Property mogul Ross Makris is facing possible bankruptcy, but what does that mean?

If Adelaide property mogul Ross Makris is made bankrupt, it triggers a series of events, including publicly divulging what assets exist.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Editor's Note: The bankruptcy proceedings against Ross Makris were ultimately dismissed by the Federal Court in November 2021. The proceedings had been initiated by the former wife of Mr Makris in the form of a creditor's petition, sourced from the Federal Court by News Corp Australia.

Adelaide property identity Ross Makris, who was once estimated to be worth more than $400m, is facing potential bankruptcy over a debt of slightly more than $50,000 - but what happens if the Federal Court makes that order next month?

The bankruptcy process, according to specialist insolvency firm SV Partners which is seeking to have Mr Makris declared a bankrupt, is triggered by a formal, final demand for the payment of a debt of at least $5000, which has been subject to one or more “final judgments or final orders”.

“Failure to pay within 21 days is an act of bankruptcy,’’ a fact sheet published by SV Partners says.

The Federal Court can then make a “sequestration order”, which legally makes a person bankrupt.

Once this has happened, most of a bankrupt’s assets come under the control of their trustee in bankruptcy, except for superannuation funds, necessary household items, tools of the trade, and modestly priced vehicles (worth less than $8150).

Any real estate owned will be sold, and a person’s bankruptcy details will be made public via the National Personal Insolvency Index.

Bankruptcy usually lasts for three years, SV Partners says, however it legally starts from when a “statement of affairs” is lodged.

If that is not lodged, bankruptcy can continue indefinitely.

The statement of affairs includes details of a person’s financial position an some personal details.

Bankrupts must also surrender their passport, and need written consent from their trustee to travel.

They also cannot be a company director, and over a certain earnings threshold must make contributions to their bankrupt estate.

THE STORY SO FAR

Mr Makris, the son of property magnate Con Makris – with the family’s net worth estimated at more than $1bn – was listed for a bankruptcy hearing on Tuesday, which he did not attend, and which he did not oppose.

The matter was adjourned until mid-November while insolvency firm SV Partners provides further evidence to the court about when Mr Makris was served with legal documents.

The creditors’ petition, sourced from the Federal Court by News Corp Australia, shows that Mr Makris is facing bankruptcy over a debt of $50,378.07.

“The respondent debtor owes the applicant creditors the amount of $50,378.07 for a judgment debt ... on 13 December, 2019,’’ the court documents state.

“The applicant creditors hold security by way of lien over the property of the respondent debtor for payment of the applicant creditors’ remuneration and proper expenses, together with costs of and incidental to the application in a case filed by them on 16 November 2017.’’

The documents further state that Mr Makris “failed to comply ... with the requirements of a bankruptcy notice served on him on 23 June, 2021’’.

Mr Makris was contacted for comment, and said that “it does not involve any banks, it has nothing to do with my business dealings’’.

Documents obtained by News Corp Australia show that Mr Makris currently owns a $3.3m house in a prestigious street in St Georges, which has three mortgages over it, including one to the NAB and two to companies owned by his father Con Makris – Balgra Pty Ltd, and Balgra Shopping Centre Management Pty Ltd.

News Corp Australia reported last year that a palatial Springfield home owned by Ross Makris, valued at about $3.6m, had sold, after being listed for a fifth time.

That property, which has five bedrooms, four bathrooms, and an 18-car undercroft garage, was also mortgaged to the companies owned by his father, and both were the subject of a 2017 lawsuit, seeking to recoup money loaned by the companies for the purchase of the houses.

Court documents from that Supreme Court action included a claim from the companies that Ross Makris had defaulted on a $3.075 million mortgage loan on the Springfield mansion which he bought in February 2008, and defaulted on a $988,000 loan on the St Georges property he bought in November 2014.

Documents from Land Services SA indicate that the Springfield house was sold in September last year.

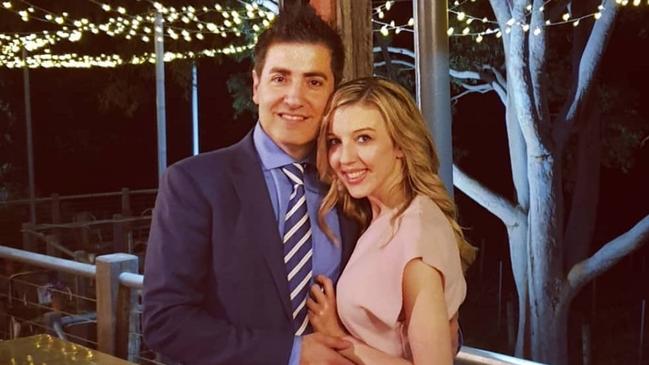

Ross Makris was previously married to former Miss World Australia Olivia Stratton, with the pair eloping to New York in late 2013.

The pair have since divorced and Mr Makris’s social media profiles indicate he is in a relationship with Felicity Ward.

If Ross Makris is made a bankrupt at the hearing in mid-November, he will be assigned a trustee and will have to provide them with details of his debts, income and assets.

A trustee can sell assets to help settle a bankrupt’s debts, and if a bankrupt earns more than a set amount, half of all money earned over that threshold (with the lowest level being $60,515) goes toward repaying creditors.

Bankrupts cannot own a car worth more than $8150, and also cannot be company directors.

Ross Makris is currently a director of six companies, however four of these are in administration.

He owns shareholdings in two companies of which he is also a director, Beaumont Holdings Nominees and Greengate Holdings.

THE MAKRIS FAMILY AND ADELAIDE

Con Makris founded The Makris Group back in 1980, and over the years built up a commercial property portfolio estimated to be worth more than $1bn.

With a strong focus on shopping centres, perhaps Con Makris’s most famous acquisition was the former Le Cornu site on O’Connell St.

Mr Makris acquired the property in the early 2000s, but was unable to get the required approvals for the grand project he wanted, sparking an acrimonious war of words with people including Adelaide City councillor Anne Moran.

While he blamed Cr Moran for being among those who stymied the project, Cr Moran has always rejected this notion, telling The Advertiser in 2018 that she wanted Mr Makris’s plans to proceed but the council could not assess it due to its zoning.

The Makris Group’s last plan for the site included a $200 million development and hotel, but Mr Makris said the proposal approved by the State Government would have caused a $30-40 million loss.

He sold the site for a “dirt cheap" $34m to Adelaide City Council, and, seemingly disenchanted with Adelaide, has since moved to Queensland, and has been selling some of his South Australian assets.

This includes the Hallett Cove Shopping Centre which he sold recently for $71m, and the earlier sales of the City Cross centre in the CBD and North Adelaide Village for a combined $110m.

He still owns the Marina Pier precinct in Glenelg and the Gilles Plains Shopping Centre, which was listed for sale early last year.

Ross Makris, 52, followed his father into the property game, and was at one point in business with Shaun Bonett, now a Sydney-based billionaire who runs Precision Group and thriving online gift card company Prezzee.

Mr Makris was formerly a director of Port Adelaide Plaza Pty Limited, which represents one of Mr Bonett’s early big breaks into the property scene.

Mr Bonett still owns the associated Port Canal Shopping Centre, which is being redeveloped.

Ross Makris was reported as being the nation’s richest man under 40 by The Australian in 2009, with a net worth of $420m.

More Coverage

Originally published as Property mogul Ross Makris is facing possible bankruptcy, but what does that mean?