Second biggest ever bank collapse hits US

A $20 billion last minute deal has seen the US’ largest bank buy one of its competitors in the second largest ever failure of an American bank.

A $20 billion last minute deal has seen the US’ largest bank buy one of its competitors in the second largest ever failure of an American bank.

Australia’s big banks are predicted to reveal they have raked in their biggest earnings in the last 30 years.

An obsession with “pork barrelling” has rendered Australia’s infrastructure pipeline ineffective, prompting a wide-scale review.

A huge change is coming for Australian punters amid desperate calls for Labor to do more to crack down on gambling harm.

The apartment glut in Melbourne and Sydney is adding further pain to the market as buyers struggle to finance their off-the-plan purchases.

National Australia Bank’s online and mobile sites went down leaving customers unable to access their money as the cause remained a mystery.

The nation’s top corporate cop has vowed to take big bank bosses to court in order to force change amid revelations that senior financial executives were reluctant to adjust their behaviour.

Scott Morrison has defended allowing mortgage brokers to continue charging ongoing fees against the recommendation of the banking royal commission.

ING has shrugged off a falling housing market and a “difficult year” for the banking industry to post a 15 per cent increase in profit to $401 million.

Bendigo Bank says eftpos and ATM services are functioning, but has given no indication when its electronic banking services will be restored.

Home loan pioneer Mark Bouris has warned he has “never seen such difficult borrowing conditions” as Yellow Brick Road reports a loss of $34 million.

Depending which way you look at it, a new way to get children to do chores is genius or way too hard.

A woman has been arrested for an alleged corporate fraud scandal involving the National Australia Bank worth tens of millions of dollars.

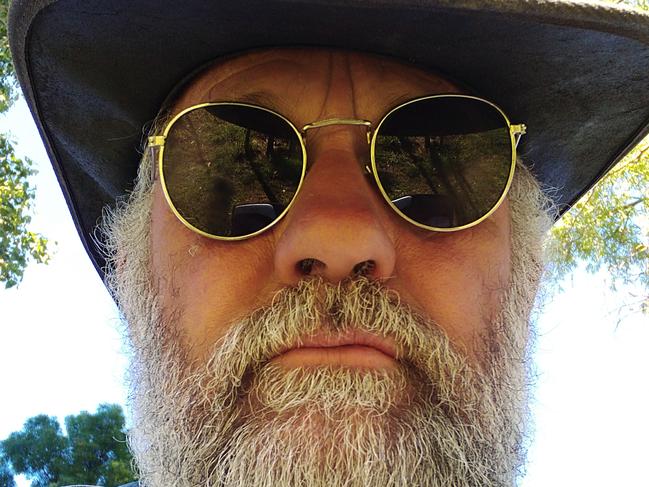

After falling behind on his $165,000 mortgage, Bill Heath was “cleaned out” by Westpac. Today, the 64-year-old lives in the bush, where it’s free.

Original URL: https://www.dailytelegraph.com.au/business/companies/banking/page/192