Strong sign RBA will have to slash interest rates in early 2023

The Reserve Bank has hiked the interest rate five times this year and shows no sign of stopping – but that may come screeching to a halt.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

The Reserve Bank of Australia’s (RBA) rapid fire monetary tightening is unprecedented, unleashing 2.25 per cent worth of interest rate hikes over five consecutive board meetings.

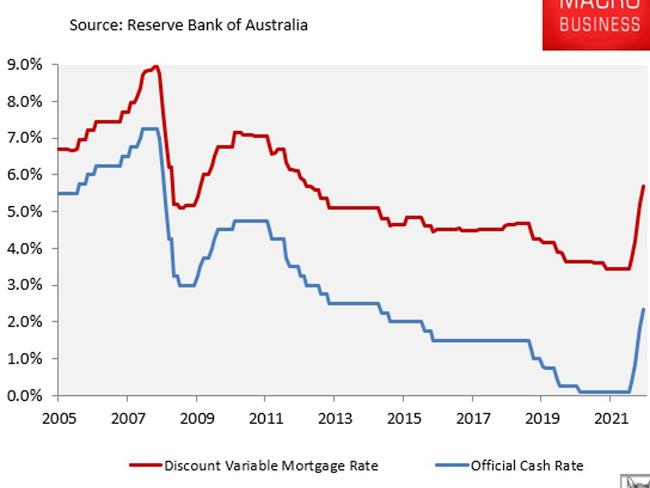

This aggressive tightening has already lifted Australia’s average discount variable mortgage rate by two-thirds, from 3.45 per cent in April immediately before the first rate rise to 5.70 per cent currently.

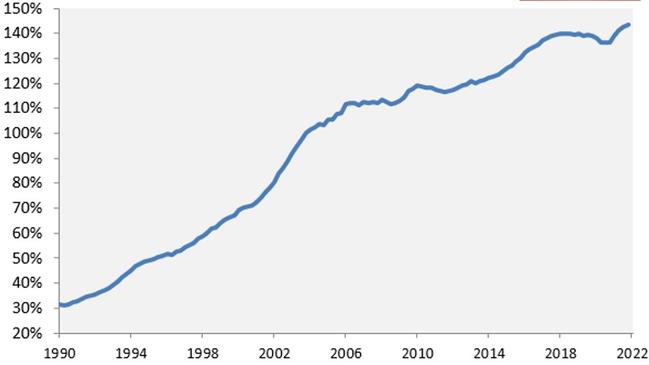

This is the highest discount variable mortgage rate since January 2013 and comes at a time when Australian mortgage holders are more indebted than ever.

According to the RBA, the ratio of mortgage debt to household disposable income was a record high 144 per cent in March 2022, up from 119 per cent in January 2013.

The cumulative impact of the RBA’s aggressive rate hikes will, therefore, be devastating for mortgage holders.

As illustrated in the next table, average monthly mortgage repayments will soar by 30 per cent from their April pre-tightening level.

For a household with a $500,000 mortgage, this represents a monthly increase in repayments of $671, whereas a household with a $1,000,000 mortgage will pay an extra $1,341 a month.

The worst is yet to come, too, with last week’s RBA monetary policy statement noting that “the board expects to increase interest rates further over the months ahead”.

There is no sugar coating the situation: the immediate outlook is bleak for Australian mortgage holders. However, we believe the pain will be short-lived and sunnier days will emerge in 2023.

Rate hikes work with a ‘lag effect’

Last week’s RBA monetary policy statement made the important observation that “the full effects of higher interest rates [are] yet to be felt in mortgage payments”.

Governor Phil Lowe followed up in his speech to the Anika Foundation noting that “there are lags in the operation of monetary policy and that interest rates have increased very quickly”.

These are pertinent points. Last week, CBA’s head of Australian economics, Gareth Aird, released research showing that it takes an average of two-to-three months for an increase in the official cash rate (OCR) to be felt by mortgage holders.

This, according to Aird, suggests that most of the RBA’s rapid monetary tightening has yet to be felt by Australians with mortgages, meaning “there’s a degree to which the RBA Board is flying blind. It has simply been too early for the spending data to pick up the impact of the already delivered rate hikes”.

Separately, Aird cautioned that the RBA’s aggressive tightening is “like having five shots of vodka in an hour and saying, everything is OK. But you know that it will soon have a big effect”.

The lagged effect from rate rises will be compounded by the circa 40 per cent of mortgages taken out at fixed rates over the pandemic that will expire over the next eighteen months. The average loan rate for these borrowers is around 2.25 per cent, which is significantly lower than the discount variable rates illustrated above.

Therefore, the fixed rate mortgage reset creates further natural tightening, even in the absence of additional OCR hikes from the RBA.

