Aussies warned of costly frequent flyer credit cards from Virgin Australia and Qantas

Consumer advisory groups have warned Australians not to be lured into costly credit card deals tied to frequent flyer points, as Qantas and Virgin try to lure customers in.

Money

Don't miss out on the headlines from Money. Followed categories will be added to My News.

Consumer advisory groups have warned Australians not to be lured into costly credit card deals tied to frequent flyer points.

“Exorbitant” interest rates on credit cards tied to Virgin Australia’s frequent flyer scheme have been found to be as high as 20.74 per cent among lenders including NAB, Westpac, American Express and Virgin Money which have credit cards tied to Virgin’s loyalty scheme.

It comes as Qantas is trying to tempt customers with its low or no annual fee credit cards connected to it’s frequent flyer program.

Consumer group Choice said banks should cap the interest rates on Virgin Australia credit cards at 10 per cent because the value of Virgin Velocity points were “in limbo”.

“While the banks’ response to customers affected by COVID-19 has been commendable to date, more work needs to be done to make credit cards fairer, especially frequent flyer cards,” Choice banking expert Patrick Veyret said.

“Virgin Australia remains in voluntary administration and its Velocity program remains essentially frozen. The value of Virgin Velocity points remains in limbo.

“It’s simply indefensible that banks continue to charge people interest rates in excess of 20 per cent on Velocity frequent flyer cards. While the value of the Virgin program is in jeopardy, the interest rates on these credit cards must be capped at 10 per cent.”

He added this should be extended to all types of credit cards while the cash rate was at a historic low of 0.25 per cent.

A Westpac spokesperson told News Corp it was “working closely with Velocity Frequent Flyer on the matter”.

They said the bank was reviewing how it could support customers with airline rewards cards.

American Express told News Corp it had introduced a range of offers and benefits to try and meet the immediate needs of card members, and those facing financial hardship.

NAB told News Corp it was also working closely with Velocity and will provide information to customers as soon as it becomes available.

“Currently customers can redeem their Velocity points for domestic flights booked for travel from September 1, 2020, and can continue to earn points at their full value,” a spokesperson said.

“We have a range of reward and non-reward credit cards which customers can choose from, and they also can apply to transfer between products to suit their personal preferences and circumstances.”

Citi Australia, the provider of Virgin Money Australia’s credit cards, told News Corp it is also working with Velocity to review the benefits available with its Virgin Australia Velocity Flyer and High Flyer credit cards.

“Citi offers a range of credit cards, with different fees, interest rates and rewards. Customers can contact us to discuss moving to a lower rate card if they are unhappy with the interest rate on their product. They can also arrange a transfer to a low fee card,” a spokesperson said.

“Customers seeking lower interest options are able to convert their balance into an instalment plan that allows them to break large payments into monthly repayments at a fixed rate, that will be lower than the annual rate for their card, providing flexibility and interest savings.”

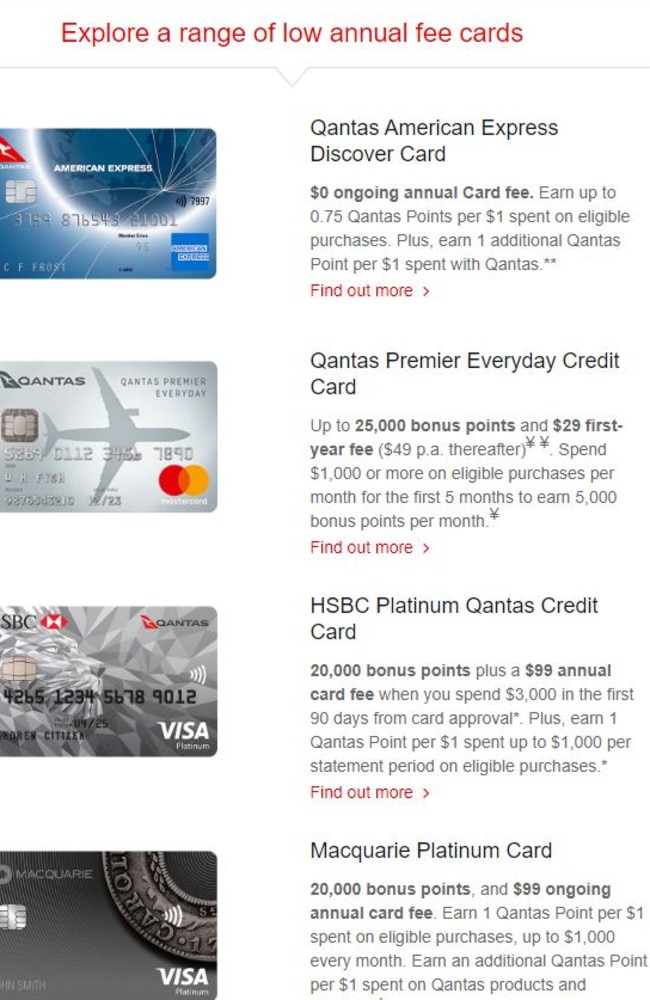

Qantas, in an email this month, listed four credit cards including the Qantas American Express Discover Card, Qantas Premier Everyday Credit Card, HSBC Platinum Qantas Credit Card, and Macquarie Bank’s Platinum Card.

A Canstar analysis awarded one of the cards listed with a five star rating, based on a monthly spend of $3000. The rating is based on the rewards return of the card net of fees, and other benefits.

HSBC’s Platinum Qantas Credit Card was given five stars, and had a new rewards return of $405. It has an annual fee of $99, and the standard earn per $1 spent is one point.

However, Canstar finance expert Steve Mickenbecker said consumers should be careful when applying for credit cards tied to frequent flyer loyalty schemes.

“Frequent flyer rewards can turn into a nightmare if the cardholder is carrying debt on their card at an interest rate in excess of 20 per cent, making it hard to cover the interest cost let alone get out of debt. Throw in a high annual fee and you could well find that unless you are spending big on your card the rewards just aren’t worth it.

“The fine print tells you how many dollars you need to spend to earn a point and how many points it takes to earn a flight. Smaller spenders can take years to get onto a plane that the annual fee might have paid for twice over.”

Mr Mickenbecker said consumers should consider stockpiling their points for travel instead of redeeming them for consumer goods.

“A $100 shopping gift card may cost around 20,000 points compared to around 15,000 points required for a flight from Sydney to Brisbane, worth say $200,” he said.

“If you are redeeming points now, the most likely choice is gift cards or merchandise.”

He said Velocity Frequent flyer could survive independently of an airline, similar to programs like Flybuys and Woolworths rewards. But an independent Velocity program might not be able to deliver the same benefit in this form.

“Holders of credit cards linked to Velocity have a choice of waiting to see how this plays out over the next few months in the hope that not much will change or to direct spending to another credit card,” he said.

MORE NEWS:

Countries Aussies most likely to visit first

‘It actually works’: COVID-19 vaccine breakthrough

180 ways to help Aussies get back to work right now

Scrapping ‘free childcare’ may force centres to shut

Qantas said its Frequent Flyer members typically stockpiled points for an annual holiday, and that behaviour hadn’t changed, with customers booking rewards flights for 2021.

Velocity says it is “working through timings to reopen the Rewards Store with our suppliers” in a statement on its website, and will provide an update when more information comes to hand.

Originally published as Aussies warned of costly frequent flyer credit cards from Virgin Australia and Qantas