Why Google was slow to AI and how it plans to catch up to Amazon and Microsoft

The tech behemoth has been accused of being too slow in the AI race, but its Cloud chief Thomas Kurian says it’s all part of a plan and the pay-off is already landing.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Google was slow to the artificial intelligence race for a reason, says the chief executive of the tech titan’s cloud division, Thomas Kurian, as he outlines a plan to seize market share from rivals Amazon and Microsoft.

“Enterprises – having worked with them for so many years – once bitten, three times shy, and appropriately,” Kurian tells The Australian.

The velocity of AI product launches have hit the market since ChatGPT thrust the technology into the mainstream has been extraordinary, taking the biggest tech companies by surprise. Elon Musk, Apple co-founder Steve Wozniak and others even called for a pause on the breakneck development of AI’s more risky technology to ward off potential harm.

The rush has not been without its consequences, as Google knows too well. It has indeed been bitten, suffering setbacks in its earlier AI attempts which plagued its consumer-facing tools.

This left it trailing Amazon Web Services and Microsoft, which dominate the cloud computing market and gateway to artificial intelligence.

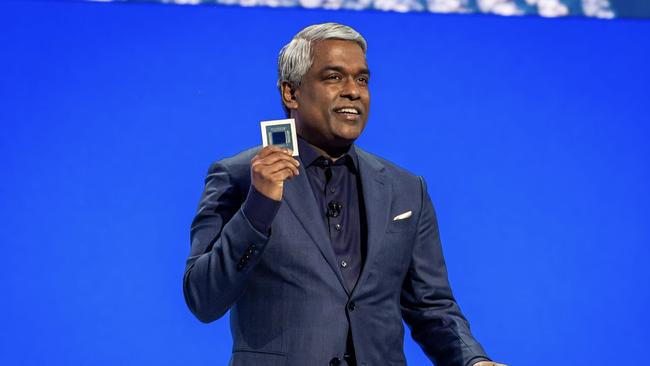

But Mr Kurian is not shy. He revealed a suite of updates to Google’s Gemini model before a packed crowd at Michelob ULTRA Arena – a 12,000 seat stadium in Las Vegas that has hosted headliners from Katy Perry to UFC fights – declaring the technology is ready for corporate use.

Floor to ceiling posters across the massive convention centre where Google held its annual cloud conference reinforced the message. “The AI era is here”, “the new way to cloud” and “the next big thing” were among the bold declarations. It is almost as if the past 18 months never happened.

Never mind that Microsoft has integrated its AI co-pilot into its suite of Office products, including Word, Outlook and Excel – among other developments which have propelled it to become the world’s most valuable company.

Mr Kurian believes Google has a superior product. He took a veiled swipe at his rivals, saying one (AWS) had no AI experience, while the other (Microsoft) operates a “closed system” and uses another company’s model.

“We blend both,” he says, talking up Google Cloud’s open platform that allows customers to choose between Google’s own technology as well as other providers.

He believes this combination will be key to taking further market share from AWS and Microsoft.

“When you go to a grocery store, you want choice. We give you that choice – not just from Google but every layer of the cake from other partners,” Mr Kurian says.

This extends to semiconductors for the enormous computing power required to operate data centres and deliver AI models.

Mr Kurian unveiled a new chip called Axion – which the company says can deliver up to 50 per cent better performance and up to 60 per cent improved energy efficiency – as part of its efforts to rein in rising AI costs. But customers aren’t locked into that product.

“Google Cloud is the only major cloud provider offering both first-party and extensible, partner-enabled solutions at every layer of the AI stack,” he says.

“We listened to customers. Customers said ‘I want to adopt AI in many, many different parts of the organisation. Can I get a platform from Google? That gives me all the core capabilities, but I want to choose my models. I want to choose what tool I get to use … because my people prefer this one and not yours’.

“And so we said let’s open the platform and open the platform and every layer.

