Anthony Albanese accused of ‘secret tax’ plan to pay for election promises

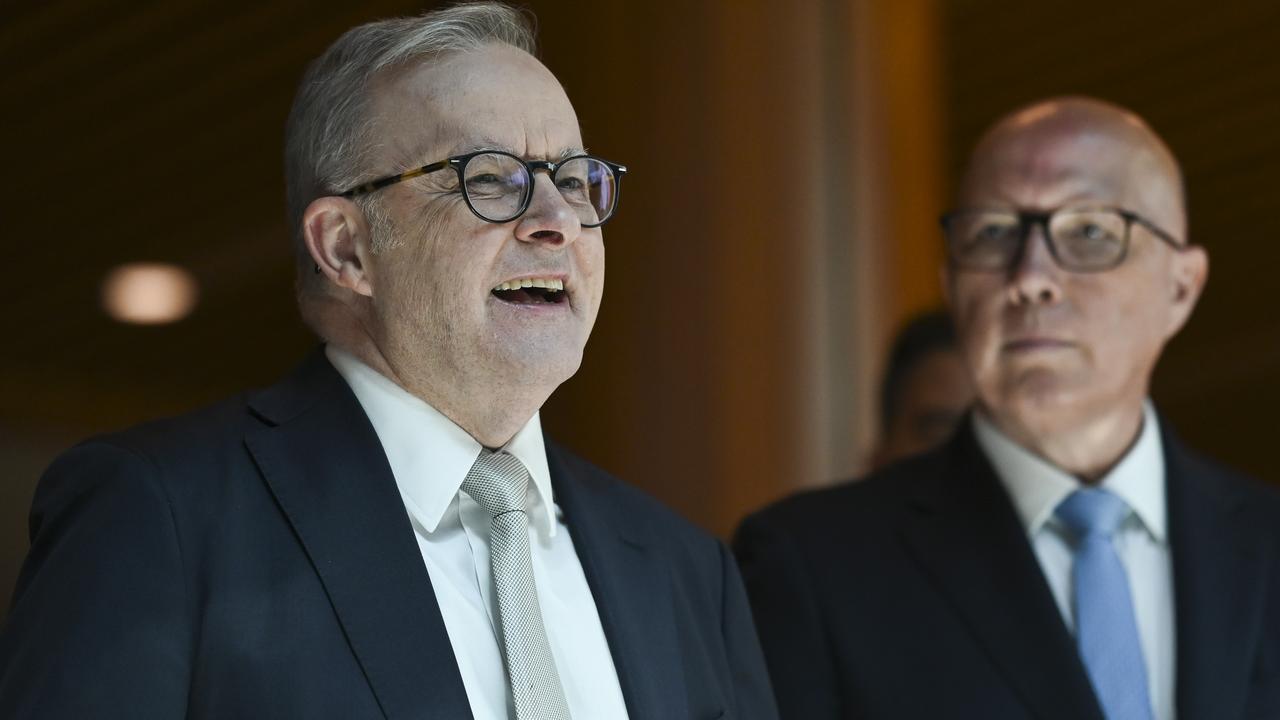

Josh Frydenberg has accused Anthony Albanese of preparing ‘new taxes in secret’ after the Opposition Leader refused to rule out tax hikes on family trusts.

Josh Frydenberg has accused Anthony Albanese of preparing “new taxes in secret” after the Opposition Leader refused to rule out tax hikes on family trusts to help pay for Labor’s growing list of election promises.

Following a major speech at the National Press Club on Tuesday, Mr Albanese failed to distance himself from Bill Shorten’s 2019 election crackdown on family trusts, and said Labor would unveil its tax policies “when we announce them”. Mr Albanese, who this month ruled out implementing a minimum rate of tax for high-income earners under a “Buffett rule” he previously supported, is yet to decide when Labor will unveil its final suite of tax policies.

After scrapping Mr Shorten’s unpopular negative gearing and franking credits policies in the wake of the 2019 election, Mr Albanese and opposition Treasury spokesman Jim Chalmers are considering a range of revenue-raising measures to bolster Labor’s war chest, headlined by a crackdown on multinational companies.

“We announce our tax policy when we announce them. No policy is our policy until we make it. I’ve made that very clear all the way through,” Mr Albanese said.

Mr Albanese – who accused the Morrison government of having “no credibility when it comes to economic management” – said he would not engage in a game of ruling in and out policies.

The Australian last year revealed Dr Chalmers used a meeting of senior Labor MPs to propose going to the election with a tax hike on family trusts, mirroring a 2019 policy slated to raise about $2bn a year.

New Australian Taxation Office data shows around 310,000 small family businesses with turnover of less than $50m could be caught up if Labor proceeds with a clampdown on people using discretionary trusts to minimise taxes.

Mr Frydenberg, who led the Coalition’s successful 2019 campaign attacking Mr Shorten’s big-taxing agenda, has ramped up pressure on Mr Albanese over summer and accused Labor of preparing a secret election war chest of taxes.

On Tuesday he said small family businesses would be “appalled that Anthony Albanese has failed to rule out taxing them more should Labor win the next election”.

“The evasiveness of the Opposition Leader to ‘categorically’ rule out a new family business tax shows the only thing Labor has learnt from the last election is to come up with their new taxes in secret,” the Treasurer said.

“Let’s not forget at the last election Labor was promising $387bn in higher taxes. Hitting 310,000 small family businesses that employ one million Australians with a new tax, just as they are recovering from the greatest economic shock since the Great Depression, shows that Labor can’t be trusted to manage the economy.

“This includes 20,000 family businesses in the accommodation and hospitality sector employing around 200,000 Australians. In fact, Labor’s family business tax will smash around 266,000 micro businesses with an average turnover of only $220,000 per year.”

The government said if Labor implemented a tax hit on trusts, a family cafe run by a husband and wife generating a profit of $110,000 and using a discretionary trust could pay up to $16,300 a year more in tax.

Despite Mr Albanese’s support for the government’s stage three tax cuts and vow to not increase taxes, Mr Frydenberg has warned Australians could be worse off under a Labor government. Treasury analysis of the government’s income tax plan says more than 11 million workers will pocket almost $10bn in tax cuts in the first half of the year.

In his NPC speech on Tuesday, Mr Albanese maintained pressure on Scott Morrison over his handling of the Covid-19 pandemic and flagged he would pursue federation reform if he wins the election, which is due by May.

He said boosting productivity under a streamlined federation would be guided by the “spirit of goodwill”. “I’ve spoken to premiers, not just Labor premiers, about this on an off-the-record basis. And you’d expect me to do that. We need a clearer delineation of who is responsible for what,” he said.