‘Going to get worse’: Grim prediction for Aussies

Australia’s financial position is increasingly precarious – and things are about to get much worse, but with one big silver lining for homeowners.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

Monetary policy is a lot like Ernest Hemingway’s famous dictum about bankruptcy. It happens slowly and then all at once.

Put another way, when chasing inflation, central banks raise interest rates until something breaks and then they reverse in a hurry.

That is what has now happened to the global interest rate cycle.

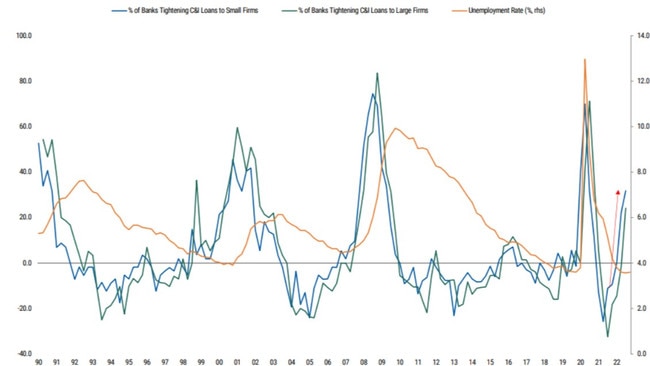

The US Federal Reserve has broken the American regional banking sector and a credit crunch is underway.

Roughly two-thirds of credit for small and medium-sized enterprises in the US economy comes from regional banks, so the implications for jobs and growth are obvious:

The coming recession will also clean up the lingering inflation problem – at least in the short term – as demand drops and an inventory glut is cleared.

How does it arrive in Australia?

There are three major sources of contagion into the Australian economy from the US accident.

The first is rising funding costs. Aussie banks will have to pay materially more for wholesale debt. This will mean marginal borrowers will have to pay more as well.

The second channel is commercial property, especially offices. Office towers everywhere have been emptied of tenants by the structural shift to ‘work from home’ post-Covid. But, so far, prices have held up OK.

Not anymore. Office towers across America and the world are about to devalue meaningfully. American commercial property lending is again dominated by the very regional banks that are beginning to repair their balance sheets rather than lend.

Likewise, Australia has a huge office space glut, and lending into that segment is also going to tighten as prices deflate. Some readers will recall that it was a similar commercial property bust that almost bankrupted Australian banks in 1990.

The good news is that Australia’s major banks have small exposures this time around, at about 6 per cent of loans. But non-banks and A-REITS are in the gun.

The final source of contagion is the stock market which is going to have to discount a further 20 per cent downside to earnings, a blow to household wealth.

Recession ‘beside the point’

Whether Australia will fall into an outright recession is beside the point. We are already in a per capita recession and it is going to get worse.

However, weak growth is going to get, it will certainly be weak enough to crush inflation.

Job ads have already fallen enough to boost unemployment to 4.5 per cent later this year. Add the above global contagion and we’ll get to 5-6 per cent easily enough. Mass immigration has also flushed worker bargaining power so wage growth is going to tumble. There is no danger of a wage-price spiral.

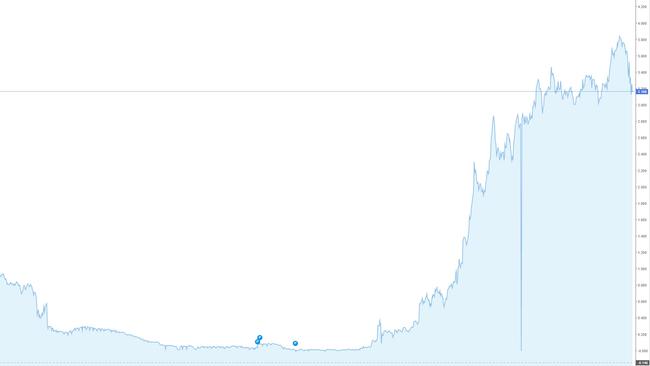

As inflation chases wages like rain down a mountainside, the Reserve Bank of Australia will cut rates in a matter of months. Interest rate futures are pricing only very slow cuts, perhaps 25 basis points in the next 18 months. The bond market knows better and is already pricing 70 basis-points of cuts within a year.

But remember the Hemingway dictum. Monetary policy happens slowly and then all at once. My best guess is that the RBA will be cutting into an emergency within months and I expect it to be more like 150 basis-points over the next year.

How much deeper we get from there will hang whether or not global inflation is beaten.

We’d better hope that it is, because our wages are going nowhere.

David Llewellyn-Smith is the editor-in-chief of MacroBusiness and co-author of The Great Crash of 2008.

Originally published as ‘Going to get worse’: Grim prediction for Aussies