Mortgage stress among Australians hits a record as rising rates squeeze borrowers

As many as 1.6 million Australians were “at risk” of mortgage stress in the three months to January, a Roy Morgan report shows.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

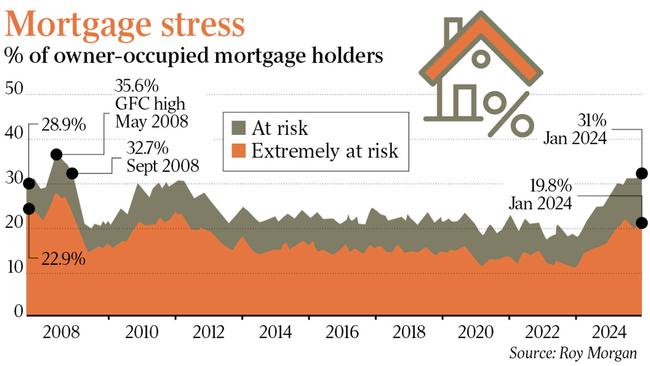

A record 1.6 million Australians were “at risk” of mortgage stress in the three months to January as the November cash rate increase – the RBA’s 13th since May 2022 – and high living costs dealt a blow to home loan borrowers, a report shows.

Since the Reserve Bank began raising the rate from 0.1 per cent to the current 4.35 per cent, an additional 802,000 people have had to spend up to 45 per cent of their after-tax household income on their home repayments, putting them at risk, the Roy Morgan report says.

“The variable that has the largest impact on whether a borrower falls into the at-risk category is related to household income – which is directly related to employment,” Roy Morgan chief executive Michele Levine said.

“The employment market in Australia has been exceptionally strong over the last year and this has underpinned rising household incomes which have played a part in reducing overall mortgage stress in January.”

Given inflation has come down to 4.1 per cent in the December quarter, but is above the RBA’s target, there are risks the cash rate could be kept at elevated levels for longer than expected or even increased again.

If the RBA decided to add an extra 0.25 percentage point to interest rates next week at its March meeting, another 29,000 home-loan borrowers would be at risk by April, Ms Levine said.

“If there is a reacceleration in inflation over the months ahead, that results in further interest rate increases in 2024, levels of mortgage stress are set to increase further to new record highs,” she said.

As a proportion of all home-loan borrowers, those at risk represent 31 per cent, which is still lower than the peak in mid-2008 of about 35.6 per cent of the market, the records show.

The higher stress is also being reflected in a steady, yet modest, increase in borrowers falling behind their mortgage repayments.

Prime mortgage arrears among publicly securitised loans rose 0.5 percentage points to 0.97 per cent in the December quarter, and credit agency S&P Global Ratings said arrears rates were likely to peak above 1 per cent. They are, however unlikely to veer too far ahead of that 10-year average.

“I think they’ll go above the 1 per cent,” said S&P Global primary analyst Erin Kitson.

“Households adapt differently to debt serviceability stress; we don’t think the rates will peak as high as what they did during the financial crisis because we’re not expecting unemployment to be as high as what it was at that time.”

Prime loans more than 30 days in arrears among residential-backed bonds peaked at 1.84 per cent in January 2009, as the unemployment rate was climbing towards 5.7 per cent later that year.

In a report, the agency said the current economic slowdown was likely to push the unemployment rate towards 4.3 per cent by next year from 4.1 per cent currently, while fewer working hours for some workers would also add to debt stress.

Residential-backed bonds are securities backed by a pool of mortgages that, when combined, represent about 10 per cent of the Australian mortgage market.

The postcodes incurring the worst arrears rates were Casula (3.34 per cent) in New South Wales and Craigieburn (2.47 per cent) and Burnside (2.44 per cent) in Victoria, and Armadale in Western Australia (2.38 per cent), the report showed.

Arrears among nonconforming loans, which include loans of lesser credit qualities and account for about one in every 10 securitised loans, rose to 4.02 per cent in the three months to December. That was up from 3.86 in the previous quarter.

In that segment, the agency expects to see a slowdown in refinancing activity will leave nonconforming borrowers locked into higher rates.

Originally published as Mortgage stress among Australians hits a record as rising rates squeeze borrowers