Aussie suburbs to be crushed as interest rates rise to 0.85%

As the RBA hikes up the cash rate again, worrying maps have exposed the mortgage stress suburbs that will be crushed by the shock increase.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

The number of Australians suffering “mortgage stress” is set to skyrocket in the wake of today's interest rate hike, with home loan repayments tipped to rise again for the second time in as many months.

The Reserve Bank this afternoon announced the cash rate will rise from 0.35 per cent to 0.85 per cent, an increase of 50 basis points that was bigger than predicted.

Particularly affected will be those who entered the market between November 2020 and May this year, the period during which the Reserve Bank of Australia (RBA) held rates at a record low of 0.1 per cent.

“Mortgage stress is defined by having less than five per cent of ordinary income left after covering your repayments and ordinary day-to-day costs,” Kate Colvin, spokesman of housing advocacy group Everybody‘s Home told news.com.au.

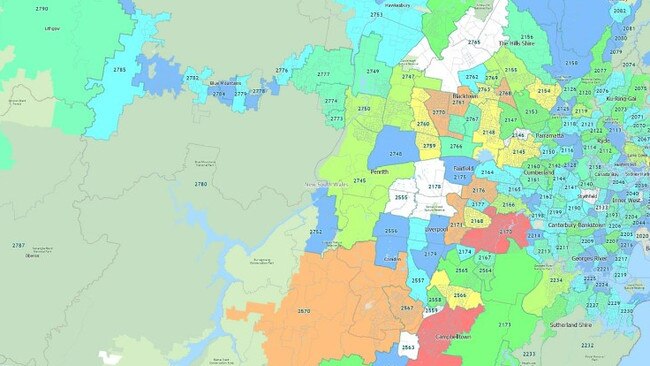

“Regional NSW and outer Western Sydney will be particularly hard-hit by these rises – especially lower-income communities which stretch right through the hinterland and up the coast of NSW.”

According to Everybody’s Home’s interactive financial stress map, NSW is the most deeply indebted state, with 70 per cent of homes in the western Sydney electorates of Hume, Macarthur and Werriwa already dealing with financial stress.

Well over 50 per cent of homeowners further inland in the regional seats of Calare, New England and Riverina are also feeling the sting of rising mortgage repayments.

However, NSW is merely the tip of the iceberg, with Digital Finance Analytics principal Martin North telling the Daily Telegraph that, should rates go beyond 2 per cent (as the RBA has flagged), nearly 50 per cent of homeowners nationally will fall into mortgage stress.

“We’ve got more than four million households out of nearly 10 million who are already close to the edge — that’s an unprecedented situation,” Mr North said.

“If we assume the RBA adds 2 per cent, or just about that, another 400,000 to 500,000 would probably fall into that stress category.”

Mr North said that according to DFA data, the south-west Sydney suburb of Campbelltown was under the toughest strain nationally, with nearly five in every six households under stress.

Tapping in Perth came second by numbers alone, with Berwick in Melbourne and Toowoomba in Queensland also topping the list.

Affluent suburbs also feel the sting

Higher-income areas on the east coast are also expected to feel the RBA bite today, with the wealthy seats of Wentworth in Sydney’s east and gentrified Melbourne proper also dealing with pre-existing levels of mortgage stress above 40 per cent.

“Stress is surprisingly high in those affluent suburbs too which reflects the fact that to buy a property in Sydney or Melbourne now, people need to stretch themselves significantly,” Ms Colvin said.

“That trend makes people very vulnerable to these interest rate rises and means these developments are going to cause a lot of pain in a lot of communities.”

Ms Colvin said that, generally, homeowners on variable rate mortgages needed to brace for impact.

“People who have brought more recently have been paying a lower interest rate for the length of their mortgage so this will be a big step up,” she said.

“These figures are showing that people will have to cut back on expenses because their budgets will be really stretched – and that will flow on to the economy.”

Ms Colvin warned that those economic impacts would cut deeper into budgets than just fewer takeaway meals and overseas holidays.

“People end up delaying expenses that aren’t immediate but are still crucially important – for example, trips to the dentist, paying for a car service or car insurance – keeping those at bay can then create more costs later on,” she said.

“For families that are well off it could mean fewer haircuts or evenings out – but even that has a flow-on impact with less income for businesses to employ workers.”

Ms Colvin noted that community vulnerability to interest rates was an avoidable problem that had been kicked down the road for decades, but commended the sitting government for their national housing strategy.

“The reason we have volatile housing markets is that we don’t have a good policy which is why we need the government to develop a national housing strategy – which they have committed to do,” she said.

“A lot of policy reform is needed in Australia to get this situation under control.

“Delivering more accommodation security is certainly possible for people, but it’s going to take time and effort.”

More Coverage

Originally published as Aussie suburbs to be crushed as interest rates rise to 0.85%