Paladin Energy shares plunge amid Fission Uranium deal doubts

Unhappy investors stripped $800m from Paladin Energy’s value in the wake of a production guidance downgrade for its flagship Langer Heinrich uranium mine in Namibia.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Paladin Energy boss Ian Purdy has blamed market uncertainty about progress with its $1.5bn acquisition of Canada’s Fission Uranium for “excessive volatility” in the company’s share price.

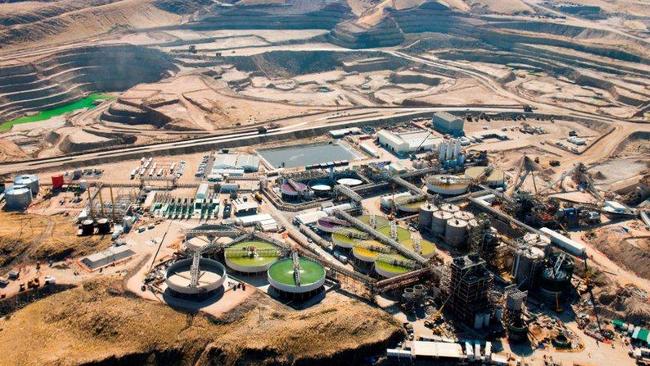

More than $800m was stripped from the value of Paladin on Tuesday after a big downgrade in production guidance for its flagship Langer Heinrich uranium mine in Namibia.

Paladin withdrew all cost and pricing guidance after slashing the 2024-25 production target from between 4 million and 4.5 million pounds to between 3 million and 3.6 million pounds.

The problems at Langer Heinrich come as Canada’s equivalent of the Foreign Investment Review Board probes the Fission Uranium transaction, including attempts by Chinese interests to thwart the takeover.

Mr Purdy said Paladin was hopeful of a resolution before the end of December.

Canadian Industry Minister Francois-Philippe Champagne ordered a national security review after China General Nuclear Power Corporation, a state-owned entity that has an 11.3 per cent stake in Fission, attempted to block the Paladin deal at a shareholder meeting in September.

Paladin owns 75 per cent of Langer Heinrich, with the remainder in the hands of the China National Nuclear Corporation.

Mr Purdy conceded Paladin may have been too optimistic on its previous guidance, with Langer Heinrich in the ramp-up stage.

The mine, owned by Paladin since 2002, has had a chequered history, and only restarted commercial production at the end of March.

Paladin said the operations had been hit by water supply issues and variability in the quality of the stockpiled ore it was processing.

The Paladin share price fell almost 29 per cent to $6.88 on Tuesday after the production downgrade.

The stock fell more than 19 per cent on October 28 when Paladin released a September quarter report detailing “operational challenges” that included issues with the ore stockpile and water management.

The Perth-based company received a “please explain” from the ASX in the wake of the quarterly, which also revealed plans to shut down operations for two weeks in November.

Originally published as Paladin Energy shares plunge amid Fission Uranium deal doubts