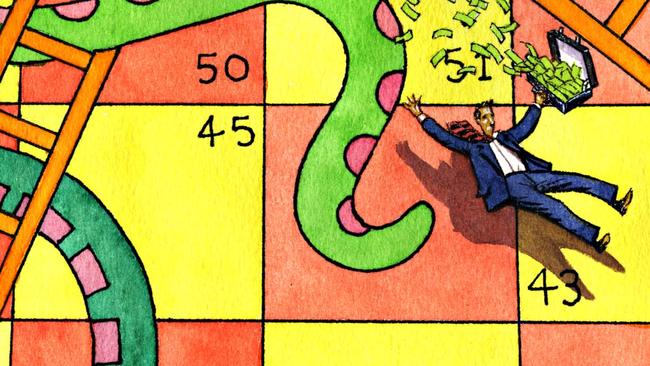

Major banks are keeping your savings lower for longer

Some $600m a month that should be going to savers isn’t. But switching to other products could make a big difference.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Millions of Australians are stuffing their hard-earned cash into dud savings accounts – some with interest rates as low as 0.6 per cent – as the banks hold back a chunk of recent rate hikes from savers.

By dragging their feet on savings rates, the nation’s biggest lenders are earning an additional $600m a month, or $7bn annualised, based on recent analysis from Morgan Stanley.

Standard savings accounts at the big four banks – those without minimum deposit or monthly balance requirements – are the worst offenders, offering interest rates of between 0.6 per cent and 0.85 per cent once you strip out the short-term bonus introductory rate, according to data from RateCity compiled for The Weekend Australian.

These minimal savings rates are in stark contrast to the 2.25 per cent in rate hikes since May.

(The majors have yet to declare how much of this month’s rate hike they will pass on to borrowers and savers.)

All up, the banks have passed on just a fraction of the Reserve Bank hikes. On one of its savings accounts, the Online Saver, ANZ has increased the interest rate by just 0.55 per cent. The other banks are not much better, lifting the rates on their online at-call saving accounts by just 0.80 per cent over the same time.

Of the big four, ANZ’s Online Saver is the worst of the lot, offering a 0.6 per cent rate once the three-month introductory period ends. Standard savings offerings at Commonwealth Bank, Westpac and NAB, meanwhile, each sit at 0.85 per cent, again stripping out the short-term bonus rate.

Savers can do marginally better in the so-called ‘bonus’ saver offerings, which have certain terms and conditions attached, such as regular deposits and limited withdrawals.

Depositors can earn above 1.5 per cent at the big four lenders in this segment, with Westpac’s Life savings account leading the pack with a 1.85 per cent rate.

ANZ does have one savings account with a bumper rate – its new ANZ Plus Save account, which is paying out 2.7 per cent on balances under $250,000.

One deft tactic the banks are using to avoid passing on the full rate hikes to savers is to pick and choose which of their savings accounts will get a bump each month. But this is just one in a host of strategies they are using to their advantage, according to Canstar’s Steve Mickenbecker.

“The banks will increase rates to one account in the range but not all, pass on a smaller increase than the Reserve Bank, increase the promotional rate which is only available to new customers but not the base rate, or increase only the rate on a new digital account which is held by very few customers,” he said.

“Savers have been very patient over the last decade as their interest drifted steadily down, but in the face of rising prices everywhere else surely their patience is wearing thin.”

The government’s patience has also been wearing thin, with Jim Chalmers turning the screws on the banks in August when they failed to fully pass on the last rate rise to savers.

However, the political pile-on will only escalate from here, according to former principal adviser to Treasury and ex-ANZ chief economist Warren Hogan.

Mr Hogan, now an economic adviser at Judo Bank, said political pressure would be the most effective way to ensure banks pass rate rises onto savers.

“Obviously banks will take advantage of the interest rates going up and pass them on to those with a variable mortgage rate, but won’t pass it onto the saving rate in order to increase their margin,” he said.

“The only way to make sure banks pass on those rates is to have ministers being very vocal about it, otherwise banks will just price what they can on the marketplace.

“We are seeing political pressure start to increase, Jim Chalmers at the last rate hike was quite outspoken about the need for banks to pass the rate onto savers and that is one of the most important tools. We will start to see it become quite a big topic politically.”

Margin Money

Recent analysis from Morgan Stanley found that the big four’s move to hold back a portion of the rate hikes from savers would provide a “material near-term margin tail wind” to their bottom line.

Ahead of the August rate rise, the investment bank’s equities analyst Richard Wiles told clients the big four had boosted their net interest margins by not passing on the full increases.

“We estimate an annualised margin benefit of around 20 basis points for the majors if the current expansion in these deposit spreads is maintained, including around 14 basis points on standard savings accounts and around 5 basis points on term deposits,” he said.

“Given funding and geographic mix, CBA and WBC would have a larger margin tailwind than NAB and ANZ,” Mr Wiles added.

This 0.2 per cent boost translates to about $7bn annualised, or $580m a month in boosted earnings, according to The Weekend Australian’s calculations.

Banks will find it increasingly difficult to hold back the hikes going forward, analysts warn. “It’s a highly politicised topic and I don’t think banks will want to be on the wrong side of that,” UBS banking analyst John Storey said.

Canstar’s Mr Mickenbecker said the August data showed the banks were moving to offer rates closer to those passed on from the RBA. But a majority were still far from offering an equal rate, he noted. “The banks’ record was stronger in August, in that on the accounts they have adjusted, they have passed on almost the full 0.50 per cent Reserve Bank increase. Perhaps the pressure from the Treasurer has had this desired outcome,” Mr Mickenbecker said.

“However, to date in August almost half of all savings accounts are yet to receive a rate increase.”

RateCity research director Sally Tindall pointed to the higher rates on offer outside of the big banks, including the current best in market, Virgin Money’s boost saver, at 3.6 per cent. (This saving account comes with a number of terms and conditions including minimum monthly deposits.)

“For someone with $50,000 in one of the big banks’ traditional online savers, they would have earned $61 interest on this amount over the last 12 months. However, if their money was in a market-leading account, that same $50,000 could have earned up to $812 in interest – a difference of $751,” Ms Tindall said.

“If you’re still earning next-to-nothing on your savings, don’t get angry – get even. There are banks out there offering ongoing savings rates that are more than four times what the big banks are offering on their no-frills accounts.

“While these accounts typically come with reams of terms and conditions, if you’ve got a decent nest egg it could be worth the extra effort,” Ms Tindall told The Weekend Australian.

Originally published as Major banks are keeping your savings lower for longer