Looming disaster of ‘Hemsworth effect’ could see house prices fall

The pandemic and the “Hemsworth effect” have seen thousands of Aussies relocate to northern NSW and southern Queensland – but it all may come crashing down.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

People are fleeing the rest of the country to move to northern NSW and Queensland – but they could be in for a huge shock, according to a new official report.

Southerners have been moving north in a giant locust-like swarm, landing in the sunny climes between Byron Bay and the Sunshine Coast where they are making property prices go ballistic. Byron Bay has the fastest growing median property prices in the country, rising from $1.3 million to $2.7 million in the last year, according to realestate.com.au.

Brisbane and the Sunshine Coast are also zooming ahead. But the dreams of sun and sand could all come crashing down, according to a new government report released quietly last week.

Analysts from the Reserve Bank of Australia recently prepared a new report on how climate change would affect Australian banks. Because Australian banks do so much lending for property, they had to check how climate change will affect property prices. The research is summarised in this alarming map, showing that while Sydney, Melbourne and Perth each contain areas where prices will be hit by climate change, the effect on southeast Queensland is predicted to be far worse.

The red areas correspond to places where house prices are expected to fall by 10 per cent or more because of climate change by 2050. The orange areas represent estimated price falls of 5-10 per cent.

Now, 2050 might sound far away, but it’s just 28 years. Plenty of people buying houses in Queensland right now would expect to keep them for that time frame.

The analysis of price falls considers the effect of a range of natural hazards on property prices – riverine flooding, coastal inundation, forest wildfires, wind storms (other than cyclones), and ground subsidence in drought.

“The price of properties considered to be at ‘high risk’ of being affected by climate events could decline sharply,” the RBA said. “Banks could experience significant credit losses if borrowers default.”

The good news is that most areas of Australia won’t see property prices fall by more than 10 per cent because of these hazards. The bad news is there are 254 suburbs where such price falls are expected, and they’re clustered together, largely in agricultural regions and on the coasts.

Beautiful one day, under water the next

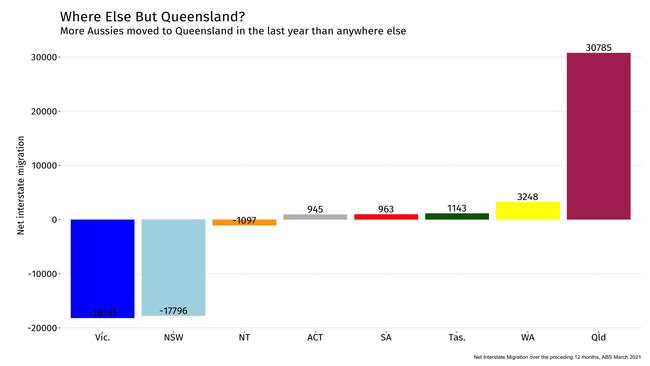

The flow of Australians to Queensland has been strong now for years. People get sick of Melbourne’s weather or Sydney’s traffic and they get up and go. But during the pandemic the exodus has been even stronger.

As the next graph shows, Queensland is a magnet for people from other states.

But in their quest to dodge the pandemic, some might be getting out of the frying pan and into the fire, the report suggests.

“The regions with the largest rise in the proportion of properties that are projected to be high risk … include some populous regions in southeastern Queensland and northern New South Wales, which have a large number of houses at risk of coastal inundation.”

Australian actor Chris Hemsworth portrays Thor in the eponymous Marvel movies and recently built himself a huge mansion in Byron Bay. The “Hemsworth effect” has drawn people to Byron Bay and nearby communities. But the greenhouse effect might prove even stronger than Thor himself.

Banks may be unconcerned

It might be cold comfort in a warming world, but the good news is banks won’t be too concerned about these falls in property prices.

The RBA finds that “the risks facing domestic banks appear manageable”.

It also admits the modelling is at risk of being wrong.

Predicting the effect of climate change way out in the future is hard. There could be tipping points where the effects are worse than expected, or mitigating factors that mean the effects are gentler than expected. What’s more, banks will probably stop lending for properties with high exposure to climate change risk, so their exposure to climate change risk will get smaller over time.

The insurance industry could also make things worse for property owners if they stop insuring properties with the highest risk.

“If a large number of insurers increase annual premiums or withdraw their coverage of certain climate-sensitive regions, this may leave households without insurance cover and banks susceptible to borrower defaults. Evidence of this has already started to emerge in Northern Australia, where high, unaffordable premiums are leading to a rise in uninsured homes,” the RBA analysts write.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.

Originally published as Looming disaster of ‘Hemsworth effect’ could see house prices fall