Private credit starts to crumble just as retail investors join the party

Money managers are spruiking the next evolution in private lending, but cracks are appearing just as retail investors step in.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

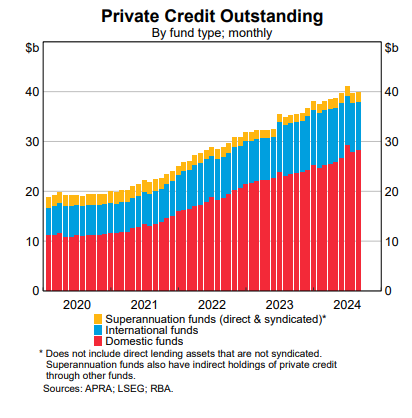

Private credit is booming. The asset class has exploded into the mainstream following a decade of growth.

But even as the biggest players spruik the next evolution in private lending, cracks are appearing and it’s just as retail investors are stepping in.

We’ve already seen regulators boost their offensive against the sector. The Australian Securities and Investments Commission, sick of being left in the dark, is now demanding answers from funds on governance, valuation practices and conflicts of interest to get a handle on risks in the space.

But what has really spooked the market is Count Financial’s move this month to hit sell on several private credit funds and kick off a review of the sector.

Count, one of the largest financial planning groups in the nation, recommended advisers sell three Metrics Credit Partners funds, one MA Financial fund and another couple of private credit funds, all of which are established and well-respected operators.

“The industry was really surprised (by Count’s move),” Zenith Investment Partners head of alternatives Rodney Sebire said.

“They formed a view on the sector as opposed to Metrics specifically. They must have formed a view on future defaults or the future level of non-performing loans and that’s what the (Count) investment committee is focusing on.”

Research houses Zenith, Lonsec and SQM have all put out notes on private credit in recent days.

For Lonsec and Zenith, the focus appears to be on reassuring the market of their research and ratings processes, with both detailing how their models capture the risks posed by this private lending segment and that they focus only on top-tier providers.

“Private credit can present compelling opportunities for both investors and borrowers but it also brings significant risks and challenges. Balancing opportunities with risk management is essential,” Lonsec deputy head of research Darrell Clark warned in his note to clients.

Zenith said in its note: “Lack of independent oversight and governance is a red flag for us and part of the reason our manager coverage is limited to a small number of top-tier providers in this sector.”

Private credit ‘on watch’

SQM, which has faced criticism over its ratings of some funds, including the failed multi-asset Shield and First Guardian funds, covers a much broader universe.

The research house has ratings on 70 private credit funds, covering retail and wholesale funds, representing $33bn of funds under management. It is the largest researcher of private credit funds in the Australian funds management sector.

This week it placed the private credit sector “on watch” and CEO Louis Christopher says it is making changes to how it rates funds, with a greater weighting put on governance.

“We’ve been concerned by some of the new offerings put in front of us, particularly wholesale market offerings,” Christopher tells The Australian.

What he is seeing should be a warning to all investors.

For a start, the quality in terms of credit assessments, transparency and overall processes in assessing loans is varied in the funds management sector, he says. But more than that, there is now “a certain element in the space of inexperienced operators, or operators who are basically putting profit before everything”.

More and more, fund managers are coming to SQM with documents that don’t even pass the research house’s “pre-review” stage. These are essential questions asked before SQM agrees to review a fund and consider issues such as the independence of the fund manager, whether there are any related-party loans and transparency of where the money is going.

These are issues investors in Shield and First Guardian know only too well. Both of these funds, classed as multi-asset, have been exposed as providing interrelated loans to property developers and having major governance and independence issues, based on allegations by the corporate regulator.

Shield is now in liquidation and First Guardian looks to be headed the same way, if the Federal Court grants ASIC’s request.

Both funds were given a favourable 3.75 rating by SQM before they were suspended and shut down. Many retail investors – more than 10,000 – now find themselves locked out of their life savings as they wait to see just much money is left in these funds.

Christopher says SQM has since made changes to the weighting it gives to elements such as transparency and inter-party loans.

The next evolution

As research houses and regulators grow more concerned about certain elements of the market, the biggest global players, such as Blackstone and Apollo, are already looking to the next stage in the cycle.

This week the president of US alternatives giant Blackstone, Jon Gray, told a Melbourne audience private credit was a megatrend as he detailed the next evolution his firm is chasing beyond the sub-investment grade debt that is typical of private lending.

“You’re taking investors and you’re bringing them right up to borrowers. That farm-to-table model allows you to generate higher returns.

“It started in direct lending, in non-investment grade lending to companies. The real evolution that’s coming is the movement towards private investment grade credit, and that’s something Apollo (and Blackstone) are spending enormous amounts of time on,” Gray said.

For retail investors, liquidity challenges that come with private lending are also front of mind. Listed private credit funds seek to fix this problem, and there are a number emerging in the market.

But Hostplus chief investment officer Sam Sicilia has some sage advice: “If you’re not sure what you’re investing in, if you’re not sure what you’re doing, then don’t do it.

“There are certain areas where even institutional super funds don’t go near because we haven’t built enough confidence, we haven’t done the research. We don’t (invest) until we do our research.”

More Coverage

Originally published as Private credit starts to crumble just as retail investors join the party