Third of world is facing recession, says IMF

The International Monetary Fund has warned a third of the world is headed for recession amid a deepening cost of living crisis, with Australia’s growth halving next year to 1.9 per cent.

The International Monetary Fund has warned a third of the world is headed for recession amid a deepening cost of living crisis, with Australia’s growth halving next year to 1.9 per cent.

As central banks persist with aggressive interest rate hikes, Jim Chalmers said on Tuesday the global economy was a “dangerous place”, with an inflationary shock ripping through the global order.

The Treasurer said he was confident Australia would avoid a recession but he would factor into his October 25 budget the briefings from key officials, including Federal Reserve chair Jerome Powell, in Washington this week.

Dr Chalmers said the gap between rising US interest rates at just over 3 per cent and the Reserve Bank’s 2.6 per cent cash rate was the cause of the slide in our currency and would raise the cost of imports, as inflation here galloped to 7.7 per cent by the end of the year on rising energy costs.

But the IMF is forecasting a relatively soft landing for Australia, with unemployment likely to rise to 3.7 per cent next year, from its current near 50-year low of 3.5 per cent, and with inflation a year from now easing to 3.1 per cent, just above the Reserve Bank’s target range.

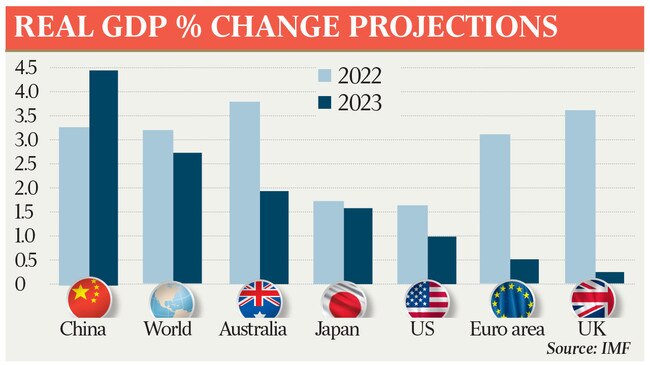

In its latest World Economic Outlook, the Washington-based body predicts the three largest economies – the US, China, and the euro area – will continue to stall, with global output growing by 2.7 per cent, 0.2 percentage points lower than the July forecast and 0.5 percentage points below this year’s expected growth. Given tighter monetary and fiscal policies, the US economy is forecast to grow by 1 per cent next year, after posting a likely rise of 1.6 per cent this year.

China’s growth rate next year is expected to be 4.4 per cent, or about half its average annual growth rate of the previous two decades, due to lockdowns and problems in its property sector.

IMF chief economist Pierre-Olivier Gourinchas said “this year’s shocks would reopen economic wounds that were only partially healed post-pandemic”

“In short, the worst is yet to come and, for many people, 2023 will feel like a recession,” he said.

Dr Gourinchas said the slowdown would be broadbased, “with countries accounting for about one-third of the global economy poised to contract”.

Europe will be the epicentre of the slowdown, where growth will be 0.5 per cent next year, against 1.2 per cent predicted three months ago. The economies of Germany and Italy will shrink, while the UK will grow by a paltry 0.3 per cent.

The IMF outlook said price pressures were persistent and broadening, and global inflation would peak at 9.5 per cent this year and would slow to 4.1 per cent by 2024.

Dr Gourinchas said that given central banks “are now laser-focused on restoring price stability, and the pace of tightening has accelerated sharply”, there were risks from both under- and over-tightening policy.

“Under-tightening would further entrench inflation, erode the credibility of central banks, and de-anchor inflation expectations,” he said. “As history teaches us, this would only increase the eventual cost of bringing inflation under control.

“Over-tightening risks pushing the global economy into an unnecessarily severe recession.

“Financial markets may also struggle with overly rapid tightening. Yet, the costs of these policy mistakes are not symmetric.

“The hard-won credibility of central banks could be undermined if they misjudge yet again the stubborn persistence of inflation. This would prove much more detrimental to future macroeconomic stability. Central banks need to keep a steady hand with monetary policy firmly focused on taming inflation.”

The IMF said in dealing with the cost of living crisis, governments should not allow fiscal and monetary policies to be at odds.

Second, it said targeted and temporary transfers to the most vulnerable in the face of runaway energy prices was superior to price controls, untargeted subsidies, or export bans, which are “fiscally costly and lead to excess demand, undersupply, misallocation, and rationing”.

Third, the IMF said fiscal policy can help economies adapt to a more volatile environment by investing in productive capacity – human capital, digitalisation and green energy among them.

“Expanding these can make economies more resilient to future crises,” Dr Gourinchas said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout