With gold prices rising, experts have revealed how Aussies can profit from investing in the precious metal, and have also highlighted some red flags.

Money

Don't miss out on the headlines from Money. Followed categories will be added to My News.

As the demand for gold has hit a new high, experts say now could be a good time for Aussies to buy a piece of the precious metal.

But investors are warned to do their research.

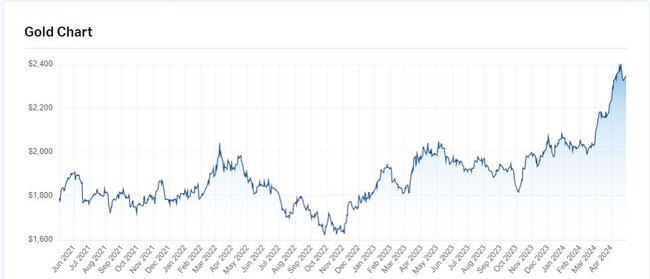

General economic uncertainty and the Russia-Ukraine and Israel-Palestine conflicts have pushed gold up by 20 per cent over the past two months, although that has slightly dipped this week to $US2344/oz.

This has also been compounded with a weakened Aussie dollar with our own domestic prices sitting at $3574/oz.

“Gold prices have been rising on the back of safe haven demand in the face of geopolitical risks (notably in the Middle East), expectations for eventual central bank rate cuts globally and strong demand out of China,” AMP chief economist Shane Oliver said.

“I think there may be more upside as more investors jump on the gold bandwagon particularly as central banks eventually cut interest rates.

“But investors need to allow that gold prices are very hard to predict because gold does not produce a dividend or rents like other assets and does not have a strong industrial use like other commodities.”

Claire Alotto, 37, has been investing in gold since she was just 20 after her dad encouraged her from a young age.

“There is never a bad time to invest in gold. I believe it’s a commodity that will continue to rise,” Ms Alotto said.

“Buying while it’s high means there is a chance that it may dip but if you are in it for the long haul you will always make money.”

So if you’re looking to invest in gold, here is what you need to know.

WHAT IS BEHIND THE GOLD RUSH?

General manager of ABC Bullion Jordan Eliseo said the recent strength in gold prices comes as “no great surprise” and comes down largely to what’s happening in the world, including rising interest rates, an upcoming US election and the wars in the Middle East and Ukraine.

“It typically does well in periods when inflation is high, and when economic uncertainty is elevated, with both these drivers highly relevant in the current investing climate,” Mr Eliseo said.

“While the price of gold will always gyrate, the long-term fundamentals, which have seen gold generate annual returns of over 8 per cent per annum, remain as strong as ever.”

However, Mr Eliseo said while gold prices are “high in dollar terms”, they have some way to go to reach “all-time highs in inflation adjusted terms”.

“Gold is also at best only fairly valued when compared to other assets, like shares and property,” he said.

“As such, it wouldn’t surprise to see gold prices continue to perform strongly in the months and years ahead.”

SHOULD YOU BUY GOLD?

Dr Oliver said agile traders may like to buy in on the assumption that the value of gold is going higher, but warned potential investors to be careful.

“The pros are that the gold price tends to follow momentum so once it starts rising it keeps going up for a while,” he said.

“It’s also a safe haven against geopolitical turmoil, say a worsening in the Middle East, and it’s a form of hard currency unlike paper currencies like the Australian dollar so should hold its value in real terms.

“And it’s a popular long term store of value which you can see and touch.”

However, Dr Oliver noted that downside to investing in gold is that it can be “very volatile”.

He also recommends any interested investors to seek financial advice before doing so.

“Momentum on the upside can also apply on the downside and it can be hard to predict where it will go with any confidence as unlike say shares, property and industrial commodities its not directly connected to the real economy,” he said.

“It has sometimes gone down initially in tough times like the Global Financial Crisis, it hasn’t always protected against inflation and it’s expensive to store if you insist on buying physical gold.”

WHERE CAN YOU BUY GOLD

Mr Eliseo said there are a number of ways you can invest in gold.

“The traditional method, which was to buy gold bars or coins is still very popular, though the drawback for some is then the question of where to store your metal,” he said.

“We are also seeing a real shift toward ‘set and forget’ gold accumulation plans, which allows any Australian to invest in gold from as little as $50 a month.”

HOW TO STORE YOUR GOLD

Mr Eliseo said there are two primary methods to store your gold, outside of storing at home which “carries a huge risk”.

“Store with the bullion dealer they’ve purchased it from,” he said.

“This is one of the reasons it is important to buy and sell gold through a reputable bullion dealer with a long history.

“Store in a private vault, which is typically for not only secure storage of bullion, but other valuables like jewellery, cash etc.”

If you do decide to store your gold at home, it’s best to get a home safe installed and update your home insurance to ensure your precious metal is covered by the policy.

Originally published as Gold prices reach new high as experts explain how Australians can invest