Interest rate rises looming after shock jump in inflation

Economists are pencilling an August rate hike after inflation jumped to 3.5 per cent in 2021.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Interest rates could begin rising within months as higher inflation in the December quarter and a strong jobs market force the Reserve Bank to rethink its economic stimulus program.

Australian shares plunged to an eight-month low after soaring petrol and surging housing construction costs pushed the consumer price index to a larger than expected 1.3 per cent rise in the December quarter, up from a 0.8 per cent rise in the previous three months.

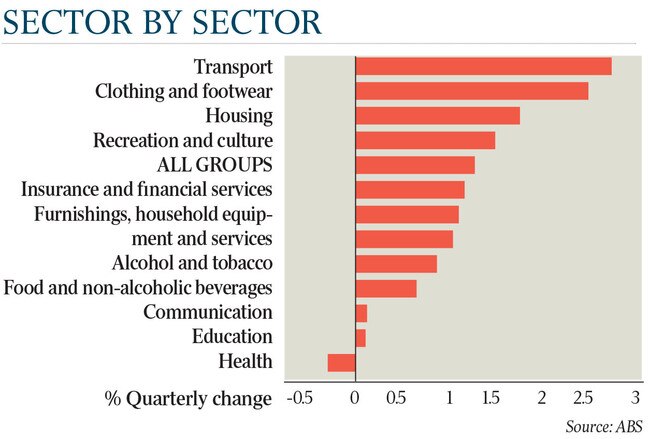

The biggest drivers for the shock result were a 4.2 per cent quarterly jump in new dwelling purchases, and a 6.6 per cent lift in fuel prices, but prices rose across almost all categories tracked by the ABS.

Consumer price growth for the year rose to 3.5 per cent in 2021, up from 3 per cent over the year to September.

There is growing belief in financial markets that the Reserve Bank, which will hold its first board meeting of the year next Tuesday, will concede an interest rate rise is highly possible by late 2022 — having previously ruling one out until late 2023 — but reject speculation it will keep pace with US interest rate increases.

It is also widely expected that the RBA’s bond-buying program, which had been running at up to $4bn a week, will be wound up.

Investors wiped $59bn off the value of Australian shares with the ASX 200 falling 2.5 per cent to 6961.6 points.

Josh Frydenberg said pandemic-related supply chain problems, alongside a spike in the demand for goods, underpinned the latest inflation numbers. But he said inflation in Australia remained half of what it was in the United States and lower than in Germany, Canada and Britain.

“Despite the global supply chain disruptions Australia faces, and indeed so many other countries do around the world, the Australian economy is remarkably resilient,” the Treasurer said.

ABS head of price statistics Michelle Marquardt said “shortages of building supplies and labour, combined with continued strong demand for new dwellings, contributed to price increases for newly built houses, townhouses and apartments”.

“Fuel prices rose again in the December quarter, resulting in a record level for the CPI’s (consumer price index) automotive fuel series for the second consecutive quarter,” Ms Marquardt said.

Opposition Treasury spokesman Jim Chalmers seized on the consumer price figures, saying “skyrocketing” household expenses meant real wages were going backwards under the Morrison government.

“Australians are working hard but they aren’t getting ahead, and they can’t afford three more years of record low wages growth like the last eight,” Mr Chalmers said.

CBA head of Australian economics Gareth Aird said that, with inflation running much hotter than the RBA anticipated, the central bank would need to make a fundamental adjustment to its “low and gradual” inflation narrative next week.

Mr Aird said he now expected a rate hike from 0.1 per cent to 0.25 per cent in August – three months earlier than predicted before Tuesday’s inflation figures.

Deutsche Bank chief economist Phil Odonaghoe also predicted a rate rise in August, followed by a further two hikes by the end of the year. “The large beat on underlying inflation materially undermines the RBA’s ‘wages first’ narrative,” Mr Odonaghoe said. “Price and wage expectations are now at serious risk of ratcheting up and self-fulfilling a higher inflation environment.”

Investors now price in a cash rate of 1 per cent by the end of 2022, starting with a hike to 0.25 per cent in June.

The RBA’s preferred measure of core consumer price growth lifted to 2.6 per cent over the year, from 2.1 per cent, with the ABS’s trimmed mean measure – which strips out the largest price swings at either end – growing by one percentage point for the three months, also far above economists’ predictions and the fastest quarterly rise since 2008.

Underlying inflation is now tracking ahead of the RBA forecast for a 2.25 per cent lift through 2021, and is above the midpoint of the central bank’s 2-3 per cent target range for the first time since mid-2014.

KPMG chief economist Brendan Rynne said it was possible the latest inflationary pulse could prove short-lived as Covid-related factors waned through the year – an oft-repeated view from Dr Lowe. But there was also the real prospect of climbing consumer prices “feeding through to higher wages more broadly and initiating a cost-price spiral”.

While inflation has jumped, wages grew by only 2.2 per cent over the year to September, on the latest ABS figures, underlining the challenges for policymakers to boost pay amid rising cost-of-living pressures.

Prices for essential goods and services – including the cost of health, transport, mobile phone and internet, education and insurance premiums – climbed by 4.5 per cent last year. Childcare costs jumped by 6.5 per cent in 2021. This compared to a 2 per cent increase in the prices for non-essential goods and services, such as clothing and electronics.

EY chief economist Jo Masters said that while progress towards the central bank’s inflation and full employment targets “has clearly been faster than expected, there continues to be considerable uncertainty for the economic outlook”.

“Omicron has pushed Australia in to a shadow lockdown, and confidence has taken a hit,” Ms Masters said.

She pointed to a collapse in business sentiment in December.

“This uncertainty is important for the timing of the first rate hike – which increasingly looks likely to be late this year,” she said.

Covid disruptions to global supply chains have triggered a spike in the price for many imported goods, and also led to shortages for many materials.

Dr Lowe will address the National Press Club in Sydney next Wednesday.

Originally published as Interest rate rises looming after shock jump in inflation