How investing $5000 could lead to $250k payday

It’s a common money mistake that most Australians make but the consequence over time is a $250,000 loss. Here’s what to do about it.

Investing

Don't miss out on the headlines from Investing. Followed categories will be added to My News.

Money isn’t easy. You know it, I know it. But not a lot of people talk about it. And because we don’t talk about money, it’s easy to fall into the trap of thinking everyone else has it more together than you do.

They don’t.

There’s so much confusion out there when it comes to money.

In Australia there are thousands of different investment options and providers, banking solutions, crypto investments, super funds, and the list goes on. Figuring out which options are best is hard.

Then, even if you manage to work through these options, you then need to wrap them into a money plan that will deliver solid results and fit in with the thousands of potential variations of your lifestyle into the future.

So yeah, money can be tricky.

But the good news is that you don’t need to be an expert from day one.

If you plan to achieve serious money success, by the time you get to the finish line you will need to have a lot of money knowledge and skills. But, those aren’t the skills you need to get started.

The main building block of money success is investing. And while you do need to have some knowledge to get started investing, you don’t need to know it all.

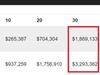

For example, if you were to invest $5000 in the next year, this money would grow to be worth $248,022 in 40 years time assuming the long-term Australian share market return of 9.8 per cent.

But, thinking you need to be a money or investing expert before you get started often leads to feeling overwheled, which in turn can result in getting stuck in the inaction trap.

The real cost of not taking action

You can see from the example above the upside of getting started, but the flip side of this example is the real cost of not taking action.

The fact that investing $5000 this year will likely grow to almost a quarter of a million dollars over time means that the actual downside of not investing is huge. For every single year you delay getting started, you’re costing yourself six figures in lost wealth you’ll never get back.

You’ll then need to play catch up in the future, sacrificing more to get to the same position, or having to compromise on where you can get to with your money.

Money is a muscle

Just like any muscle, you start with the basics, and as you grow and develop you can get more complex and nuanced with your approach.

I do a lot of financial advice and education work with professional athletes, and through this work I’ve come to realise there’s a lot of crossover between your being an elite athlete and being elite with your money.

When you first start playing sport as a kid, you don’t jump straight into a high performance plan, conditioning framework, and all the rest of the things a professional athlete does day in and day out.

Instead, you focus on the basics. You do some running to get your physical fitness up. You practice basic drills to help with your co-ordination. And you do exercises to build your strength and speed, maybe some push ups or sprints.

And then you practise. Regularly. For years. Over time you add more skills and techniques to your training routines to level up your game.

When you watch an elite athlete play sports, they make it look so easy.

But what you don’t see is the countless hours of practice over years and often decades. It’s this practice where skills are formed, honed, and perfected.

If you fast forward to the future state where you’re crushing it with your money, at that point you’ll have all the skills you need to be there. You’ll have put in all the practice needed to build your money muscle. And you’ll make it look effortless too.

But you don’t need to be there yet.

When you’re earlier on in your journey to money success, you just need to take the next step. You need to flex your money muscle to build it just that little bit so you can do the next exercise and the next variation to make the progress you want today.

Once you make it there, you’ll have learned some lessons and built some skills that will make whatever comes next easier. You then set the next target to work towards, then pursue that goal until you get there.

At that point, you’ll have learnt some more and added more new skills to your tool kit, that in turn will help you move further forward.

You can see where this is going …

The wrap

If you let it, thinking you need to be an expert from the start can stop you from getting started. It can stop you from making progress. And it can stop you from learning and growing your money muscle. Ultimately, it will stop you from building your money momentum.

Take action today to start driving results. Focus on what your next step is with your money and what you need to do to make it happen.

If your next step is investing, don’t think you need to be an expert on day one. This is an impossible benchmark that will stop you from getting started and building your money momentum. And it will cost you serious dollars, but only if you let it.

Ben Nash is a finance expert, commentator, podcaster, financial advisor and founder of Pivot Wealth, the host of the How to be Successful with Money podcast, and Author of the Amazon best selling book ‘Get Unstuck’

Ben runs regular free online money education events to help you make better money choices and get ahead faster. You can check out all the details and book your place here

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.

Originally published as How investing $5000 could lead to $250k payday