Major bank fined over data issues

A major bank has been fined for breaches of Australia’s economy-wide data-sharing scheme that let down Australian consumers.

A major bank has been fined for breaches of Australia’s economy-wide data-sharing scheme that let down Australian consumers.

Alarm bells rang at a NAB branch when staff noticed a “spineless” scammer instructing a customer on how to increase her internet banking limit.

Hundreds of CBA customers were unable to send money transfers or pay people for several hours on Friday after bank systems went down.

Australian first-home buyers would be better off without one thing, as it is simply driving up the price of the housing market, an economist warns.

Australian businesses have been hit with a grim forecast for the year ahead, as US President Donald Trump implements his tariff plan.

A major bank has reduced its variable rates, as experts predict a ‘rates war’ between the big four lenders is about to heat up.

Australian economic growth will likely slow over the next two years, a leading forecaster has warned, as Trump’s tariff agenda shadows the world.

The new theme for the $5 bill has been revealed, swapping out British royalty for something closer to home.

Australia’s sharemarket snapped a three-day losing streak on the back of the major miners, as the price of gold and iron ore climbed throughout the trading day.

The chief executive of one of the country’s largest banks said Australia should remain calm and use the Trump tariffs to our advantage.

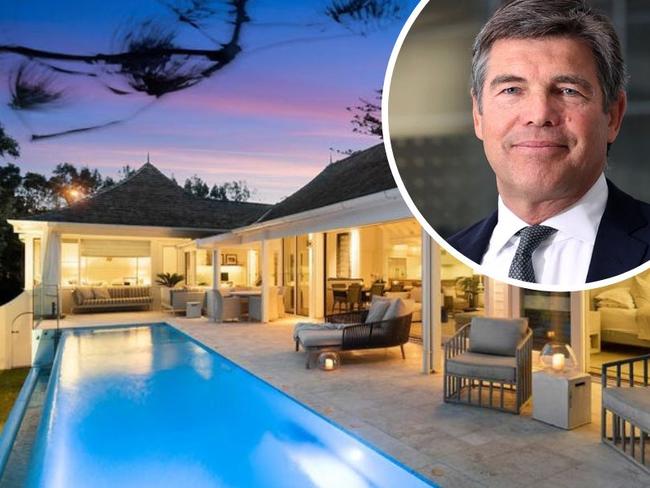

Startling details have emerged about the Bank of Queensland boss’ mortgage for his $7m beachfront home, as customer outrage continues over the lender’s decision to not pass on a rates cut.

The boss of big-four bank NAB has more skin in the game than most in Donald Trump’s tariff war. There are also lessons for Australia out of this.

If the first casualty of trade wars are markets, Donald Trump’s tariffs are a stunning form of economic self-harm.

US President Donald Trump has sparked a bloodbath in global stock markets and Aussie shares were not immune on Tuesday.

Original URL: https://www.dailytelegraph.com.au/business/companies/banking/page/6