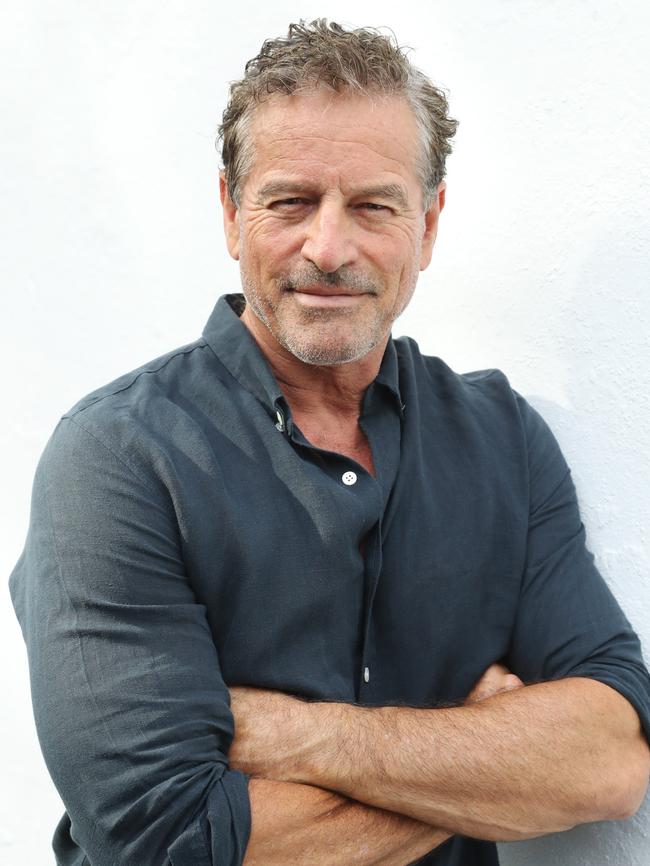

Mark Bouris: How to borrow money and manage your business debt

DEBT can a vital part of your business but you have to manage it properly or it will end you, The Mentor and Sunday Telegraph columnist Mark Bouris says.

- The Mentor Mark Bouris: ‘Don’t become a tax target’

- Mark Bouris: ‘I have a problem with foreclosing on drought-affected farmers’

HE’S one of Australia’s most successful entrepreneurs and he’s now writing for The Sunday Telegraph. In a new column, Mark Bouris will share his extensive business skills and answer your questions about doing good business.

DON’T be too joyful about the new Banking Code of Conduct that’s been released by the government and will apply to business credit up to $3 million. It won’t save you from yourself.

Most of the action we’ve seen at the Financial Services Royal Commission has been about SME debt and business owners’ decisions.

SMEs need debt to grow but, when badly-managed, that debt can sink them. I find that business owners can benefit from thinking like a finance professional and being more dispassionate about borrowing.

Try using these insider tips when you want to borrow to build your business:

■ State Your Case: you should know what the finance is for, what gains it will produce and have a clear pathway for repaying the debt. Debt is a tool with a cost — you must understand how it grows your business.

■ Finance-Ready: before borrowing, get your business cleaned-up. Have your accounts in order, be ahead on your taxes, have a business plan that makes sense. Be organised.

■ Horses for Courses: don’t mismatch the credit-type to the purpose of the borrowing. If you need to fly interstate to do an important meeting, you use the business credit card; use an ongoing facility like an overdraft to cover small shortfalls on recurring costs like lease and wages; and to buy more equipment you get a term loan. When you start using the credit card for long-term asset-purchases, you’ll get in trouble.

■ Downside: before borrowing money, balance the downside risk against the upside opportunity: what happens if my sales don’t materialise? What happens if the economy turns south? You have to think like a banker for a few hours: stand outside your enthusiasm and see how bad it could get.

■ Business is Different: business lending is not covered by the National Credit Code which protects consumers. So while most business loans to SMEs are secured by your personal property the documents are not standardised, they are complex and are written in favour of the lender. Before signing you need …

■ Advice: experienced businesspeople will tell you they should have spent that $500 on professional advice rather than just sign what was put in front of them. Whether it’s a solicitor, accountant or a finance broker, you need an adviser who knows which clauses to strikeout and which parts of the contract has to be explained. Paying for advice now will save you in the future. If nothing else, a professional will show you alternatives to borrowing — you might not be as desperate as you think.

■ Security: SME borrowing usually includes an ‘all moneys’ clause. It means that once you have put up your house to secure one loan, the lender uses that security against ‘all moneys’ lent. If you get into trouble the lender can call-in all the loans and control the security asset. You may not even be behind on repayments — you might have slipped above the agreed LVR …

■ The Loan-Valuation Ratio: business lending runs on the LVR, the agreement that you your borrowings are not more than — say — 70 per cent of the value of the security. If your property is revalued downwards and now your credit facility has a 75 per cent LVR, the lender can either call-in the loan or issue crippling penalty rates. Be careful with this and do some downside planning: what happens when interest rates rise and your property value slides?

■ Interest rate: while variable-rate mortgage lending is running at around 4.3 per cent, the average business lending rate for SMEs is 8.65 per cent, according to the Reserve Bank. And these low interest rates won’t last forever; in 1989, business lending rates were over 20 per cent. Again, look to the downside: can I afford repayments at 10 per cent? 12, 15, 18 per cent? What is my plan?

The bottom line is that businesses will borrow to grow, governments will pass regulations and banks will cover their risk with interest rates, security and LVR rules.

Your job is to be organised, get advice and to treat business finance as a tool. Good luck.

* Ask Mark at mentored.com.au. Mark Bouris is chairman of Yellow Brick Road, ybr.com.au

* The Mentor airs on Channel 7, Mondays at 9pm