Lesson for all new governments from UK mess: Larry Summers

Former US Treasury secretary and influential economist Larry Summers has issued a warning for governments in the inflation battle.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Former US Treasury secretary and influential economist Larry Summers has issued a stark warning for all governments heading into their budgetary cycles: Money markets are extremely edgy and there is zero tolerance for missteps when it comes to fighting inflation.

This is another overlay for Australian Treasurer Jim Chalmers who later this month faces a highwire balancing act in delivering his first budget that holds the promise of being all things to all people. The budget, which now looks to include top end tax cuts from 2024, comes amid a backdrop of raging global inflation and the IMF warning much of the world slipping into recession in 2023 as growth in the three largest economies – the US, China, and the euro area stall.

Chalmers, who is in Washington this week for a G20 Finance Ministers meeting, has softened his instinctive resistance to the Stage Three tax cuts and still is weighing up a budget that is set to include plenty of cost of living relief and required infrastructure investment. It comes as the Reserve Bank is attempting to suck money out of the economy by pushing up interest rates.

Just hours after the Bank of England was forced to step into bond markets overnight Wednesday to calm markets for the second time in weeks, Summers says there is a lesson for everyone after the UK’s new Truss Government sparked the latest round of market volatility. Last month’s UK mini budget was built around a lavish spending spree that was set to add more fuel to rampant inflation there.

But Summers says the rapid rise in interest rates around the world this year has fundamentally changed market dynamics and sometimes in unpredictable ways.

“I should just be more careful about everything,” Summers told the Citi Australia Investment Conference. “The lesson of what’s happened in the United Kingdom is to make people think that these (market) events are a bit more likely”.

However, he said that the combination of a plan to roll out enormous energy subsidies, substantially increase defence spending and promise of tens of billions in tax cuts was alarming for markets should not have not been surprising.

“I’ve been doing this a long time and it’s rare that I have seen such a misguided combination of policy and policy communications, as the new Tory Government,” he said.

Summers was the Treasury secretary in the Clinton Administration and was an economic Adviser during the Obama administration in the aftermath of the global financial crisis.

The slide in UK bonds as a result of the Truss policies – some which have since been rolled back – flowed through to global equities. Giant UK pension funds were also caught up with some being forced to dump shares to raise money after being squeezed on their leveraged strategies. Even Australian fund managers including Magellan were sideswiped with some of their big investors being forced to pull funds to raise cash.

Speaking to the Citi conference via video link Summers says a US recession is firmly on the horizon as the central bank there ramps up its fight against inflation.

He believes that US interest rates will have to rise substantially more than what even markets or even the Federal Reserve is guiding if the central bank wants to “achieve credibility” in its fight against inflation.

The Fed has indicated that it is prepared to do whatever it is necessary to win the fight, including moving interest rates to the 4.5 per cent range. Currently US interest rates are in the 3 per cent to 3.25 per cent range and are tipped to jump another 75 basis points next month.

Summers says the US jobs market has structurally changed and the neutral unemployment rate – that is when demand created by a booming jobs market is not adding into inflation – is probably closer to 5 per cent from 4 per cent pre-pandemic. Currently the US unemployment rate is running at 3.5 per cent which means substantial job losses will have to follow to fight inflation.

“In order to bring down inflation, unemployment has to rise above the neutral employment rate by a significant margin. And so that’s why, in my judgment, that a recession is an almost inevitable consequence of the path to achieve substantial disinflation,” Summers told the conference.

All this is important for Australia. Higher US interest rates are driving up the US dollar. A weaker Australian dollar will complicate the Reserve Bank of Australia’s own flight against inflation and a slowing US also threatens to put further pressure on the global economy. Late Wednesday the Australian dollar touched US62.40 US cents – the lowest level since April 2020.

‘Turning on the tap’

Once touted a lead candidate for the Federal Reserve, Summers illustrated just how difficult it is for central banks to use the blunt instrument of monetary policy to fine tune an economy. He likened the lag effect of the cash rate being changed to “turning on a shower in an old hotel” where there’s a 20 second delay from the time you turn the tap until the water temperature changes.

“You get in and you turn and it’s not enough. You turn, nothing happens, so you turn and still nothing happens then all of a sudden it’s first warm and then scalding and you’re jumping out of the shower”.

“That experience demonstrates the difficulty of managing a system with this kind of long and variable lags”.

So while it remains a tough task to fight inflation, Summers says his sense is the US Fed has some determination to tackle it. However, he acknowledged that slowing an economy comes with political challenges as well.

On Ukraine, Summers sees no evidence yet that an escalation of the conflict to the point where Russia uses tactical nuclear weapons has been priced into money markets.

However if this changes, and nuclear weapons were used – even on a small scale – it would be a “seismic event in markets and set off all kinds of volatility”.

At that point “I wouldn’t be surprised if we didn’t see forced liquidations that led to a need for some kind of emergency lender of last resort or market maker of last resort type activity,” Summers says.

When it comes to oil, both recessionary outlook and a lack of escalation is being priced into the forward curve which continues to show a price decline over time. This suggests that despite uncertainties that exist there is a “basic optimism” around the outlook for the Ukraine conflict.

Stress free

If there is stress in the economy from rapid-fire interest rate hikes it is yet to be seen across the banking spectrum. The nation’s biggest lender, Commonwealth Bank of Australia returned to Melbourne for the first time in eight years for its annual general meeting. There was no indication that the very low level of lending losses had changed in recent months, although CBA chief executive Matt Comyn noted there was “concern and anxiety” among some customers given the rate hikes and other rising household costs. He also acknowledged some will need support with more pain expected in the future, but did not quantify any impact.

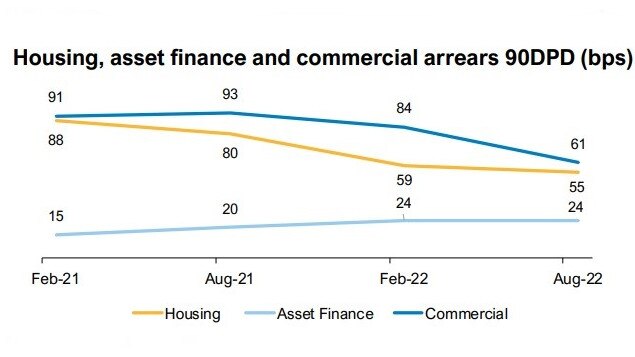

Across the country, the full year results of George Frazis’ Bank of Queensland showed a drop in the level of stressed housing and business loans for the year to end-August. Bank of Queensland topped up its general provision partly due to its ME Bank acquisition and partly heading into what is expected to be a rocky economic environment. But its specific provisions – that is funds set aside for actual problem loans – fell during the second half.

So were BOQ’s total number of impaired assets which are down nearly 40 per cent from this time a year ago when interest rates were rock bottom. BOQ skews to small business and small construction but a deep dive review of its lending book has not raised any red flags to date. It also used the exercise to assess the impact of thousands of borrowers rolling over from low fixed interest rates to higher variable rates. Some 35 per cent of BOQ’s housing loans are currently on a fixed-rate loan and the bulk of these are set to mature in the first half of 2024. With a third of the book protected from rate hikes, the stress is still clearly front loaded. This week outgoing bank regulator Wayne Byres told a parliamentary committee there will be people who took advantage of very low fixed interest rates through the Covid pandemic will start facing the “shock” of a higher mortgage rate.

johnstone@theaustralian.com.au

More Coverage

Originally published as Lesson for all new governments from UK mess: Larry Summers