Housing sentiment sours as market downturn accelerates

Sydney and Melbourne have led the declines, but prices in other capital cities now appear to have also peaked – and falls in Brisbane have accelerated.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Property prices will continue their slide well into next year as the sentiment in the market sours, a survey of the sector has concluded.

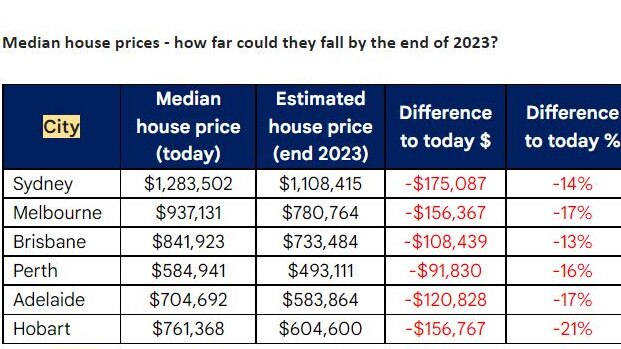

Forecasters say the value of a median Sydney house could fall by another $175,000 by the end of next year if that sentiment holds.

National Australia Bank’s housing market sentiment fell for a second consecutive quarter for the three months to the end of September, drifting below the survey average for the first time in two years, figures show.

Sentiment fell in all states except Western Australia – dropping the most in the ACT. Both Victoria and NSW saw sentiment turn negative for the first time since the start of the Covid-19 pandemic.

“Our outlook for property prices is broadly unchanged, with dwelling prices expected to decline by around 20 per cent across the capital cities from the peak in mid-2022,” said Alan Oster, the bank’s chief economist.

“The declines are expected to be broadbased, but led by areas where affordability constraints are most binding. To date, Sydney and Melbourne have led the declines, but prices in other capital cities now appear to have also peaked – and the decline in Brisbane has accelerated.”

On Tuesday, the Reserve Bank slowed the pace of interest rate increases, delivering a smaller-than-expected 0.25-basis-point increase to 2.6 per cent. Most economists had tipped a rise of 50bps.

“We expect the RBA to lift rates further in coming months, taking the cash rate to 3.1 per cent before pausing to assess the impact of rate increases to date,” Mr Oster said.

“While the influence of global factors on inflation is expected to wane, domestic factors will become increasingly important – including faster wage growth.”

Analysis of the sentiment data released by NAB, undertaken by mortgage comparison service RateCity, found the median Sydney house would be valued at $1.1m by the end of 2023 if the bank’s price forecasts were correct. It currently stands at $1.28m.

There would be a 17 per cent fall in Melbourne, with house values down $156,000 to $780,000, the same analysis shows.

“While some buyers’ budgets are shrinking, other buyers are tapping out altogether, in the hope of finding a cheaper deal down the track,” RateCity research director Sally Tindall said.

“In the boom, a ‘fear of missing out’ drove property prices higher. Now a ‘fear of getting in’, is having the reverse effect.

“Falling property prices are typically good news for would-be first-home buyers looking for a window in. However, with interest rates still on the rise, it’s not going to be a walk in the park. They’ll be paying more in interest for the money they borrow against what is an uncertain backdrop,” Ms Tindall added. “Borrowers who can’t refinance their loan because of their equity position should still negotiate with their lender for a better rate. This will help them make their monthly repayments, and potentially extra so they can break out of mortgage prison faster.”

But Mirvac chief executive Susan Lloyd-Hurwitz said her company was focused on the domestic owner-occupier who was well-capitalised and “probably the least interest rate-sensitive”. “But there’s no doubt that it changes sentiment and confidence in the market,” she added.

Mirvac has made about 400 sales since the start of July across projects including strong presales in Brisbane, where it had a 50 per cent sellout over the first weekend.

“We are very confident in the embedded margins in our projects; that we’ve got the right product in the right place with the right customer base. We are definitely not stopping,” Ms Lloyd-Hurwitz said. “We have seen developers who have been unable to proceed with their projects because they can’t get the financing or the pre-sales or construction costs have blown out. That has sent customers in our direction.”

However, the NAB sentiment survey, which polls property industry professionals, showed the outlook for rents lifted in the last quarter, and are now expected to grow by a solid 3.5 per cent in the next 12 months and 3.8 per cent in two years’ time nationally.

With rents growing faster than house prices, gross yields should improve, with rents outstripping prices in all states. With supply chain issues, high raw material prices and labour shortages persisting, construction costs are still seen as the main constraint on new housing development.

Rising interest rates have also overtaken tight credit as the next biggest constraint. With the upswing in rates continuing, the survey highlighted rising rates as a growing constraint for buyers of existing property.

UBS analyst Lucy Huang has also noted that the spring selling season is off to a slow start. The investment bank has cut expectations of listing volume growth to a 10 per cent drop this financial year. The bank’s economics team is expecting a more moderate house price decline scenario of 13-15 per cent, with downside support from low supply, tight rental markets, strong employment and migration resuming.

“We are now more conservative on overall listing activity longer term, given lack of churn catalysts (for example stamp duty reform in NSW less likely) and ongoing uncertainty on the housing outlook for consumers,” Ms Huang said, adding consumer surveys suggested increased intentions to sell property and fewer off-market listings.

More Coverage

Originally published as Housing sentiment sours as market downturn accelerates