Kim Kardashian’s next gig: Wall Street investor

Kim Kardashian may have conquered reality TV and fashion, now she’s the latest Hollywood star to join another competitive sector.

Entertainment

Don't miss out on the headlines from Entertainment. Followed categories will be added to My News.

She’s conquered reality TV and made SKIMS a billion-dollar athleisure brand.

Now Kim Kardashian is entering the world of finance by founding her first private equity company.

But Kardashian isn’t the first big Hollywood name to take on Wall Street.

Here we take a look at how so many superstars of the stage, screen and court are diversifying their financial interests, investing in tequila, vegan leather, and even a meditation app, as more and more celebritieslook towards big business.

KIM KARDASHIAN

The 41-year-old Kardashian is teaming up with Wall Street titan Jay Sammons to launch a private equity firm, according to a report in the Wall Street Journal.

Named SKKY Partners, the fund will focus on investments across various industries, including consumer products, e-commerce, media and entertainment.

“The exciting part is to sit down with these founders and figure out what their dream is,” Kardashian told the Wall Street Journal.

“I want to support what that is, not change who they are in their DNA, but just support and get them to a different level.”

SERENA WILLIAMS

The recently retired tennis legend will reportedly now turn her focus to the venture capital firm, Serena Ventures, she formed eight years ago.

The company, with its motto “Play to Win,” has funnelled money into promising new ventures, raising $165 million of outside financing in an inaugural fund this year to invest in “founders with diverse points of view,” Williams told The New York Times.

The firm is focusing on health, wellness and athletics and the 23-time Grand Slam champ has also been mentored by Sheryl Sandberg, the former COO of Facebook.

LEONARDO DICAPRIO

The Oscar-winner has made a series of big dollar investments in recent years. And with an estimated net worth of $600 million, he has some cash to splash around.

DiCaprio has invested in close to 20 start-up funds, many of which revolve around environmental/animal issues.

Earlier this year, the star was named an adviser and investor of Regeneration VC. The firm focuses on seed and series A investments in circular and regenerative approaches to consumer industries.

In May, DiCaprio invested in a start-up that aims to take cows out of leather production.

VitroLabs has raised $68 million with the help of the star to make the world’s first pilot production of cell-cultivated leather.

JESSICA ALBA

Jessica Alba had a promising Hollywood career, appearing in Fantastic Four films, Little Fockers, Sin City, and Valentine’s Day, but her business career really took off in 2012 when she founded The Honest Company, which sells various baby, personal, household products. In 2014, the company was valued at US$1 billion ($1.5 billion).

She has also invested in the company Headspace, which helps people deal with stress and teach them how to meditate.

JAY Z

Hip-hop’s first billionaire founded his venture capital firm, Marcy Venture Partners, in 2018 with two business partners.

The firm says it “invests in Consumer & Culture with an emphasis on positive impact including sustainability, inclusivity, accessibility, empowerment and health & wellness”.

Jay Z, who is married to Beyonce, has made investments in nearly 100 different companies, including Rihanna’s Savage X Fenty, Epic Games, the wildly popular healthy food chain, Sweetgreen, Oatly, and Fanatics.

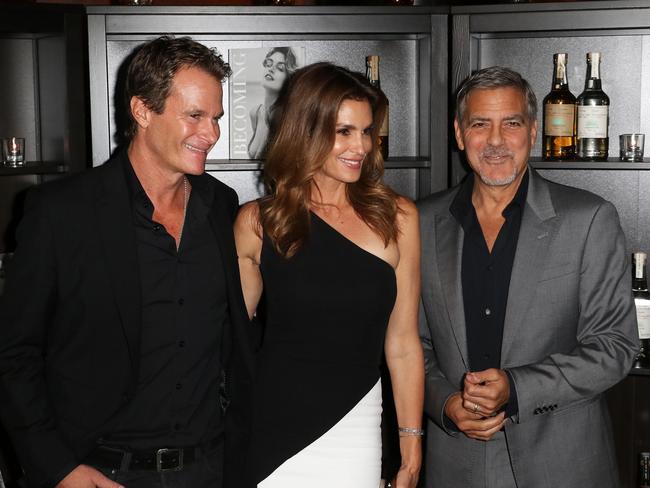

GEORGE CLOONEY

George Clooney may have dropped out of university but the Hollywood superstar and canny investor is laughing all the way to the bank with his piles and piles of cash.

In 2013, he founded the Casamigos tequila brand with his pal Rande Gerber (Mr Cindy Crawford) and business partner Mike Meldman. In 2017, the trio sold the popular tequila to drinks giant Diageo for $US1 billion ($1.5 billion).

“If you asked us four years ago if we had a billion dollar company, I don’t think we would have said yes. This reflects Diageo’s belief in our company and our belief in Diageo. But we’re not going anywhere. We’ll still be very much a part of Casamigos,” Clooney told CNBC when the deal was announced.

ASHTON KUTCHER

The original Hollywood investor, Kutcher, who had a middling screen career, made the smart move of turning his attention to finance. In 2010, he founded venture capital firm, A-Grade Investments with Guy Oseary (who manages Madonna and U2) and billionaire, Ron Burkle.

It was very quickly a success. In 2016, Forbes magazine reported that the firm had turned an initial $US35 million ($52 million) into $US250 million ($370 million).

That cash boost came via shrewd investments in Spotify, Uber, Shazam, Couple, SoundCloud, Muse, and Airbnb.

In a 2013 interview, Kutcher said, “If we can create efficiencies in that which is mundane, then we accelerate our paths to happiness. The companies that will ultimately do well are the companies that chase happiness. If you find a way to help people find love, or health or friendship, the dollar will chase that.”

NATALIE PORTMAN

Another Oscar winner with an eye on business, Portman founded Angel City FC, in the US Women’s National Soccer League.

For Angel City, that has meant creating an ownership model that asks investors to act more like founders and engage with the team at every level.

Her other investments include a French food-tech start-up that specialises in vegan bacon.

More Coverage

Originally published as Kim Kardashian’s next gig: Wall Street investor