‘There is a downside’: Huge danger in way almost everyone invests

It’s how countless Australians invest their hard-earned cash – but an alarming new trend has emerged, which could endanger your money.

Investing

Don't miss out on the headlines from Investing. Followed categories will be added to My News.

Since the onset of the pandemic, the growing valuations of the American tech giants have continued to make headlines.

Recently, the likes of Apple, Microsoft, Nvidia and others have grown to sizes more traditionally associated with the gross domestic products of major economies.

Earlier this month, Nvidia briefly hit a total market value of $5.96 trillion ($US3.7 trillion), which is roughly 2.2 times the size of Australia’s national GDP.

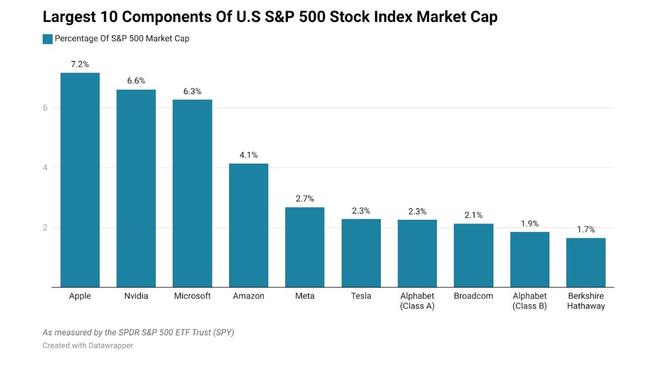

Currently, the top 10 largest companies in the United States account for roughly 38 per cent of the S&P 500 stock index, the highest level since comparable records began over a century ago.

The only other instance on record that gets close to this level of US stock market value being so concentrated in the top 10 largest companies occurred immediately prior to the Great Depression in 1929.

The sheer combined size of the US tech giants has prompted concerns that if there was to be a major downturn in the stock prices of these mega corporations, that it could drag down the fortunes of the broader US stock market – with potential implications for global asset markets.

Passive investing

In recent years, the popularity of index funds has continued to surge, as the promise of low fees and diversification across potentially hundreds of stocks in a single fund incentivised fund managers and everyday investors alike to invest in them.

But there is a downside to the rise of index funds. Their very nature of robotically buying the index can help to drive the sort of market concentration and risk we are now seeing.

For example, when someone buys $100 worth of shares in an index fund, the fund effectively buys $100 worth of shares in that index as weighted by the index. So if your super fund used $100 of your super contributions to buy an S&P 500 index fund, approximately $6.60 will go to buying Nvidia shares, $7.20 to Apple shares, $6.30 to Microsoft shares and so on.

This ends up driving what is effectively price insensitive demand from Wall Street, retirement funds and everyday investors alike. It also exacerbates the inevitable overvaluation of certain stocks when the market is experiencing what former US Federal Reserve chairman Alan Greenspan called “irrational exuberance”.

As the relative weight of a stock within the broader index rises, so too do the purchases of that stock by index funds. This adds to the demand for the stock, which in a vacuum places upward pressure on the stock’s price.

This can be what is effectively a self-fulfilling prophetic cycle of a rising stock price, followed by rising passive purchases on repeat.

The American juggernaut

But there is another concentration risk in global markets.

According to an analysis by Creative Planning’s chief market strategist Charlie Bilello, in December, US stock indices made up 65 per cent of all global stock market value.

The next largest nation’s market is Japan, holding 5.5 per cent of global stock market value, followed by the UK with 3.4 per cent and China with 2.8 per cent.

US stocks now make up 65% of the global equity market, their highest weighting in history. This is more than 11x bigger than the second largest country by market cap (Japan at 5.5%).https://t.co/l5IYmkeySJpic.twitter.com/1XM92LOlZu

— Charlie Bilello (@charliebilello) December 15, 2024

The US has been a vital nation for global asset markets for well over a century, but the size of markets relative to the broader global whole is currently at its highest level in over 50 years, when the world was a very different place.

