Why you should set up an emergency savings fund

A new survey has revealed an alarming number of Australians have minimal safety nets in place for this life essential.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

Although the past year might have taught us that we should be prepared for anything, when it comes to finances, Aussies are leaving themselves dangerously exposed.

Whether you’ve read the Barefoot Investor, listened to She’s On The Money with Victoria Devine, or watched Tash Invests on TikTok — pretty much every financial guru recommends having a stash of cash kept separate for unexpected hard times.

But according to results from the latest news.com.au Cost of Living survey, most of us have no savings at all.

More than 10,000 people responded to the survey, which asked readers about their biggest household money worries, and we’ve now kicked off The Money Project to help get your finances in shape for 2021.

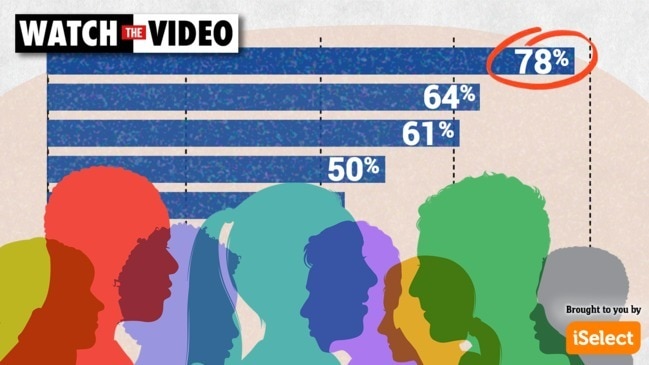

The survey found only 38 per cent of respondents have more than $5,000 in savings, despite the majority of financial experts recommending we all have three months’ worth of expenses saved in case of an emergency.

RELATED: Big change saving young Aussies $2,000 a year

As part of the survey, respondents were asked if they felt they were on “Struggle Street”, “Barely Coping”, “Doing OK” or on “Easy Street” based on how they believed they were faring financially.

And some of the responses were surprising.

While those who identified as being on Struggle Street and Barley Coping explained how they were mostly living week-to-week and couldn’t save due to rising living costs.

Even those who identified as Doing OK said they didn’t have enough surplus cash to be able to save.

“I have enough money to pay rent and bills, but not enough income to reliably add to savings when expenses come up,” said one respondent.

“[I] Have enough to live week by week, struggle to save for big things like electricity, car rego, dentist etc,” said another.

While another responded, “I’m not saving but I’m not struggling to pay bills or buy food, I’m comfortable.”

The findings align with recent figures from the Australian Bureau of Statistics that state that almost 23 per cent of Australians couldn’t raise $2,000 in a week for something important.

How much do I really need in my emergency savings fund?

The rule of thumb for an emergency savings fund is that it should be worth a minimum of three months’ living expenses and ideally, 12 months’ worth.

According to the Moneysmart, the average Australian household spent $74,301 on general household living costs in 2016, which means you need around $18,575 in your three-month emergency fund.

If you don’t have one, however, and aren’t sure where to begin, money guru and financial coach Jane Walters recommends starting small.

“Start with $1,000 then work your way up to three months and see how that feels. If you would feel more secure with more, then direct a bit more to your emergency savings account,” she states.

“And if you dip into it, try to build it back up to the level you’re comfortable with as soon as possible. Personal finance is personal. So make sure you think about what is right for your unique circumstances, money temperament and goals.”

RELATED: Combining energy bills could save hundreds

For ME Bank’s money expert, Matthew Read, success in saving money comes from setting goals and taking an ‘out of sight, out of mind approach’ too.

“Setting a target is important. Studies show we’re more likely to save when we have a goal to work towards,” he says.

“A great way to save is to put your savings away immediately each payday. You can set this up easily automatically, so it coincides with your pay deposit.

“A key aspect of this savings plan is deciding where to store your emergency funds. Ideally, you need an account that’s accessible, but not so easy to dip into that it becomes your go-to money for impulse buys.”

RELATED: How tradie saved $800 on power bills

If you’re a homeowner, Ms Walters recommends stashing your emergency cash in an offset account.

“You may wish to keep it there so that you’re saving on your home loan interest,” she says. “But not everyone can manage an offset account, so know what’s right for you.”

Why it’s important to have an emergency savings fund

Both Walters and Read agree the most important reason for having an emergency savings fund is the peace of mind it affords.

“Knowing that you have the cash to cover unexpected expenses or a period of unemployment without having to go into debt or scramble around to find the money is the ultimate in financial security,” says Ms Walters.

Tips to build and grow an emergency savings fund

Financial coach Jane Walters offers the following tips to help you build and grow an emergency savings fund.

1. Start with a budget, so that you know what you’re going to need to include in your calculation

2. Think about how many months of expenses is right for your emergency fund and times that by your expense amount to get your target amount.

3. Automate your savings and make sure it gets transferred as soon as or straight after you get paid

4. Start small (especially if you have debts to repay) and work your way up to your target level. Any emergency fund is better than none.

5. Decide on your own personal “rules” for when it’s OK to withdraw from your emergency fund (i.e. car breakdown, bond for moving house, etc).

6. Know yourself and your habits around money and if necessary, make it difficult to access the funds on a whim (or a drunken night out!)

7. Shop around for better deals on energy bills, insurance and internet, as the savings made could be used to bolster the fund.

Read more stories about the Cost of Living here.

Originally published as Why you should set up an emergency savings fund