Toll road operator Transurban set to bid for WestConnex

TOLL road operator Transurban says the potential toll earnings from the WestConnex motorway represent “tremendous value” for the company, should it be selected to operate at least part of the network.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

TOLL road operator Transurban says the potential toll earnings from the WestConnex motorway represent “tremendous value” for the company, should it be selected to operate at least part of the network.

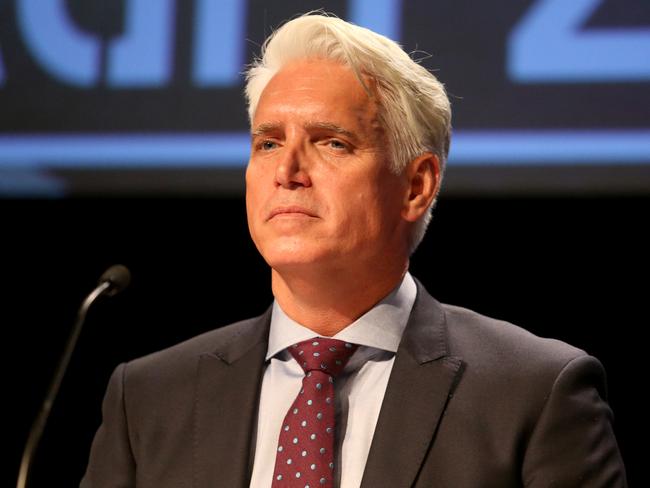

The company is poised to lob a bid for a slice of the under-construction motorway when the NSW government begins a planned sell off of the WestConnex, Transurban chief Scott Charlton said yesterday.

“We look at it as a transformational transport project … we believe it offers tremendous value,” Mr Charlton said.

It comes after Australia’s largest toll road operator said revenue from Sydney roads jumped 8.8 per cent to $434 million, helping lift its first-half net profit by 41.9 per cent to $88 million on the back of strong increases in traffic.

The Sydney revenue spike was partly due to trucks on the M5, Lane Cove Tunnel and Westlink M7 now being charged three times the price of a car.

Transurban’s customers paid the operator $1.06 billion in tolls the six months to December, up 10.9 per cent, with almost half of that derived from Sydney road users.

Mr Charlton said Transurban was aware that toll increases could squeeze family budgets at a time when Premier Berejiklian has signalled housing affordability is an issue.

“Household budget is what everyone in the industry is conscious about … its obviously been front and centre of people’s minds because they see the tolls and they see the bills,” he said.

“We do need to do better communicating the time savings and other benefits people get from using our assets.”

The company will pay a partially franked interim distribution of 25c a share, up 2.5c from the prior corresponding period.

Mr Charlton said yesterday that Transurban was attracted to the WestConnex project because it was like a “mini network”, rather than just a single toll road.

“It is a mini network … it’s more like a business in its own right rather than just a single stand-alone asset,” he said.

OTHER NEWS

Mr Charlton said Sydney’s medium and long term population growth justified the need for these infrastructure projects linking western Sydney with the CBD.

He said Transurban was positioning itself to put forward a competitive bid if the road is potentially sold off by the NSW government.

“We believe we can bring a lot of value but we also understand that it will be a competitive process if the government does sell the asset, and we will have to bring the most value to the table in a financial sense as well,” he said.

A spokeswoman for Minister for WestConnex Stuart Ayres said the government will “consider options as the project develops.”

“Government equity can be sold down to fund any future projects, effectively recycling the NSW Government’s investment,” she said.

Mr Charlton said there were plenty of other long term investment opportunities for Transurban in the Sydney region, including the roads to the proposed Badgerys Creek airport, the Moorebank Intermodal, another western harbour crossing, the North East Link, the Beaches Link and the F6 extension.

Transurban shares closed up 6.4 per cent, or 66 cents, to $11.04.