ASX Trader: Gold just fired a warning shot and it means big things for Aussie stocks

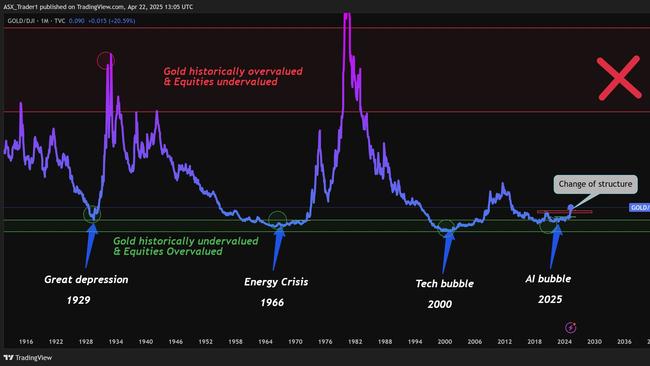

A quiet but powerful market signal just flipped - one that’s only appeared three times in the past 100 years. And it could mean a major change in direction for Aussie stocks, writes ASX Trader.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

While most investors are busy watching stock market charts and listening to social media hype, a quiet but powerful signal just flashed.

One that’s only appeared three times in the past 100 years.

It’s called the Gold-to-Dow ratio, and every time this signal has shifted in the past, it’s been followed by massive changes in the global economy.

It just changed again.

That’s your cue to pay attention.

What’s the Gold-to-Dow Ratio — and why should you care?

Don’t worry if you’ve never heard of it.

The Gold-to-Dow ratio simply compares the price of gold (a safe-haven asset) to the Dow Jones (a major US stock market index).

Think of it like this:

When people trust stocks and the economy, they put money into shares and the ratio falls.

When people get nervous, they move their money into gold and the ratio rises.

Now here’s the big deal: that ratio just changed direction in a major way, and it usually signals the beginning of a new investing era.

It’s only happened three other times in history:

1) During the Great Depression

2) During the 1970s energy crisis

3) During the 2000 dot-com crash

Each time, it meant trouble for US stocks and a boom for gold, commodities, and “real world” assets.

And now? It just flipped again.

Gold: The best-performing asset of 2025

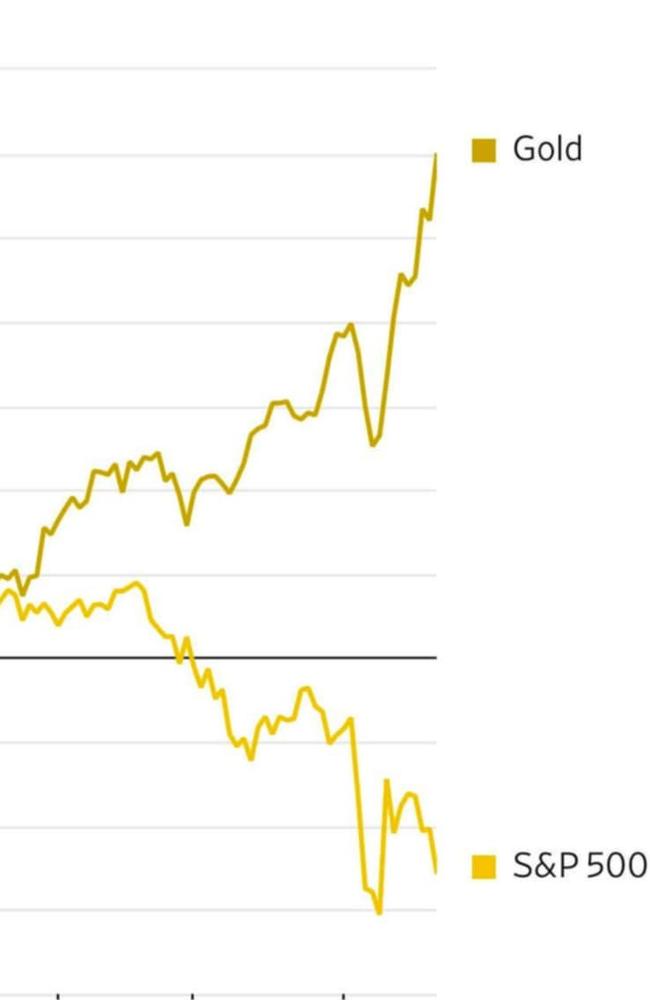

This isn’t just theory, gold is already the best-performing major asset class of 2025.

It’s beating stocks, bonds, crypto, and real estate.

Back in October 2022, while much of the market was focused on tech stocks and speculative trades, I began highlighting gold as a long-term opportunity.

I shared my analysis publicly at the time, including when it appeared to be forming a major bottom.

Now, two years later, that early entry is paying off and it’s changing the structure of the entire market.

Gold isn’t just “going up.”

It’s leading a global rotation away from risky speculation and toward real value.

That’s exactly why the Gold/Dow ratio is flipping because gold is doing exactly what it’s always done during uncertain times: protect and grow wealth.

What this means in plain English

This signal tells us that investors may be starting to lose confidence in big US companies, especially the tech-heavy ones that have led the market for the last 15 years.

Instead, money is starting to flow toward:

- Gold

- Commodities (like iron ore, copper, lithium)

- Energy (like oil and gas)

- Strong, cash-generating businesses (like banks)

And guess what country is full of those exact things?

Why Australia is built for this moment

Australia’s stock market (the ASX) is packed with companies that thrive in this type of environment.

We’re a resources and energy powerhouse, with world-leading producers in:

- Iron ore (think: BHP, Rio Tinto)

- Lithium and critical minerals

- Oil and gas

- Big, profitable banks that pay high dividends

In contrast, the US market is heavily skewed toward tech stocks, which often rely on cheap money, low interest rates, and future promises.

Those days are over.

Interest rates are up. Inflation is sticky. And the world is more uncertain than ever.

This is Australia’s time to shine.

What should everyday investors do?

You don’t need to make huge bets.

But you should start thinking differently.

- Consider adding more exposure to Aussie commodities, energy, and banks.

- Be cautious about US tech if it’s been the core of your portfolio.

- Think in decades, not weeks - this is a long-term shift, not a quick trade.

Most people are still stuck in the old mindset of “buy the dip” and hope tech bounces back. But the big picture is changing and history says those who spot the shift early are the ones who thrive.

The bottom line

A rare signal just lit up.

One that’s only happened three times before in the last century.

Gold is the top-performing asset of 2025.

Australia is perfectly positioned to lead the next phase of global markets.

I’ve been watching this unfold since my gold call in 2022.

That signal is now echoing across the macro landscape.

Most people are still cheering rebounds in the Nasdaq.

But the big picture is shifting and history rewards those who spot the change early.

It could mean:

- A slowdown for US stocks

- A major run for gold and commodities

- And a huge moment for Australia to lead the way

The shift has already begun.

The US had its time. Now it’s Australia’s turn.

Originally published as ASX Trader: Gold just fired a warning shot and it means big things for Aussie stocks