“Through Google Cloud’s own innovations and those of our partners, we’re able to provide choice across infrastructure, chips, models, data solutions, and AI tooling to help customers build new-gen AI applications and create business value.”

Google’s timing is crucial. This year many companies are advancing their generative AI experiments into production and are consolidating their apps, according to a Canva study.

The battle for the cloud has prompted Google to step up criticism of Microsoft, accusing its rival of what is known as vendor “lock-in” – an anticompetitive practice which Google has raised with regulators.

But Mr Kurian says the tables are now turning, as customers are demanding more choice.

“It’s helpful when players like to lock people in with licensing, bundling and packaging things, tricks,” he says.

“We continued to work, grow our market share, and we’ve seen it grow remarkably fast.”

Microsoft president Brad Smith has rejected such criticism. “Today, only one company is vertically integrated in a manner that includes every AI layer from chips to a thriving mobile app store,” Mr Smith said in February.

Mr Smith says Microsoft has launched new principles to “promote innovation and competition in the new AI economy”, which is an extension of its Windows guidelines.

“In 2006, after more than 15 years of controversies and litigation relating to Microsoft Windows and the company’s market position in the PC operating system market, we published a set of ‘Windows Principles’.

“Their purpose was to govern the company’s practices in a manner that would both promote continued software innovation and foster free and open competition.

“The competitive pressure is fierce, and the pace of innovation is dizzying. As a leading cloud provider and an innovator in AI models ourselves and through our partnership with OpenAI, we are mindful of our role and responsibilities in the evolution of this AI era.”

Microsoft and AWS have galloped ahead in the cloud computing race. In Australia, the pair account for more than 60 per cent of the $2.68bn infrastructure as a service market (IaaS), according to Gartner. This compares with Google’s share of 19.7 per cent.

Google’s first generative AI attempt, Bard, failed to take off like ChatGPT and also attracted criticism last year when it backed the Indigenous Voice to parliament. It suspended its image generation feature on its second attempt, Gemini, after it depicted white historical figures, including Nazi soldiers and a US founding father, as black.

But Mr Kurian says these issues were confined to Google’s consumer-facing tools, not its enterprise product.

“The issue was not with the base model at all. It was in a specific application that was consumer facing,” he says.

“We had zero reports of issues from enterprise customers of that problem. We have got … safety and responsibility controls in the platform that allows you to choose exactly how you want to set it.”

Gartner analyst Michael Warrilow says Google Cloud has been taking an increasing share of the Australian market, which was “showing no signs of slowing down”, soaring 37.1 per cent in 2022.

“The company’s goal is to become a primary choice for business and government, but its growth continues to come from a smaller base than its key rivals, Amazon and Microsoft, which are likely to continue to dominate the Australian market for the foreseeable future,” Mr Warrilow says.

Amit Zavery, a vice-president and head of platform for Google Cloud, says the gap is closing between Google’s rivals.

The Alphabet-owned company has signed up a raft of big-name Australian companies, including ANZ, Macquarie, Woolworths and Canva, while its global clients include Mercedes-Benz, McDonald’s, Uber and Goldman Sachs.

It has been eager to cut deals, and comparison website Finder revealed that it more than halved its cloud costs when it switched from AWS to Google.

“When I joined Google five years ago, we were $US5.5bn ($8.41bn) in revenue. Last year we posted $US36bn, which is five times in five years, and this year we are on a path for $US40bn-plus,” Mr Zavery tells The Australian.

“Microsoft and Amazon have been in this space for a longer time than us but if you look at our last year, for example, we added $US7bn in new net new revenue.

“To contrast, Amazon added like $US12bn, and they’ve been in this business for 20 years. So I think our scale has got very big now compared to other vendors and we are keeping up very closely.

“It’s a good test and validation of our strategy.”

The author travelled to Las Vegas as a guest of Google Cloud.

Originally published as Why Google was slow to AI and how it plans to catch up to Amazon and Microsoft