Superannuation

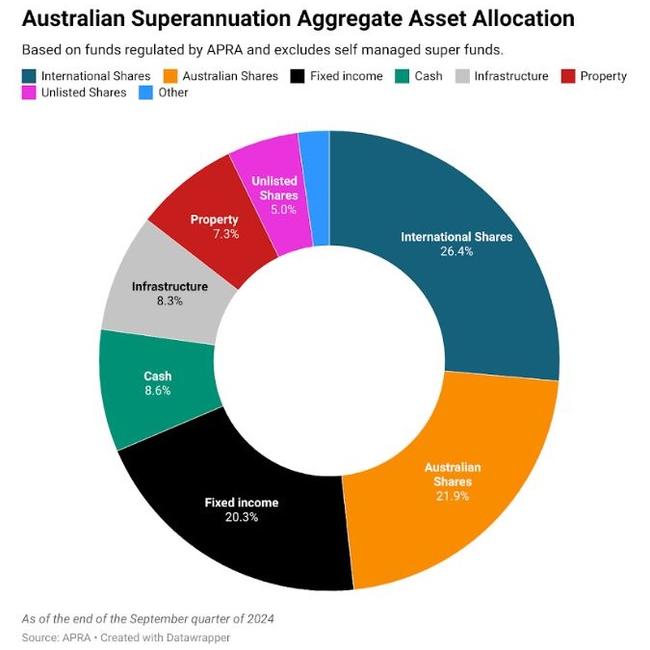

As of the latest data from the Australian Prudential Regulation Authority (APRA), which covers up to the end of the September quarter of last year, the nation’s collective superannuation accounts (excluding self-managed super funds) hold $617.2 billion (26 per cent of total super balances) in foreign shares and equities, with the lion’s share held in US markets.

In total, the nation’s super funds hold $1.25 trillion worth of shares and equities, representing 53 per cent of total super balances.

While a major stock market downturn would be bad news in a vacuum for super balances, there is at least a degree of a silver lining in that large falls in major stock indices are overwhelmingly accompanied by a flight to safety in bonds, which increases the value of that asset class.

According to figures from the Australian Bureau of Statistics, Australians hold 20.3 per cent of their collective superannuation balances in bonds.

Australia is no different

While the concentration of such a sizeable proportion of the S&P 500’s value into just 10 companies is concerning, particularly when put into context with historical US norms, when looking at the issue from a more global perspective, this type of concentration is more common than not.

According to a recent analysis from Carson Investment Research, of the top 21 largest stock markets globally, the top 10 stocks represent an average of 58.1 per cent of the respective stock markets as measured by the iShares MSCI ETF.

On this metric, Australia’s stock market value is more concentrated in the major players than most, with the top stocks representing 60.9 per cent of value.

🇺🇸 Market

— ISABELNET (@ISABELNET_SA) January 7, 2025

Concerns about US stock market concentration, especially among the top 10 stocks, have grown. However, a broader comparison with other major economies suggests that the US market may not be as top-heavy as perceived

👉 https://t.co/blMxcoG7WG

h/t @RyanDetrick#spxpic.twitter.com/7SQNeicPxz

Too big to fall

Amid uncertainty about the policies of incoming US President Donald Trump and their geopolitical and economic consequences, as well as ongoing concerns about the potentially persistent nature of US inflation, markets are arguably in a vulnerable position.

Add to that the record concentration in the biggest names in indices, and there are risks that a major slump in the stock price fortunes of America’s mega corporations could ignite a broader downturn in asset prices with potentially far-reaching implications.

Ultimately, markets are markets – they have risks as well as rewards.

To what degree those risks have increased due to the rise of passive investing and higher levels of market concentration, we’ll just have to see where fortune takes us.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

More Coverage

Originally published as ‘There is a downside’: Huge danger in way almost everyone invests