Australian house prices are already plummeting

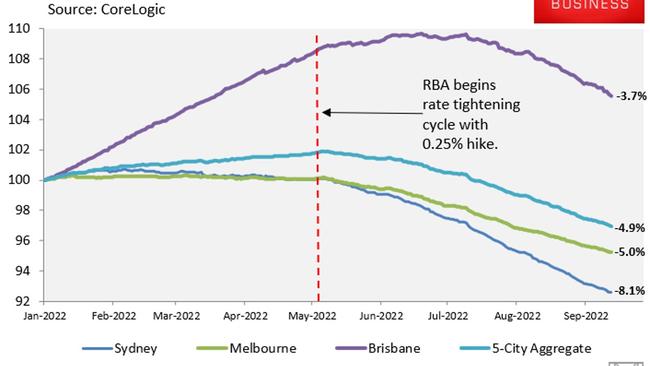

Already, the RBA’s aggressive monetary tightening has hammered Australian house prices.

As illustrated in the next chart plotting CoreLogic’s daily dwelling values index, home values at the five-city aggregate level have fallen 4.9 per cent from their peak, driven by sharp 8.1 per cent and 5.0 per cent declines across Sydney and Melbourne.

The delayed impact of rate hikes, let alone further rises, will send prices sharply lower, likely resulting in the biggest price correction on record.

According to CoreLogic records dating back to 1980, Australian capital city dwelling values have never fallen by more than 11 per cent. This record looks certain to be smashed over the next six months.

Recession risks rising

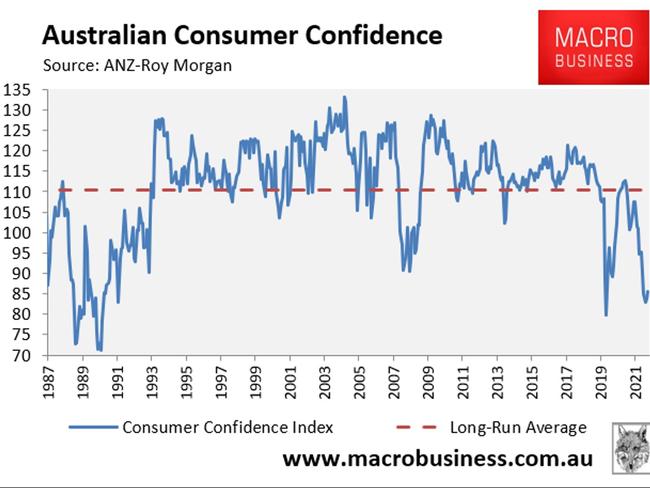

Never has the RBA commenced a rate tightening cycle with consumer confidence in such poor health.

Outside of the pandemic, Australian consumer confidence is tracking at close to its lowest level since the early 1990s recession, well below the trough experienced during the Global Financial Crisis in 2008.

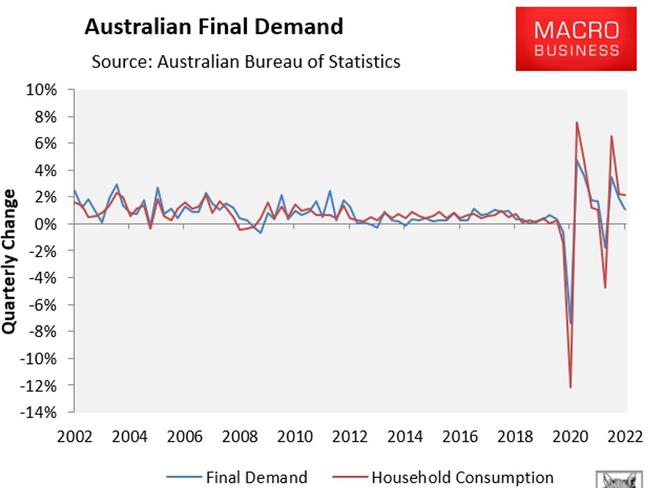

Household consumption is the engine room of the Australian economy, accounting for 55 per cent of growth on average.

Therefore, where household consumption goes the economy usually follows, as illustrated in the next chart.

Once the full impact of the RBA’s rate hikes flow through to mortgage holders, there will necessarily be significantly less funds available in household budgets to spending across the Australian economy.

Moreover, the negative drag on household consumption will be exacerbated by the record fall in house prices, which will make Australians feel poorer.

The upshot is that the RBA’s aggressive rate hikes risk driving the Australian economy into an unnecessary recession in 2023, once their full impact comes into force.

Expect rate cuts in 2023

In its monetary policy statement last week, the RBA noted that inflation is “expected to peak later this year and then decline back towards the 2–3 per cent range”.

This means that by early 2023, the RBA is likely to face a situation where house prices have experienced their largest fall on record, households are cutting their consumption, the economy is stalling, and inflation is declining.

So, after going too hard on tightening, expect to see the RBA backtrack and slash rates next year to stave off recession.

Leith van Onselen is Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.

Originally published as Strong sign RBA will have to slash interest rates in early 2023