Stocks with a global footprint give investors important diversity

Our experts’ buy, hold and sell recommendations this week have an international element. See their top suggestions.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s share market followed overseas indices lower last week as economic and geopolitical uncertainty dominates investors’ minds.

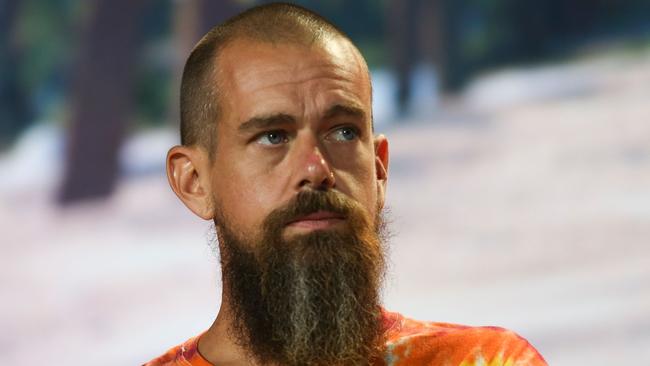

Companies with global businesses were also on the minds of our share tips columnists, with US payments giant Block – founded by former Twitter boss Jack Dorsey – at the top of the “buy” recommendations.

Several other companies mentioned also have a global footprint. Think California-based sleep apnoea giant ResMed, global drinks company Treasury Wine Estates and toll road giant Transurban.

Financial markets will be jittery over the week ahead as the November US presidential election looms, and investors worry about the mayhem that may follow.

It all illustrates why many share specialists say investors should take a long-term view, and see through the inevitable short-term market noise. And it’s another lesson in why it’s good to diversify shareholdings beyond Australia’s borders.

Here are this week’s stock recommendations.

Equity Trustees head of equities Chris Haynes:

BUY

Block Inc (SQ2)

The company’s Square segment provides businesses with the ability to accept card payments, while its Cash App segment offers an ecosystem of financial products and services to help consumers manage their money. SQ2 has had three consecutive quarters of meaningful profit beats, and it recently raised calendar year 2024 guidance to 18 per cent gross profit growth. Good value.

PEXA Group (PXA)

PEXA Group develops and provides electronic conveyancing systems. It has a monopoly in Australia and is working hard to establish itself in the United Kingdom. Arguably, the market gives no value for this potential offshore growth.

HOLD

ResMed (RMD)

ResMed provides digital health and cloud-connected medical devices. The company has a strong growth outlook as the sleep apnoea market for its products is not fully penetrated. Recent weight loss drugs have some impact on future growth, so there is some

uncertainty around how to value the business. This will become clearer as RMD delivers.

Cleanaway (CWY)

The company engages in the provision of total waste management, industrial, and environmental services. The stock trades on 28 times earnings, which is a lot for company that does not grow much above GDP.

SELL

Transurban (TCL)

The toll operator trades on a PER of 50 times and with a yield not much better than cash. Growth will be difficult going forward and likely to disappoint. There are better yield plays in the market.

Charter Hall Group (CHC)

The office, retail, and industrial property company looks expensive now trading on a PE of 17 times, reflecting a 11 per cent premium to the three year average of 15 times. Underlying drivers of the business are yet to materially improve.

Shaw and Partners senior investment adviser Jed Richards:

BUY

NextDC (NXT)

I recommend buying NextDC due to its leading position in the data centre market and robust demand for cloud services. With excellent growth initiatives and positive industry momentum, NextDC is well-positioned for significant future expansion. This investment offers a compelling opportunity to capitalise on the growing tech landscape

Treasury Wines (TWE)

I recommend buying TWE shares, currently low and undervalued. With the rising demand for premium wines (Penfolds in particular) and strong brand portfolio, particularly in China, TWE is positioned for growth. The recent share price drop presents a compelling entry point for investors.

HOLD

Orora (ORA)

ORA’s international alcohol bottling operations show solid potential, making them an attractive acquisition target for larger companies. However, current market conditions warrant a cautious approach. Investors are advised to hold off on buying until there’s clarity on strategic partnerships and growth opportunities. Maintain a hold while we wait to hear from management.

Worley (WOR)

Given the anticipated infrastructure growth in the energy sector over the next 10 to 20 years, we believe Worley is well-positioned to benefit from increased demand for its services. However, potential market volatility and project execution risks warrant a cautious approach.

SELL

Washington H. Soul Pattinson (SOL)

Washington H. Soul Pattinson is now a sell recommendation as it trades near highs and above asset backing. While the company shows solid financials, the future expectations suggest limited growth potential in the near term. Despite solid strategic initiatives, I suggest it may be prudent to take profits.

Tabcorp (TAH)

Tabcorp continues to lose investors as the new management has yet to convince the market. The outlook for the industry growth remains challenging and costs continue to increase. Significant changes are required to improve competitiveness and profitability. There is better value with less risk elsewhere.

More Coverage

Originally published as Stocks with a global footprint give investors important diversity