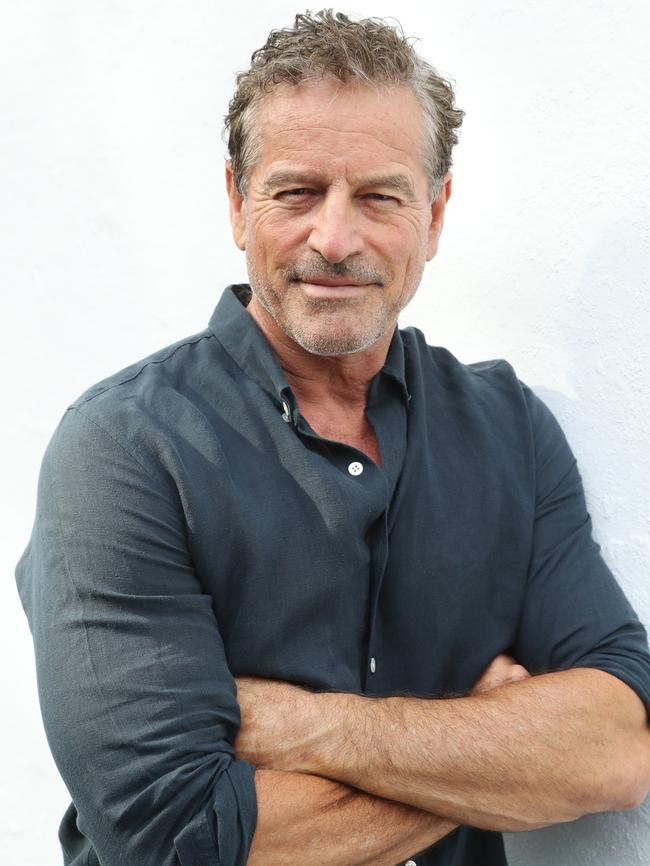

Mark Bouris: 10 Points of Pain Treasurer Josh Frydenberg needs to address

NEW Treasurer Josh Frydenberg has to hit the ground running. Here’s my 10-point plan to get things moving in the small business sector, Mark Bouris writes exclusively for The Sunday Telegraph.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

LAST week I became the new chairman of the SME Association of Australia — an industry organisation of 300,000 business owners that we intend to grow to one million.

In Canberra we also have a new Treasurer and, with more than 2.1 million business entities in Australia, Josh Frydenberg has a large and important constituency to watch over.

I look forward to discussing the issues with Mr Frydenberg.

But for now, here are the 10 Points of Pain I think he can address before the next election:

ACCESS TO FUNDING

The Treasurer should examine the British Business Bank and see if a similar idea could work here. In the BBB, commercial lenders fund loans and investment into SMEs, but the government shares some risk. An Australian Business Bank is needed in Australia. It could be seed-funded by the Big Four banks and that seed funding could be in substitution

for the Banking Levy, which makes the banks happy and gives the SMEs a lift.

BANKS

SMEs need their banks and the problems they face were aired in the Royal Commission. Now it’s time to act.

WRITE-OFFS

Allowing faster, simpler write-offs on business assets makes it easier to modernise equipment. The immediate write-off scheme has been extended again for 2019 but it should be embedded and increased.

RED TAPE

Business owners need less bureaucracy, red-tape and legislation.

The Treasurer could introduce a “needs test” for the Commonwealth — if we don’t really need it, don’t introduce it.

TAXES

The pathway to a 25 per cent tax-rate for SMEs shouldn’t have to wait until 2026 — and 25 per cent is probably too high. And please stop this argument tax cuts “cost” the budget — the real hit comes from lower tax receipts from struggling businesses.

PAYROLL TAX

A massive growth-roadblock for business, that should have been eliminated when GST was brought in. End it now.

RESOURCES

The government could help to upskill owners with a toolkit of resources covering budgeting, marketing, raising credit and hiring etc. A bit of advice goes a long way in SMEs.

ENERGY

Stop the fighting, stop the ideology and start working for Australians! Business owners need a reliable and affordable power supply.

DIGITAL

Digital tools increase business productivity, yet 60 per cent of businesses were interrupted by

cyber-attacks last year. There’s a knowledge-gap around the benefits/threats of digital — if government can reach SMEs with advice and resources, it’s a good investment.

SUPPORT

The Treasurer should always feel free to mention the strength and potential of our SMEs and their importance in our economy.

Lastly, the Treasurer must remember that while business owners have not been politically organised, they are numerous and their success drives our economy. It’s time to unleash our small businesses and see what this nation can do.

Ask Mark at mentored.com.au

Mark Bouris is chairman of Yellow Brick Road, ybr.com.au